The discrepancy between FX volatility and equity volatility is perhaps the most important indicator for markets. That’s my story and I’m sticking to it, dammit.

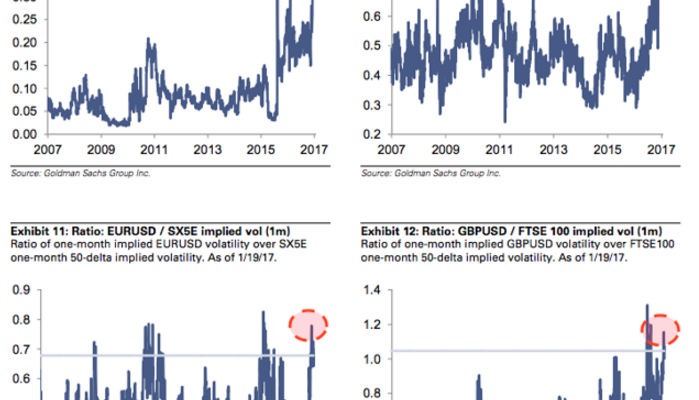

The FX volatility/equity volatility ratios are near records across markets:

(Goldman)

Or, to visualize it another way, we’re seeing nothing in the S&P 500 implied volatility term structure. No kink at the front end to reflect Trump policy uncertainty:

(Goldman)

How long can this possibly hold up? Not long, I would contend. Then again, it’s held up for longer than I would have anticipated and you can’t very well expect elevated implied volatility when realized volatility is subdued. The VIX seems comfortable at a 10 handle.

Well, at least one FX trader agrees that this is probably an exceptionally precarious scenario. Below, find the latest from Bloomberg’s Mark Cudmore, a sell-described “perma-bull†who is now just plain “worried.â€

Via Bloomberg’s Mark Cudmore

The market is full of counterintuitive price action. This should erode confidence and equities may see a sharp reversal lower soon.