Photo by on The Q3 earnings season is slowly grinding to a halt, with just a small chunk of S&P 500 companies yet to reveal their quarterly results.But looming large is AI-favorite Nvidia ( – ), whose results are expected after the market’s close on Wednesday. A peer, Advanced Micro Devices ( – ), has already delivered its quarterly results, giving us a small read-through of what to expect concerning AI demand and trends within video gaming.Let’s take a closer look.

Photo by on The Q3 earnings season is slowly grinding to a halt, with just a small chunk of S&P 500 companies yet to reveal their quarterly results.But looming large is AI-favorite Nvidia ( – ), whose results are expected after the market’s close on Wednesday. A peer, Advanced Micro Devices ( – ), has already delivered its quarterly results, giving us a small read-through of what to expect concerning AI demand and trends within video gaming.Let’s take a closer look.

AMD Posts Robust Data Center Growth

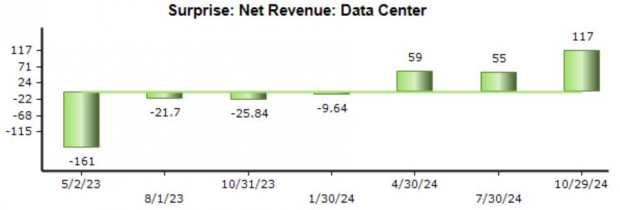

Advanced Micro Devices posted strong growth in its release, with EPS growing 31% on the back of 17% higher sales. Margin expansion unlocked higher profitability, with its reported gross margin of 54% expanding from the 47% mark in the year-ago period.Notably, Data Center revenue of $3.5 billion reflected a quarterly record and climbed an astonishing 122% from the same period last year. Overall, the Data Center results confirm strong underlying demand for AI, a trend we’ve been very accustomed to over recent periods.AMD’s data center results have regularly exceeded our consensus expectations in recent quarters, as we can see below. Image Source: Zacks Investment ResearchThe valuation picture doesn’t warrant immediate concern, with the current 29.4X forward 12-month earnings multiple comparing favorably to a 42.3X five-year median and 106.9X five-year highs. Further, the current PEG works out to 1.0X, again well beneath historical values and comparing nicely to the Zacks Computer and Technology sector average.

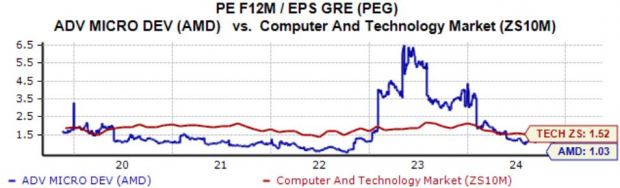

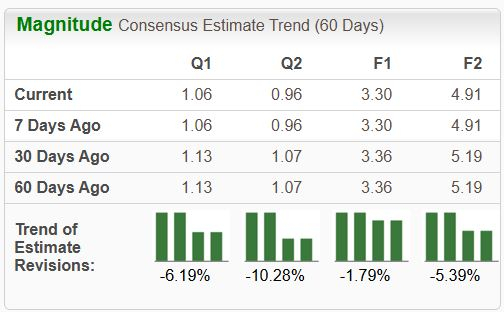

Image Source: Zacks Investment ResearchThe valuation picture doesn’t warrant immediate concern, with the current 29.4X forward 12-month earnings multiple comparing favorably to a 42.3X five-year median and 106.9X five-year highs. Further, the current PEG works out to 1.0X, again well beneath historical values and comparing nicely to the Zacks Computer and Technology sector average. Image Source: Zacks Investment ResearchThe stock didn’t see a great post-earnings reaction despite the favorable Data Center results, with analysts also downwardly revising their earnings expectations following the release. Weaker-than-expected sales forecasts have been a driver behind the negative share sentiment over recent months, also explaining the downward estimate revisions.

Image Source: Zacks Investment ResearchThe stock didn’t see a great post-earnings reaction despite the favorable Data Center results, with analysts also downwardly revising their earnings expectations following the release. Weaker-than-expected sales forecasts have been a driver behind the negative share sentiment over recent months, also explaining the downward estimate revisions. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Nvidia Guidance Remains Key

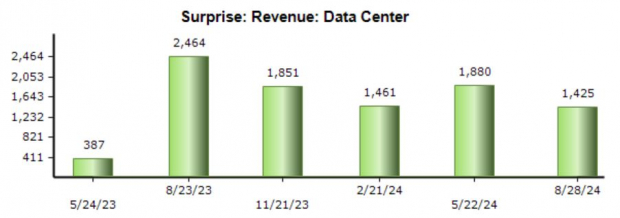

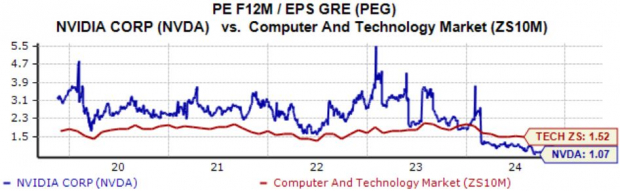

Nvidia’s Data Center results have been nothing short of remarkable, consistently blowing away our consensus expectations in recent quarters. As shown below, the beats have been quite sizable, with the most recent totaling a sizable $1.4 billion amid another period of scorching-hot demand. Image Source: Zacks Investment ResearchInvestors can likely expect another robust showing within its Data Center, with our $28.9 billion consensus estimate suggesting nearly 100% growth year-over-year. The read-through AMD gave us concerning AI demand also bodes well for NVDA here.CEO Jensen Huang provided a bullish long-term comment following the Q2 release, confirming strong demand for Hopper and overall anticipation for Blackwell. ‘NVIDIA achieved record revenues as global data centers are in full throttle to modernize the entire computing stack with accelerated computing and generative AI.’Valuation multiples aren’t expensive on a relative basis, with the current 38.7X forward 12-month earnings multiple well beneath the 50.7X five-year median and five-year highs of 106.3X.In addition, the current PEG ratio works out to 1.1X, again well below historical levels. As shown below, the multiple compares favorably to the Zacks Computer & Technology sector average of 1.5X.

Image Source: Zacks Investment ResearchInvestors can likely expect another robust showing within its Data Center, with our $28.9 billion consensus estimate suggesting nearly 100% growth year-over-year. The read-through AMD gave us concerning AI demand also bodes well for NVDA here.CEO Jensen Huang provided a bullish long-term comment following the Q2 release, confirming strong demand for Hopper and overall anticipation for Blackwell. ‘NVIDIA achieved record revenues as global data centers are in full throttle to modernize the entire computing stack with accelerated computing and generative AI.’Valuation multiples aren’t expensive on a relative basis, with the current 38.7X forward 12-month earnings multiple well beneath the 50.7X five-year median and five-year highs of 106.3X.In addition, the current PEG ratio works out to 1.1X, again well below historical levels. As shown below, the multiple compares favorably to the Zacks Computer & Technology sector average of 1.5X.

Image Source: Zacks Investment ResearchPutting Everything TogetherInvestors are eagerly awaiting Nvidia’s Q3 release, which will wrap up the reporting period for the broader Mag 7 group overall. We’ve already heard from a peer, Advanced Micro Devices, whose Data Center results showed strong underlying demand.While the reaction to the AMD results wasn’t bullish, it was a result of weaker-than-expected sales guidance. It’s reasonable to assume that guidance from NVDA will likely dictate the post-earnings move as well, as many already know that sizable Y/Y growth is on the horizon.Still, consistently strong execution from NVDA and an already established stance within the AI space keeps the stock the clear AI favorite.More By This Author:These 2 Companies Shattered Quarterly RecordsThese 3 Quarterly Reports Positively Shocked Investors: Tesla, Micron, Arista Networks2 Companies Unlocking Higher Profits: AMD, TSLA

AMD Vs. Nvidia: What’s The Better AI Stock?