AT40Â = 36.5% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200Â = 51.2% of stocks are trading above their respective 200DMAs

VIX = 15.6 (volatility index) – a 46.4% increase!!!

Short-term Trading Call: neutral (downgrade from cautiously bullish)

Commentary

Time to downgrade my cautious bullishness to neutral.

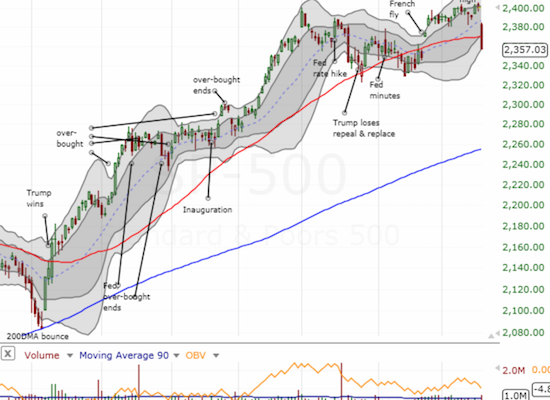

The S&P 500 (SPY) lost 1.8% on its way to a major breakdown of support at its 50-day moving average (DMA). This breakdown forced me to downgrade my short-term trading call. I am not bearish because AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, closed at 36.5%. In a strong bull run, the low 30s is “close enough†to the oversold threshold of 20%. So there is little upside here in flipping to a bearish stance. A neutral trading call facilitates navigating across longs and shorts as the circumstance fits (very short-term).

The S&P 500 sliced through 50DMA support. In one day, it lost all the painstaking gains of the previous 3 weeks…all created by the launch of the French Fly.

AT40 (T2108) lost a whopping 12 percentage points and hit a 2-month closing low.

AT200 (T2107), the percentage of stocks trading above their respective 200DMAs, closed at 51.2%, a new 6+ month low. Yesterday’s loss confirmed the on-going breakdown of AT200.

AT200 (T2107) continued its decline…and warning about the longer-term health of the rally in the stock market.

The “French Fly†launched the gains for the S&P 500 over the last three weeks. The near complete reversal of those gains in just one day is like a shock to the system that will certainly serve as a wake-up call. The volatility index (VIX) was a major recipient of this wake-up call. The VIX soared an incredible 46.4% and closed just above the all-important 15.35 pivot. This surge tied August 21, 2015 as the 6th largest one-day percentage gain on record (data available through 1990). Traders will recall that was the day of a nasty one day-sell off that immediately preceded a flash crash and epic oversold period which drove its own 45.3% jump in the VIX – together I called this period the August Angst.