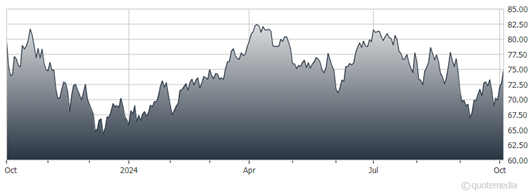

Image Source: Iran fired hundreds of missiles at Israel on Tuesday in response to Israeli airstrikes and attacks. Israel’s Prime Minister Benjamin Netanyahu said Iran made a big mistake and would pay for it, and Iran threatened a crushing response if Israel retaliated. Wednesday, oil ran right up to resistance and was looking for an excuse to break out higher. But it pulled back to support after the Energy Information Administration (EIA) reported a surprise crude oil supply increase of 3.9 million barrels from the previous week. That was different from the supply draw that was reported by the American Petroleum Institute (API).United States Oil Fund (USO)

Image Source: Iran fired hundreds of missiles at Israel on Tuesday in response to Israeli airstrikes and attacks. Israel’s Prime Minister Benjamin Netanyahu said Iran made a big mistake and would pay for it, and Iran threatened a crushing response if Israel retaliated. Wednesday, oil ran right up to resistance and was looking for an excuse to break out higher. But it pulled back to support after the Energy Information Administration (EIA) reported a surprise crude oil supply increase of 3.9 million barrels from the previous week. That was different from the supply draw that was reported by the American Petroleum Institute (API).United States Oil Fund (USO) EIA puts US crude supply in commercial inventories at 416.9 million barrels. US crude oil inventories are about 4% below the five-year average for this time of year. EIA said gasoline inventories increased by 1.1 million barrels from last week, different from the draw reported by the API. Distillate fuel inventories decreased by 1.3 million barrels last week and are about 8% below the five-year average for this time of year.

EIA puts US crude supply in commercial inventories at 416.9 million barrels. US crude oil inventories are about 4% below the five-year average for this time of year. EIA said gasoline inventories increased by 1.1 million barrels from last week, different from the draw reported by the API. Distillate fuel inventories decreased by 1.3 million barrels last week and are about 8% below the five-year average for this time of year.

Gasoline demand is rocking as EIA reported that over the past four weeks, motor demand averaged 8.7 million barrels a day. That was up by 4.9% from the same period last year.

Oil is still concerned about an increasing risk of a supply disruption coming from Iran. President Biden said he did not support Israel attacking Iranian nuclear sites. If they can’t attack the nuclear sites, the best way to send them a message is to attack their oil infrastructure.

That said, Reuters reports that “OPEC has enough spare oil capacity to compensate for a full loss of Iranian supply if Israel knocks out that country’s facilities, but the producer group would struggle if Iran retaliated by hitting installations of its Gulf neighbors.”

We think the market could be sleepwalking into a supply spike if we find out that the emperor has no clothes. Be careful about a big upside extension of the big spike. The potential risk has seen option prices really start to increase in value. More By This Author:UNH: A Solid Healthcare Play In A Rotational Market The Gold Correction Could Have Legs – But So Could The Long-Term Bull MarketMeta Platforms: What Does A 15-Point Analysis Say About The Social Media Stock?