Last week, I wrote an article on HCP, Inc. (NYSE:HCP), in which I examined the risks associated with the company’s largest tenant, HCR ManorCare. While HCP’s troubles are due in large part to the company’s significant concentration with one tenant, the entire skilled nursing sector has become more volatile due to civil actions resulting from questionable billing practices for Medicare and Medicaid reimbursements.

ManorCare article it planned to “vigorously defend the DOJ’s civil action” and that its Medicare billings are submitted to and approved for payment by the Centers for Medicare & Medicaid Services, which deemed the services in question to be medically necessary and in compliance with billing guidelines.

Yet, according to BMO Research, “there has been recent precedence with similar allegations of false claims against skilled nursing operators, The Ensign Group and Extendicare. Both of these complaints resulted in cash settlements with the DOJ ($48mm for Ensign and $38mm with Extendicare, in November 2013 and October 2014).”

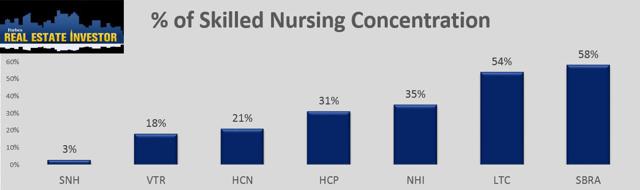

I have documented articles on other skilled nursing REITs recently, including Sabra Health Care (NASDAQ:SBRA), LTC Properties (NYSE:LTC), National Health Investors (NYSE:NHI), Ventas, Inc. (NYSE:VTR), and Healthcare REIT(NYSE:HCN).

HCP will likely trade with an overhang so long as ManorCare’s reimbursements are being heavily scrutinized; the company generates most (around 71%) of its revenue from Medicare and Medicaid sources. It’s likely that the HCP’s closest peers will also be impacted as the government billing procedures are dissected.

I have often wondered how one could invest in senior housing without the risk of government-backed revenue. It seems that most healthcare REITs have exposure that relies solely on public sources… except for now…

The Pure-Play Senior Housing REIT

Last November (2014), New Senior Investment Group (NYSE:SNR) spun from Newcastle Investment Corp. by issuing 17.5 million shares generating proceeds of around $241 million.