Image: BigstockIn the past week, Allegiant Travel Company ( – ) reported lower-than-expected earnings per share and revenues for third-quarter 2023. The results were hurt by the year-over-year decline in air traffic, as well as the rise in fuel costs. Average fuel price per gallon increased 6.5% sequentially in third-quarter 2023. Additionally, Latin American carrier Gol Linhas ( – ) reported a loss in the September quarter.Fortunes were brighter for European low-cost carrier Ryanair Holdings ( – ), which reported better-than-expected earnings per share and revenues for second-quarter fiscal 2024 (ended Sept. 30, 2023), driven by upbeat passenger volumes. Riding on the upbeat air-travel demand scenario, Latin American carrier Azul ( – ) reported rosy traffic numbers for the month of October.

Image: BigstockIn the past week, Allegiant Travel Company ( – ) reported lower-than-expected earnings per share and revenues for third-quarter 2023. The results were hurt by the year-over-year decline in air traffic, as well as the rise in fuel costs. Average fuel price per gallon increased 6.5% sequentially in third-quarter 2023. Additionally, Latin American carrier Gol Linhas ( – ) reported a loss in the September quarter.Fortunes were brighter for European low-cost carrier Ryanair Holdings ( – ), which reported better-than-expected earnings per share and revenues for second-quarter fiscal 2024 (ended Sept. 30, 2023), driven by upbeat passenger volumes. Riding on the upbeat air-travel demand scenario, Latin American carrier Azul ( – ) reported rosy traffic numbers for the month of October.

Recap of the Past Week’s Most Important Stories

Low-cost carrier Allegiant reported third-quarter 2023 earnings (excluding $1.53 from non-recurring items) of 9 cents per share, which fell short of the Zacks Consensus Estimate of 13 cents but surged more than 100% year-over-year.Operating revenues of $565.4 million also lagged the Zacks Consensus Estimate of $583.7 million, but increased marginally on a year-over-year basis. Passenger revenues, which accounted for the bulk (91.3%) of the top line, remained flat on a year-over-year basis. Management now expects 2023 earnings per share (airline) in the $7.75-$8.50 (prior view: $10.50-$13.00) range.Updates on the third-quarter earnings report of another low-cost carrier, JetBlue Airways ( – ), are available in the .Gol Linhas incurred third-quarter 2023 loss of 25 cents per share against the Zacks Consensus Estimate of earnings per share of 4 cents. In the year-ago quarter, GOL had incurred a loss of 75 cents. Net operating revenues of $956 million lagged the Zacks Consensus Estimate of $974.4 million. Management now capacity to increase 10%-15% year-over-year in 2023.Currently, Gol Linhas carries a Zacks Rank #3 (Hold).Ryanair reported second-quarter fiscal 2024 earnings per share of $7.21, which outpaced the Zacks Consensus Estimate of $7.13 and improved year-over-year. Revenues of $5,361.3 million beat the Zacks Consensus Estimate of $5,137.7 million.Average airfare, which rose 24% in the first half of fiscal 2024, is expected to rise year-over-year by mid-teens percentage in the fiscal third quarter. Management fiscal 2024 traffic to be 183.5 million. Profit after tax is anticipated in the range of EUR1.85 billion and EUR2.05 billion for fiscal 2024.For the month of October, Azul’s consolidated traffic increased 13.7% year-over-year. To match the increased demand situation, AZUL is expanding its capacity. In the same period, capacity grew 8.4% year-over-year. Since traffic growth was more than capacity expansion, the load factor (the percentage of seats filled by passengers) increased 3.9 percentage points to 81.1% last month.

Price Performance

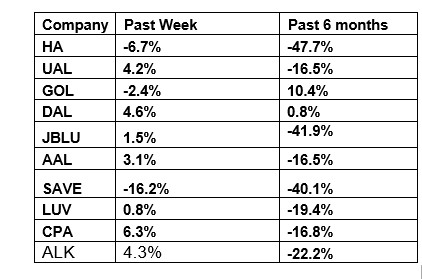

The following table shows the price movement of the major airline players over the past week and during the past six months.  Image Source: Zacks Investment ResearchThe table above shows that the majority of the airline stocks traded in the green over the past week. Consequently, the NYSE ARCA Airline Index gained 1% to $48.68 over the past week. Over the course of six months, the sector tracker decreased 18.3%.

Image Source: Zacks Investment ResearchThe table above shows that the majority of the airline stocks traded in the green over the past week. Consequently, the NYSE ARCA Airline Index gained 1% to $48.68 over the past week. Over the course of six months, the sector tracker decreased 18.3%.

What’s Next in the Airline Space?

Investors will likely look forward to the third-quarter 2023 earnings report of Azul, which is scheduled to be released on Nov. 14.More By This Author:SoundHound AI Q3 Earnings In Line, Revenues Rise Y/Y3 Top Dividend Stocks To Maximize Your Retirement IncomesBull Of The Day: Petroleo Brasileiro

Airline Stock Roundup: Allegiant’s Q3 Earnings Miss, Gol Linhas’ Loss & More