JAN BEANS(Click on image to enlarge)

In the past 2 weeks, Jan Beans have lost 90 cents (1400-1310) due to more frequent rains falling in N Brazil – potentially adding to their production potential! On the other side of the ledger is a plethora of export sales – including last Thur – 1.9 MMT, today 1.1 MMT plus numerous flash sales in the past week! But they have been unable to offset the impact of improved South American Weather! As well, two major reports are looming Friday – the Dec WASDE &the Dec Unemployment #’s! Also, add in reduced volume through the holidays adding to the mkt volatility! We feel you need to “wait out” the Brazil rains to see exactly how much good they’ve done & compare that with the chart action! One thing we didn’t have 6 months ago is the export interest & that’s a huge positive!

MAR CORN(Click on image to enlarge)

Mar Corn has been able to detach itself from a slumping bean mkt – scoring 20 cents of gains in the past 4 trading days while Jan Beans have lost 40 cents! Obviously, an uncoupling of the bean/corn spread has helped the mkt as well as frequent flash export sales such as this morning’s 267,000 MT corn purchase by Mexico! It feels like much of the bad news is dialed in ( more corn acres, a 15BB crop)! As well, there’s still a 200,000 short open interest in the mkt which supports on any breaks! Finally, US Corn is the cheapest anywhere on the Globe – which enhanced by a tumbling US Dollar – makes us export-competitve once again!

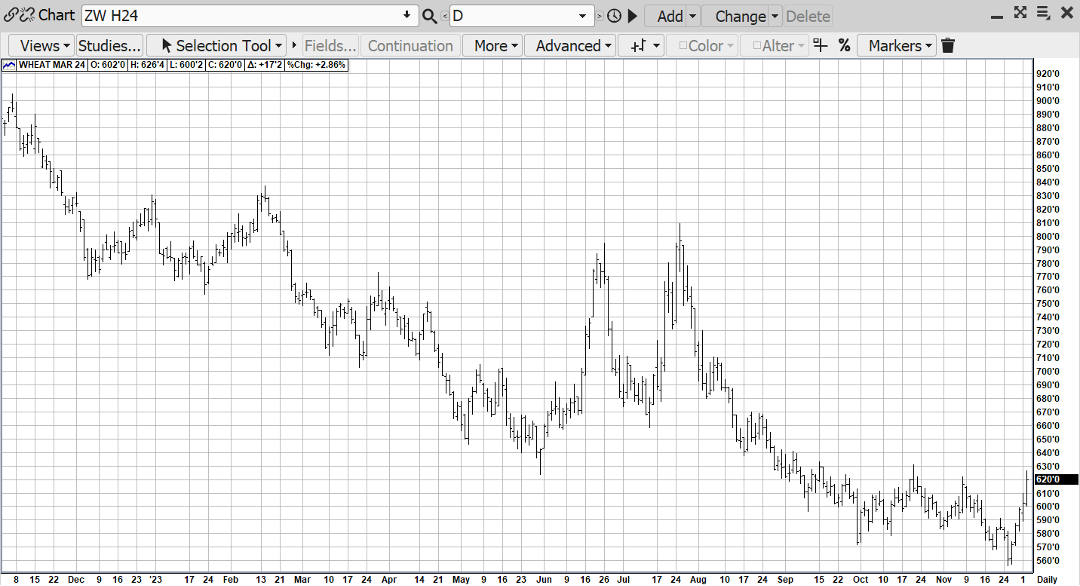

MAR WHT(Click on image to enlarge)

Mar Wht has been on a tear of late – working on its 5th consecutive higher closer a real rarity for this woebegone contract – continually bludgeoned by cheap Russian exports! But it appears CHEAP PRICES HAVE FINALLY CURED CHEAP PRICES as the mkt is in the throes of a 70 cent rally! Helping this morning was an 8am enormous Flash Sale of 440,000 HRW Wht to China! Also, wht crops in Australia & Argentina are sub-par! It all adds up to a resurgent mkt threatening this week to breach the 3-month high of 630!

FEB CAT(Click on image to enlarge)

An oversold cattle mkt gave up further ground today – as a declining cash mkt and a still sizeable long fund position led to a continuing liquidation in an already slumping Feb Cat mkt! Holiday demand favors pork over beef & exports last week were 37% under the previous week! The mkt is severely oversold but the trend is decidedly down as the mkt searches for a low!

FEB HOGS(Click on image to enlarge)

As mkts often do, Feb Hogs overdid the down last week off the Chinese mass liquidation of hogs – leaving the mkt severely oversold! To the point, where the contract was $1.00 discount to cash versus the average $6-7 premium to cash! That coupled with the seasonal consumer preference of pork over beef has buoyed futures $3-4.00 off last week’s lows – foreshadowing a probable trading range of 66-74 between now & month’s end! Heads-up for late month when “triple-witching” occurs on Friday 12-22-23 with the issuance of a Dec Cattle-on-Feed, a Cold Storage Report & a Pig Crop Report – all at 2pm!More By This Author:

AgMaster Report – Tuesday, Dec. 5