Today’s durable goods report appears to have been liked by the momentum-igniting algos, because despite the prior month’s negative revision (nobody cares about those), the January Seasonally adjusted number posted a modest beat of expectations, with the headline number declining only -1.0% compared to the expected drop of -1.7%. This more than offsets last month’s revision from -4.3% to -5.3%, but again all that matters for kneejerk reactions is the current print. We will have more to say about this shortly.

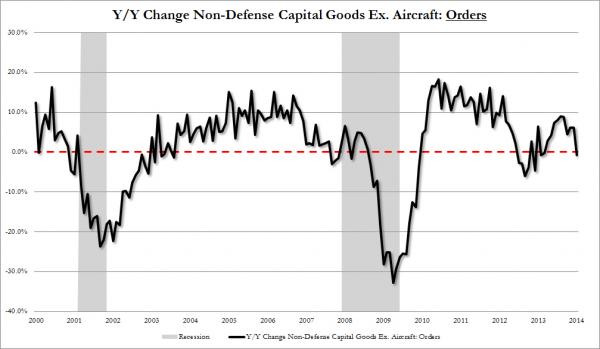

For now the only number that matters is the capital goods orders nondefense aircraft, aka core capex. It is here that while the sequential print was a modest increase of of 1.7%, compared to expectations of a -0.2% decline, it is the annual number that is of interest. We focus on this, because as can be seen on the chart, the annual change just posted its first annual decline in a year:Â in the past any such decline would mark the start of a recession, except of course for in 2012 when the New Normal central planning, and the trillions in Fed liquidity injections, made the business cycle as we know it meaningless.

So much for that $1+ trillion in QE: it is good to know that it went to stock buybacks and dividends… if not so much to actually investing in future growth.

And some of the other “spotty” charts. First: Core Capex Shipments:

Then Durable Goods:

And Durable Goods ex transports.

We can only conclude that it has been snowing for a long time.