Data/Event Risks

Data/Event Risks

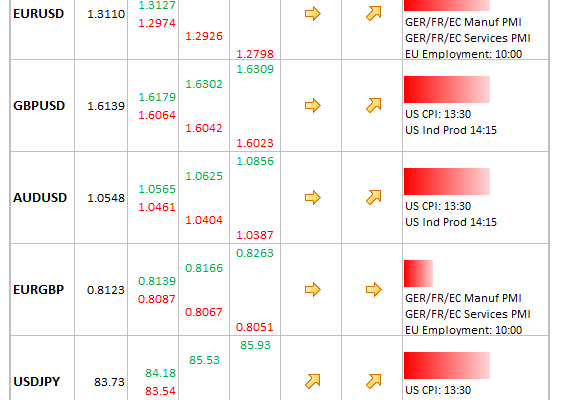

- EUR: Preliminary manufacturing and services PMI readings out of Germany/France/EU this morning, were a mixed bag.

- USD: Inflation and industrial production out later, unlikely to move the dial in any way.

- JPY: Election on Sunday, where the dovish LDP are likely to return to power. BOJ meet next Wed-Thursday – more easing on the way. Will be interesting to observe how the JPY trades next week after election out of the way – will we see some short-covering?

Idea of the Day

In recent weeks it could be argued that a new currency hierarchy has emerged, at least amongst the majors. The baton for the ‘worst’ major has been passed from the euro to the Japanese yen – EUR/JPY is up nearly 10% in the past five weeks. The dollar meanwhile has been on the defensive amidst uncertainty regarding how the fiscal cliff issue will be resolved. Remarkably, the euro has been at the top of the pile as those who have been structurally short for a long time are forced to reassess. Being short euro against any of the majors has been a painful trade for a while now.

Latest FX News

- JPY: Keeps surprising in terms of how there are just no pullbacks whatsoever, despite traders supposedly being huge net short. Geo-political uncertainty not helping the Japanese currency in recent days, with China supposedly invading Japan airspace near disputed islands. Elections straight ahead. Overnight, the Tankan was much weaker than expected, which resulted in USD/JPY almost reaching 84.0.

- EUR: Spent yesterday range-bound despite confirmation that Greece was to receive their cash. Some covering of long EUR/CHF positions after the SNB decision weighed on the single currency. Bond auctions in Spain and Italy were adequate, and nothing more. Still has a bid tone, crept back up above 1.31 overnight.

- USD: Marked time yesterday after the negative response the previous evening to the dovish FOMC. Underlying tone was helped for a time by latest retail sales figures, which were respectable. Still appears to have a slightly offered tone as investors await progress on fiscal cliff.

- GOLD: With the dollar less-loved after the latest FOMC meeting, the performance of the gold price yesterday was both abject and disturbing for the bulls. Technically, it still looks suspect, although it needs to break the early November low at USD 1,669 to really excite the bears.