The IMF is the most authoritative source for reserve holdings of central banks. It reports the data at the end of each quarter with a quarter lag. At the end of last year, the IMF published the Q3 16 reserve figures. As often is the case, the Q3 reserve figures get lost in the holiday shuffle.Â

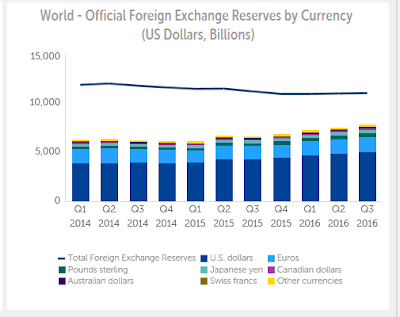

Nevertheless, there are a couple of interesting developments. First, though, let review the basics. Overall, the valuation of global reserves rose to a little more than $11 trillion, a $36 bln build on the quarter, but off $182 bln from Q3 15. It is awkward to say, but the $36 bln increase in reserves in Q3 16 is so small that it is practically a rounding error. Currencies did not fluctuate much in the quarter (euro rose almost 1.2%, and the yen rose 1.8%, sterling was off nearly 2.6%), but still could likely account for much of the change.

The other important point to recall is that not all central banks report the currency allocation of reserves. Of the $11 trillion of reserves almost $7.8 trillion are allocated, leaving $3.2 trillion unallocated. Of the allocated reserves, the dollar accounts for 63.3%, the euro accounts for 20.3%, the yen and sterling are about 4.5% each, and the Australian and Canadian dollars are 2% each. The Swiss franc and other currencies account for the remainder (~3.3%).

Central banks typically move slowly and cautiously when adjusting reserves. However, there is an important development that is taking place. China has agreed to report the allocation of its reserves. However, it is slowly bleeding them in preserve their confidential nature. Allocated reserves rose by $299 bln in Q3. Unallocated reserves fell by a little more than $263 bln. Over the past four quarters, total reserves have fallen by $182 bln. Allocated reserves have increased by $1.19 trillion, while unallocated reserves have fallen by $1.37 trillion. Â

China seems to be the main driver here. Starting with the Q4 16 COFER report, out at the end of March, the IMF will break out the yuan’s allocation. We suspect the yuan’s share of reserves is around 1.5%, despite its inclusion in the SDR.