AGNC Investment Corp (AGNC) has a sky-high dividend yield of 10.3%.

It is one of 295 stocks with a 5%+ dividend yield.

And, it is one of a select few with a 10%+ dividend yield.

AGNC yields roughly five times the S&P 500 Index, which has a 2% dividend yield on average.

In addition, AGNC pays its dividend each month, rather than on a quarterly or semi-annual basis. Monthly dividends give investors the ability to compound dividends even faster.

AGNC is one of just 21 stocks that pay monthly dividends.

That said, it is also important for investors to assess the sustainability of such a high dividend yield.

This article will discuss AGNC’s business model, and whether the stock is appealing to income investors.

Business Overview

AGNC was founded in 2008. It is an internally-managed real estate investment trust, or REIT.

Whereas most REITs own properties that are leased to tenants, AGNC has a different business model. It operates in a niche industry, mortgages.

AGNC invests in agency mortgage-backed securities. It generates income by generating interest on its invested assets, minus borrowing costs. It also records gains or losses from its investments and hedging practices.

Â

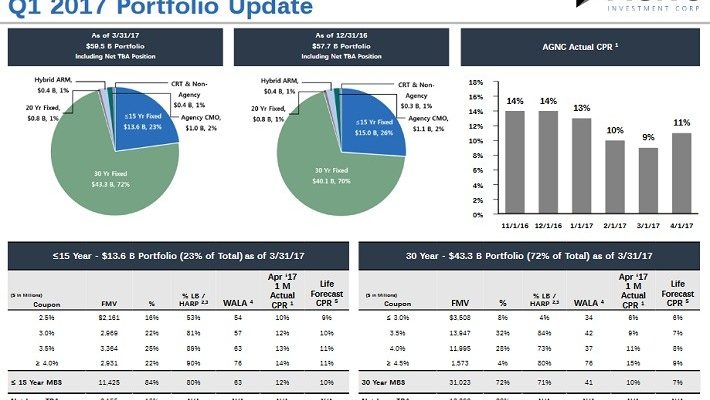

Source:Â 2017 First Quarter Presentation, page 7

As of March 31st, its portfolio consisted of $59.5 billion in securities, including $45.0 billion in residential mortgage-backed securities.

The vast majority of AGNC’s portfolio is comprised of fixed-rate mortgages. Approximately 72% of investments are in 30-year fixed rate mortgages. Another 23% of investments are in mortgages with a duration of 15 years or less.

AGNC’s financial performance has suffered over the past year, due primarily to rising interest rates. Net book value declined 6.3% in 2016.

Â

Source:Â 2017 First Quarter Presentation, page 22

Net interest income fell by 18% in 2016. Net interest income fell by 33% in the first quarter of 2017, compared the previous quarter.