With the Q2 US reporting season upon us, SocGen’s quant research team focuses on the deteriorating state of corporate balance sheets in the US. Despite Intel going full retard on forecast buybacks, as we remarked numerous times, US firms are starting to show the strains of having to buy back $500bn of shares every year, whilst cash flows were under pressure.Leverage, SocGen argues, is starting to become an issue… and with it the ability to fund ever more expensive buybacks to maintain the illusion of EPS growth

Authored by Andrew Lapthorne of Societe Generale,

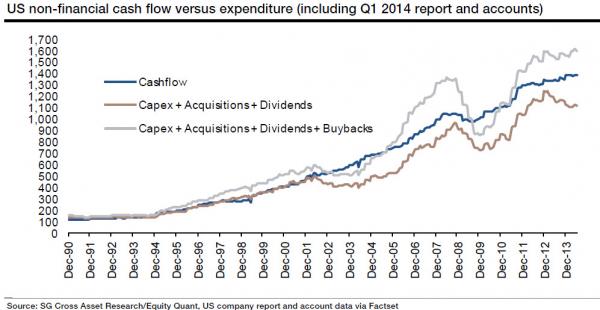

Companies are cash flow positive after investing and paying dividends (see above), but have a deficit when buybacks are taken into account. We estimate that non-financial S&P 1500 companies need to raise around $250bn per annum to make up the difference, which is what they are indeed doing – see below.

Of course as equities continue to rise, buying back shares becomes ever more expensive, so corporates will need to raise more and more debt at a time when the Federal Reverse is removing the punch bowl that is QE. Corporates, on aggregate, have shown little apparent regard to the actual execution price of their share buybacks, and the pro-cyclical availability of credit only exasperates the problem, i.e. credit is widely available when markets are at peak but hard to come by when markets are distressed and equity prices cheaper.

We do however find it somewhat ironic that, on the one hand, companies have been increasingly willing to divest assets (we assume because they can get a good price for them) and yet, on the other hand, continue to buy back their shares at an increasing rate with the proceeds. As we show below, whilst capital expenditure is barely growing, sales of investments is accelerating at 20% per annum. As a result net investment & acquisitions is falling at around 10% per annum.

The final point to make is that not all of these share buybacks are discretionary. As we show below, out of the $480bn spent on non-financial share buybacks over the last year, $180bn appears to have been spent on stopping the dilution from maturing stock options, i.e. the share count only came down by $300bn. The implication is that this $180bn is an ongoing cost for the firms in terms of staffing costs.