Image Source:

Image Source:

I apologize for the seemingly cursory nature of today’s piece. I have a commitment that will take me out of the office this morning, so I will instead focus on a few key points:

Middle East tensions: They’re certainly not good for markets by any means, but it’s important to keep in mind that equity markets are not particularly good at discerning the impact of geopolitical events on stock prices.Remember, investors are very good at figuring out how news events might affect revenues, earnings, cash flows, etc., but that’s very tough to do for the vast majority of stocks when it’s events halfway around the world.Instead, I look to bonds, where there is indeed a flight to safety bid, and oil, which is up modestly, but by no means panicky.

Dockworkers strike: Also, not good news, but not having a huge impact yet. Fedex (FDX) and UPS caught bids yesterday on hopes that they will benefit, but they’re giving much back today.And Walmart (WMT) is up, which is counterintuitive if imports are impacted.

Economic reports: Is good news bad again? On an early September media appearance I asserted that good news was good and bad news was bad because it was clear we were getting rate cuts at the next meeting no matter what. And we did, bigger than many expected.Now we’re quibbling over the magnitude of subsequent cuts, about which Powell is trying to tamp down expectations.So, when we think about this morning’s selling after mostly better than expected numbers, we seem to have switched again.JOLTS up and ISM prices down are good news for both ends of the dual mandate.But that means 25bp, not 50bp….

It is very hard for the S&P 500 (SPX) to escape the gravitational pull of Apple (AAPL) & Microsoft (MSFT). But it’s clear that at least a piece of the decline is simply giving back the end of quarter pump that we saw yesterday, since the Midcap (MID) and Russell 2000 (RTY) indices are also down similar to SPX. Consider where we were prior to the Iran story and economic data. At that point, we had simply given back the last 20 minutes of yesterday, which was clearly “mark the close” activity:

(Click on image to enlarge) Source: Interactive Brokers

Source: Interactive Brokers

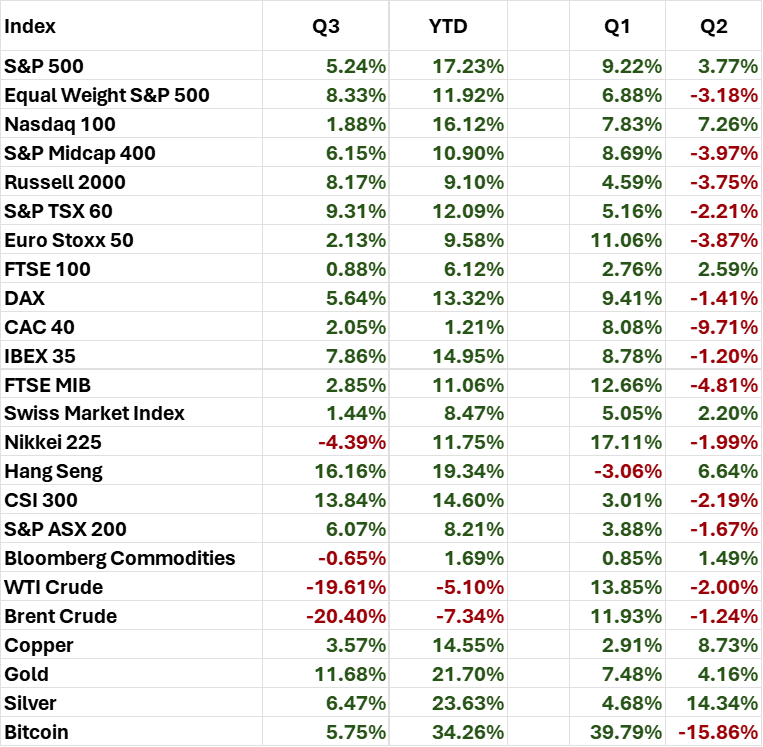

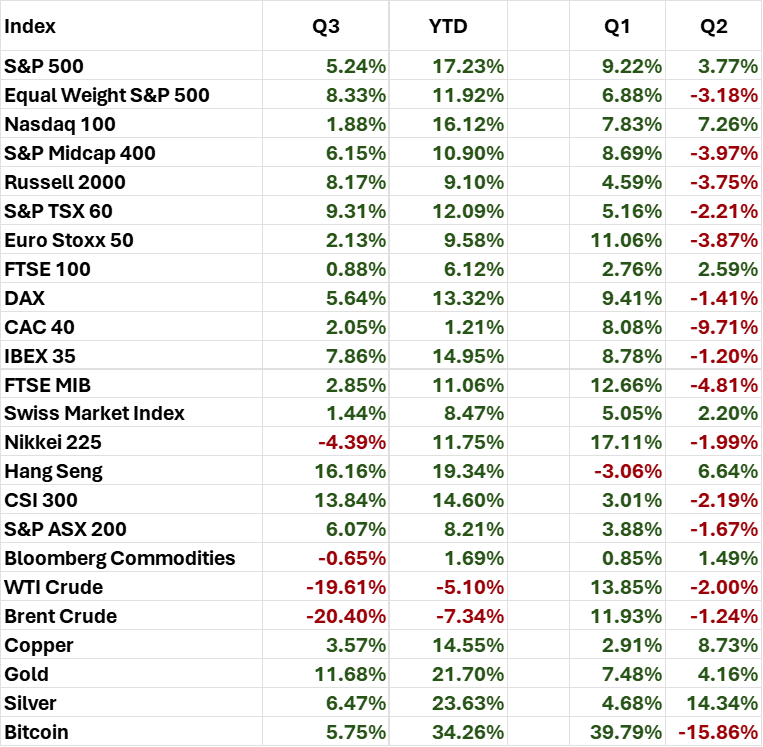

I literally just finished this table, which puts both 3Q and YTD in perspective.Basically, if you invested in risk assets, you won:

(Click on image to enlarge) Source: Interactive BrokersMore By This Author:Rotation Was The Key This Quarter Big Fireworks From ChinaRe-Checking Some Key Market Charts

Source: Interactive BrokersMore By This Author:Rotation Was The Key This Quarter Big Fireworks From ChinaRe-Checking Some Key Market Charts

Source: Interactive Brokers

Source: Interactive Brokers Source: Interactive BrokersMore By This Author:Rotation Was The Key This Quarter Big Fireworks From ChinaRe-Checking Some Key Market Charts

Source: Interactive BrokersMore By This Author:Rotation Was The Key This Quarter Big Fireworks From ChinaRe-Checking Some Key Market Charts