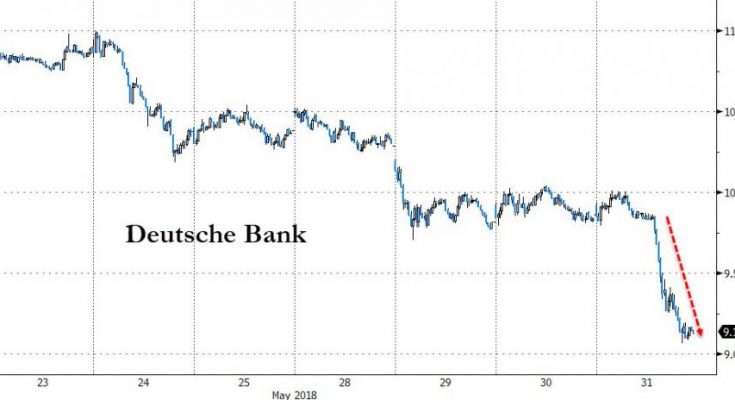

Back in September 2016, when its stock was imploding over capitalization and solvency concerns, the market was transfixed with the daily drop in Deutsche Bank stock price, which tumbled, eventually sliding below €10, and only implicit promises that Germany would bail it out, prompted a slow, if painful reversal. And yet, at no point in that period did the stock close at a level below where it closed today: a new all time low, crashing 7.2% to €9.16 following reports that the bank was on the Fed’s “Secret” probation list.

Â

However, the one saving grace is that unlike in 2016, or 2008, Deutsche Bank did not feel it needed to make an official statement addressing the recent stock crash. Because, as traders know all too well, the one thing that assures a banking crisis is imminent is for a bank to promise, plead and vow there is no reason to be worried as no crisis is imminent.

But not anymore, because shortly after 8pm local Frankfurt time, Deutsche Bank’s new CEO - experiencing a bizarre case of dreadful deja vu as his stock crashed to new all time lows – decided to validate everyone’s worst fears by issuing a report addressing “media reports about the regulatory ratings of our US entities” and which after prefacing that “we do not comment on any supervisory ratings as our communication with regulators is confidential”, goes on to comment extensively on the bank’s supervisory ratings.

And while the report said many things, many of which were superfluous, here are the key highlights of note:

The ultimate parent of the Deutsche Bank Group, Deutsche Bank AG, is very well capitalized and has significant liquidity reserves

* * *

Deutsche Bank has been engaged in remediation work to strengthen our internal control environment and infrastructure and to address concerns that have been identified both internally and by our regulators. There are no concerns with regard to the financial stability of Deutsche Bank AG.

* * *

We are highly focused on addressing the issues with our U.S. operations and will continue working diligently to solve them.

* * *

All of our U.S. subsidiaries have very robust balance sheet as disclosed in our quarterly regulatory filings. The assets of the three entities concerned are below ten percent of the overall balance sheet of Deutsche Bank

* * *

Are we committed to our U.S. business? The answer clearly is “yes.â€Â As Christian Sewing said at a public reception on Wednesday in Berlin, the U.S. is the most important market for Deutsche Bank outside Germany