A) Introduction

American International Group (NYSE:AIG) has to be one of the most unloved stocks in the entire market. While the company was widely criticized for its role in causing the ’08 financial collapse, the government bailout of the company infuriated the entire nation. With that being said, AIG is a different company nowadays. The company has long since repaid its debt to the government (with interest), and the company’s restructuring efforts have been successful. The company has posted two straight quarters of revenue and EPS growth, and last quarter’s EPS numbers beat consensus estimates by over 12%. While some analysts have recently changed tone on the stock (Credit Suisse downgraded it from ‘Outperform’ to ‘Neutral’ on January 8th), we believe the stock offers very attractive value at these prices. We’ll start this article with a quantitative breakdown of the company’s relative value, then analyze its growth profile, followed by an analysis on how the “smart money” is playing the stock, before concluding with some qualitative analysis and conclusions.

B) Valuation Breakdown

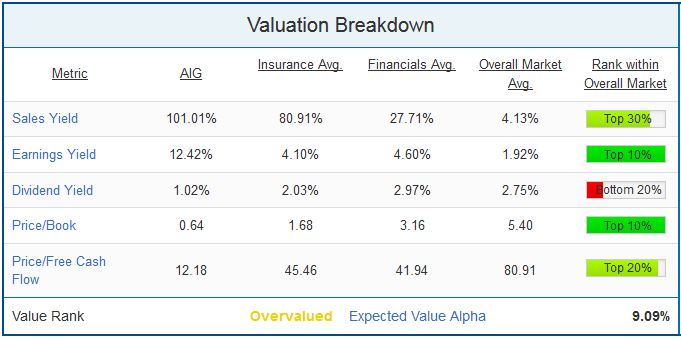

We take a quantitative approach to investing, preferring to focus our analysis on a certain set of metrics that have a strong predictive ability. We’ll start by analyzing AIG’s value profile. This is important to look at as “Value stocks (with low ratios of price-to-book value) have higher average returns than growth stocks (high price-to-book ratios)”. AIG’s valuation profile is shown below:

Source

On almost every important measure of value, AIG is attractively priced. On a revenue basis, AIG’s sales yield (101%) is much higher than the insurance (81%), financial sector (28%), and overall market (4%) averages. It also means that an investor can currently get $1.01 of revenue for every $1 they invest in a company that makes money and is growing EPS. That type of value in a growing, profitable company is very tough to find, especially in an otherwise expensive market. This is undervaluation is true of the company on an earnings basis as well, where AIG’s earnings yield (12.4%) is more than triple the insurance average (4.1%), and more than six times the overall market average (1.92%). This story is the same for AIG on a price/book value (0.64) and price/free cash flow basis (12.18), which are heavily discounted relative to the industry group, sector, and overall market averages. It’s tough to find a more undervalued stock than AIG. The company’s mediocre dividend yield (1.02%) is the lone weak spot though we believe the company should be bought for capital appreciation rather than income generation. Overall, we rate the stock as “Strongly Undervalued” and expect the company to generate 9.09% of outperformance over the market in the next twelve months solely due to its valuation.