BBVA Banco Frances del Rio de la Plata S.A. (BFR) is a full-service banker for large corporations, middle market businesses and individuals. The Company operates approximately 74 branches in Argentina, 8 branches in Uruguay and a subsidiary bank in the Cayman Islands.

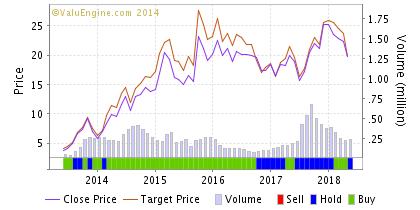

BFR was a selection for our ValuEngine Forecast 16 MNS Newsletter this month and it is up about 25% since our latest rebalance–while the SP 500 Index is down @1%. We have had a BUY on this company for quite some time–check the chart below for the green areas. Our models made another savvy pick with this company. Other analysts have followed suit, with the company receiving several upgrades. Argentine stocks have been on a tear recently due to a recently announced alliance between some of the nation’s more “market friendly” political parties.

ValuEngine continues its BUY recommendation on BBVA Banco Frances for 2015-03-16. Based on the information we have gathered and our resulting research, we feel that BBVA Banco Frances has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Momentum and P/E Ratio.

Below is today’s data on BFR:

|

ValuEngine Forecast |

||

| Â |

Target |

Expected |

|---|---|---|

|

1-Month |

21.54 | 0.54% |

|

3-Month |

22.16 | 3.46% |

|

6-Month |

22.15 | 3.40% |

|

1-Year |

22.80 | 6.45% |

|

2-Year |

28.10 | 31.18% |

|

3-Year |

11.33 | -47.09% |

Â

|

Valuation & Rankings |

|||

|

Valuation |

100.78% overvalued |

Valuation Rank |

2 2 |

|

1-M Forecast Return |

0.54% |

1-M Forecast Return Rank |

86 86 |

|

12-M Return |

193.83% |

Momentum Rank |

99 99 |

|

Sharpe Ratio |

0.39 |

Sharpe Ratio Rank |

72 72 |

|

5-Y Avg Annual Return |

20.40% |

5-Y Avg Annual Rtn Rank |

89 89 |

|

Volatility |

52.88% |

Volatility Rank |

36 36 |

|

Expected EPS Growth |

8.72% |

EPS Growth Rank |

40 40 |

|

Market Cap (billions) |

3.83 |

Size Rank |

81 81 |

|

Trailing P/E Ratio |

12.85 |

Trailing P/E Rank |

84 84 |

|

Forward P/E Ratio |

11.82 |

Forward P/E Ratio Rank |

79 79 |

|

PEG Ratio |

1.47 |

PEG Ratio Rank |

35 35 |

|

Price/Sales |

1.79 |

Price/Sales Rank |

49 49 |

|

Market/Book |

3.38 |

Market/Book Rank |

36 36 |

|

Beta |

1.92 |

Beta Rank |

15 15 |

|

Alpha |

0.64 |

Alpha Rank |

98 98 |