“I would argue in today’s environment that liquidity might be one of the biggest risks we face because it might not be as good as we think it is.â€

-Mark Yusko of Morgan Creek Capital, May 23

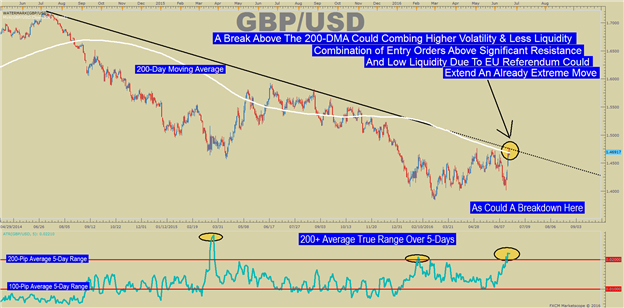

Volatility and liquidity are often lumped together, but they are very different topics that should be understood well. Volatility is a measure of price range over a given time and often utilizes tools like Volatility Bands – which are nothing more than standard deviations around an average price – and average true range readings over a fixed period. Understanding volatility is helpful because the information can help you see where you should place your stops (whether wider or tighter) or if markets have become too erratic for you to trade.

Volatility Is A Simple Number Whereas Liquidity Is a Difficult Concept [Cable Example]

Chart Created by Tyler Yell, CMT

However, liquidity is another animal altogether.

Liquidity is typically seen as the ability to quickly transact in an asset without affecting price or to convert an asset to cash. When there is liquidity, markets operate smoothly. When liquidity decreases or is depleted a liquidity gap can arise.

Liquidity gaps are common precursors to market disruptions and crashes. The easiest way that traders tend to measure risk is through the bid-ask spread; but this shows you what is available now and not the critical information of whether or not you’ll be able to hit the ask or bid when you need to get out of a trade. In addition to the bid-ask, depth of liquidity is a requisite for operational efficiency. When markets are shocked by news – whether it be a Lehman Brother Bankruptcy, Flash Crash of 2010 ( A liquidity crash), or a Chinese Yuan Devaluation – there tend to be pockets of no-bid or no-ask which can lead to a shallow or nonexistent liquidity.

You can think of such events as a Liquidity Black Hole.