Over the weekend we reported that even Goldman has now highlighted what has been clear to most, but certainly not the Fed, for quite some time: stocks are in such an epic bubble, with many of the key valuation metrics notably EV/sales, off the charts and at all time highs, that even Goldman’s own clients are asking “When does the party end?” Never one, however, to tell clients to sell and hold to cash (just think of the lost flow trading commissions, not to mention the potential prop trading losses from frontrunning said flow), Goldman Sachs was kind enough to point out that while buying into undervalued stocks at this record high market junction may be a safe bet, the alternative, going long the most overvalued stocks usually ends in tears.

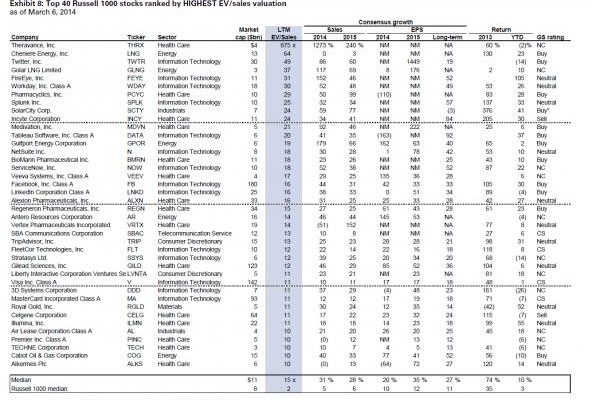

So just what are these most overvalued stocks? To answer this question David Kostin screens for those Russell 1000 companies with the highest EV/Sales ratios (because in the new normal actual earnings – not the non-GAAP, adjusted, recasted, added back mumbo jombo, and certainly cash flows no longer matter), and finds 40 companies, with a ratio between 10x and 875x (median of 15x compared to the overall Russell’s 2x), that fit the bill (and which have returned 10% YTD compared to just 3% for the broader index).

The answer – the list of America’s most overvalued companies – is shown in the table below.