DEC CORN(Click on image to enlarge)

An “export rally” from mid-October of 25 cents (400-425) was corrected this week as harvest pressure from a record US crop, an expected record S/A crop & a sharply lower crude oil mkt all combined to force a set-back! However, exports this past 10 days have been spectacular – with 16 flash sales & Monday Inspections & Thursday Sales routinely running in excess of 1-2 mmt! As well, corn harvest is 81% in (avg-68) so hedge pressure will soon be off the mkt! It is currently consolidating in front of 2 major events – the US Election next Tuesday 11-5-24 & the Nov WASDE ON Fri 11-8-24!

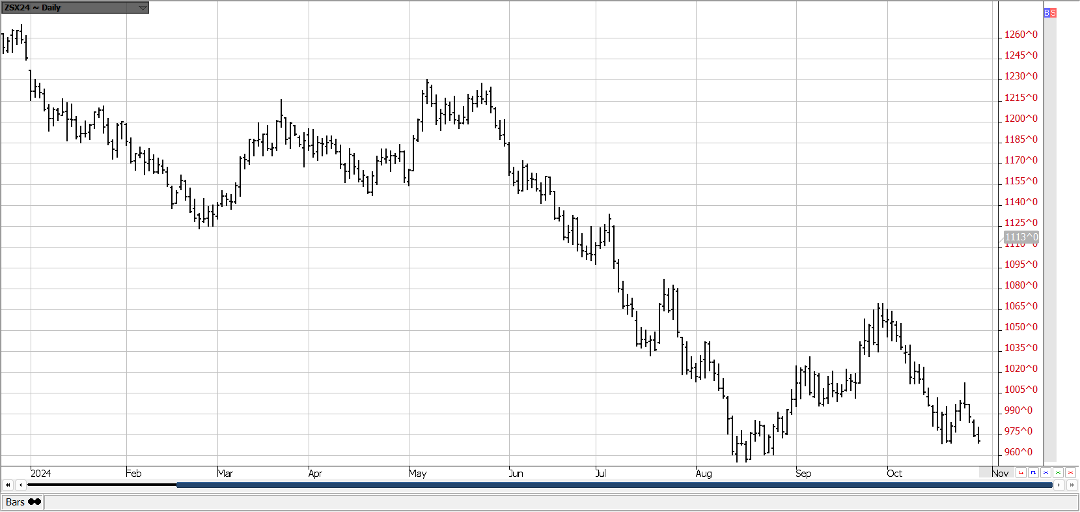

NOV BEANS(Click on image to enlarge)

Even though bean harvest is nearly over- at 89% in (82-LY), the mkt is still under pressure as South American Weather continues to be a major headwind! US Harvest is the fastest since 2010 & this had added to the pressure as a record crop is hitting the mkt much sooner than expected! Export inspections continue to impress – yesterday at 2.393mmt! We look for a post election/harvest rally into early November! The 4 year-low level should be cheap enough to continue to attract exports globally!

DEC WHT(Click on image to enlarge) The 1st Winter Wheat conditions report of the season came in shockingly low at 38% (avg – 53%) – the lowest level in 39 years! Top producer Kansas was 38% & Oklahoma was 21% (ly-42)! Winter Wheat planting is 80% in (avg-83)! The ratings have Dec Wht up 15 cents today! A substandard WW crop & improving exports along with a spill-over rally support from corn & beans should support the upside after harvest ends!

The 1st Winter Wheat conditions report of the season came in shockingly low at 38% (avg – 53%) – the lowest level in 39 years! Top producer Kansas was 38% & Oklahoma was 21% (ly-42)! Winter Wheat planting is 80% in (avg-83)! The ratings have Dec Wht up 15 cents today! A substandard WW crop & improving exports along with a spill-over rally support from corn & beans should support the upside after harvest ends!

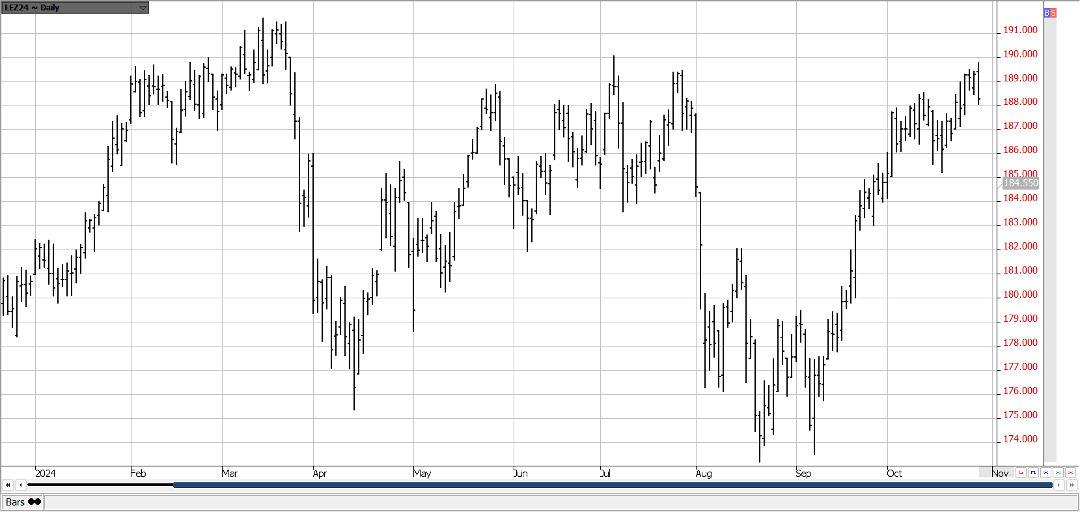

DEC CAT(Click on image to enlarge)

Today, Dec Cat is correcting an overbought rally after a $16 up (174-190) since Labor Day! The contra-seasonal move is stunning in the sense that normally the cattle mkt languishes after LD W/E as the outdoor-grilling season winds down! But this fall, the Fed stepped up with its 1st IR decrease in 4 years – .5% – & this served to inject the Cattle mkt with both domestic & export demand – which in turned energized the upmove! Last Friday’s Cattle-on-Feed Report was slightly negative with higher placements than expected but the mkt sloughed off this report – thanks to a strong cash & aggressive packer buying!

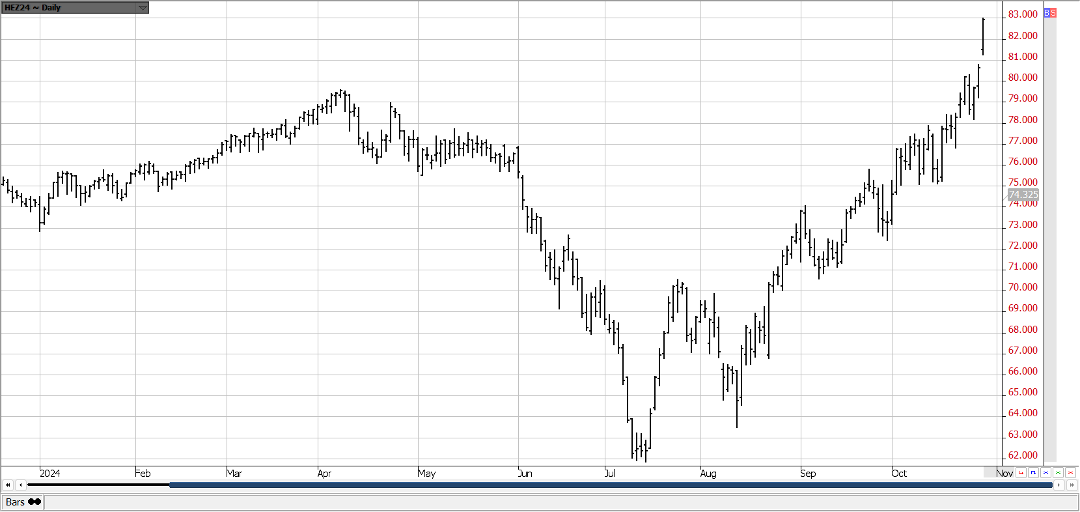

DEC HOGS(Click on image to enlarge)

Dec Hogs catapulted to new contract highs this morning – gaping higher to an over $2.00 gain – the beneficiary of strong cash prices & continued fund buying! Since early July, the mkt has staged a sensational $20 rally (63-83)! The recent Cold Storage Report reflected lower bellies in storage! The entire US economy has been rejuvenated by the Fed’s recent IR cut – validated by the DJI’s recent rally to record highs over 43,000! Pork demand has benefitted as well – conveniently replacing the Grilling Demand – lost after Labor Day W/E!More By This Author:

AgMaster Report – Wednesday, Oct. 30