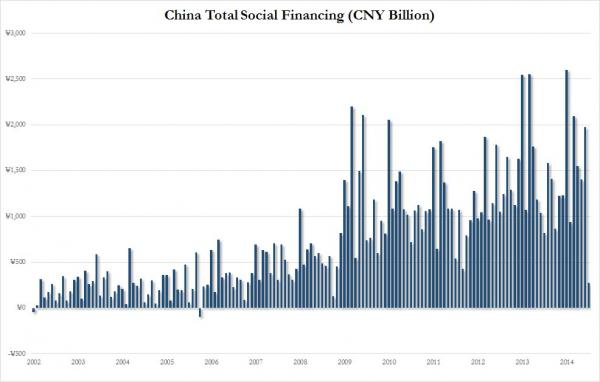

For those who are perplexed why today stocks soared despite a renewed battery of horrendous economic results, the answer lies in China, where overnight the PBOC reported that July aggregate credit creation (aka Total Social Financing), at least the “as reported” variety, plunged by the most ever, and instead of growing at the expected RMB1.5 trillion, it registered a monthly change of only RMB273 billion, or a miss to expectations of over 80%, and a complete collapse from the CNY1,974 billion reported in June.

The monthly “change in the change” amounted to just over RMB1.7 trillion, the biggest drop in history.

Aside from the TSF, new loans in July also plunged to RMB385 billion from RMB1079 billion in June.

The breakdown of actual TSF components is as follows, per BofA:

- New loans fell sharply to RMB385bn in July from RMB1,079bn in June, driven by a decline in new corporate short-term loans. The hefty RMB345bn in new corporate short-term loans in June was perhaps due to a response by banks to the government’s call for supporting growth as well as the need to meet mid-year regulatory requirements on deposits.

- Both entrusted and trust loans declined in July, perhaps due to tighter regulation on interbank business. New entrusted loans decreased to RMB122bn from RMB272bn, while new trust loans contracted by RMB16bn from a net increase of RMB120bn in June.

- New corporate bonds declined to RMB143bn in July from RMB261bn in June, in part reflecting a temporary shortage of liquidity on resumed IPOs. However, we notice the issuance of LGFV bonds decreased to RMB77bn from a monthly average of RMB237bn in 2Q. The trend of slower issuance of LGFV bonds echoed our long-held view that the central government should leverage up (via PSL for instance) rather than build up local government indebtedness. We expect local governments will get a large amount of funding from the China Development Bank which in turn will get funding from the PBoC’s PSL scheme in the second half of this year.

- Non-discounted bankers acceptance (BA) decreased by RMB416bn in July, after increasing by RMB144bn in June. However, BA is notoriously volatile and the data are of low quality.

- FX loans contracted by RMB17bn in July after rising by RMB36bn in June, although sentiment of stronger CNY/USD returned last month.

As for the new loan components:

- New medium-to-long-term (MLT) corporate loans moderated to RMB208bn in July, compared to RMB269bn in June, suggesting some moderation in loan demand for fixed asset investment projects.

- New short-term corporate loans declined by RMB236bn in July, sharply down from the RMB354bn increase in June, mainly driven by seasonal factors as new short-term corporate loans surged in June. Meanwhile, new discounted bills jumped to RMB173bn in July from to RMB78bn.

- New MLT loans to households (mainly mortgage loans) moderated to RMB180bn in July from RMB199bn in June. This number is still relatively robust compared to the monthly average of RMB188bn in 2013. There have been some local news reports of banks reintroducing discounts to the benchmark lending rate in bigger cities and shortening of mortgage release time. Meanwhile, new short-term loans to households dropped to RMB26bn in July from RMB158bn in June.