Morgan Stanley is bit more complicated as a derivatives dealer than the Big 4. Those other banks hold most of their books at their bank subsidiaries. In this case, the term bank actually means something, the legal distinction of a depository institution. Each of the four banks, JPM, C, GS, and BofA, have a holding company umbrella over them like MS which does conduct financial business, they just choose to operate more exclusively under the depository framework.

Morgan Stanley, for reasons beyond the scope of this investigation, has gone the other way. Therefore, Morgan Stanley Bank, NA, reports only a couple hundred billion in gross notional derivatives contracts outstanding (a/o Q1 2018) while Morgan Stanley the holding company tallies $35.5 trillion (including the $278 billion at its bank sub).

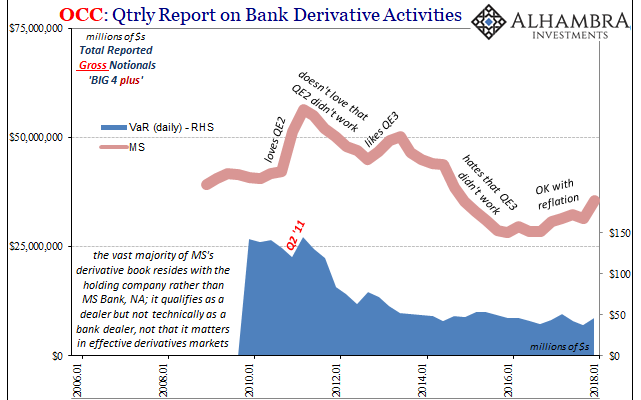

Regardless of its structure, MS is quite the template for economists overvaluing monetary policy and bank managers somehow still following that advice. The holding company’s derivative book inflates with each reflation, particularly those that followed QE2 and QE3. It inevitably shrinks or deflates in pretty short order when the markets or the world doesn’t live up to whatever it is each time that is supposed to lead toward economic recovery and financial opportunity.

What makes MS interesting is the lack of VaR shocks following QE3, meaning for the “rising dollar†and afterward. It has been largely steady since 2013 despite a whole host of serious events during that time.

For the global eurodollar disruption in 2014 and 2015, VaR rose for the company but only modestly. Still, the firm responded by reducing its book dramatically which might propose a certain high level of sensitivity.

That seems to have held during Reflation #3 starting in 2016. VaR has swung only a little higher or lower, not so much that it has disrupted the modest recovery in the holding company’s derivatives book. MS is therefore something like a control group against which we might analyze what the Big 4 banks have been up to lately.