Incoming President Trump promises higher growth in 2026 and beyond? No, he doesn’t. And the UK won’t raise taxes any further? Yes, it will. Enter the auditorium of the economic pantomime, and gear up for 2024’s grand finale. Pantomime season is in full swing here in the UK, and we can’t help but notice an all-too-familiar resemblance between Jack’s adventure up the beanstalk and the global economy’s recent battles with its own many giants.

Pantomime season is in full swing here in the UK, and we can’t help but notice an all-too-familiar resemblance between Jack’s adventure up the beanstalk and the global economy’s recent battles with its own many giants.

A Christmas Pantomime

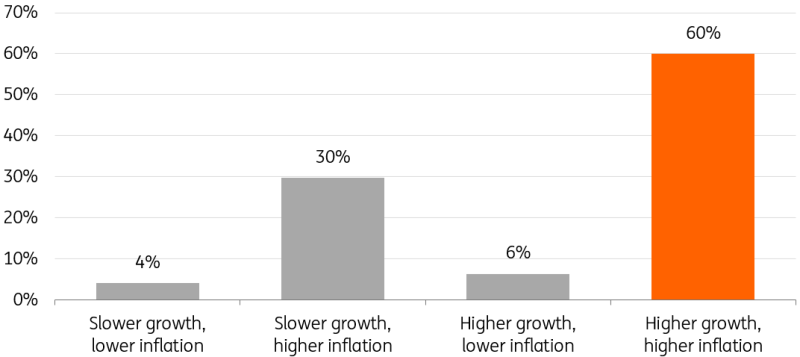

As mentioned, it’s pantomime season here in the UK. And for our international readers who frankly thought they’d seen it all when it comes to bizarre British traditions, a pantomime is a family-friendly theater show with lots of audience participation and questionable humor. I know what you may be thinking: that sounds just like the economic webinar .So, what pantomime best describes the global economic outlook, I hear nobody ask. It’s got to be Jack and the Beanstalk, hasn’t it? or should I say “ECBeanstalk”?Anyway, it’s the story of Jack, who trades his cow for magic beans that grow into a giant beanstalk, leading to an adventure with a fearsome giant. I’ll let you be the judge of who’s playing that particular character. And bad news, Jack: your cow is about to be hit with a 20% tariff. The good news for Jack is that his magic beans – US dollars, naturally – are .Investors are bullish on what the incoming Trump presidency means for the economy. 60% of Monday’s webinar audience said the US economy would grow faster and inflation would end up higher 12-18 months into Trump’s term in office.

What Will Trump Mean for The Economy in 12-18 Months?

Source: ING. Based on a live poll at our recent webinar, categorizing 222 responses.“Oh no it isn’t,” chimes in James Knightley, entering from stage left. He’s our US economist. Yes, prices are going to rise, he says, particularly if Trump’s tariff plans are as bold as promised on the campaign trail. And growth could rise in the short-term. But timing is everything. If tariffs kick in early, and aren’t compensated for by big tax cuts, there’s going to be a .Adding to this, why Treasury yields could go above 5% next year as markets become more attuned to the fiscal black hole. Higher borrowing costs would be further drag on economic activity.That gives the Federal Reserve – which meets next week – plenty to think about. But James Knightley reckons there’s enough in the recent data for the central bank to cut rates again with a clear conscience.Back to our tale, and if you hadn’t already gathered, Jack lives in the Eurozone. And it looks like he’s going to need a miracle. Enter our fairy godmother, Christine Lagarde, over at the European Central Bank.She added a light sprinkling of fairy dust at the meeting this week, in the form of . More is undeniably coming. The message from Lagarde was clear, Carsten Brzeski reckons: rates are going back to neutral and maybe even below.But what about those other magic tricks, like quantitative easing and yield curve control? In his bold call for 2025, Carsten isn’t ruling anything out if bond yields were to surge. Our webinar audience this week was less convinced. Only 22% said it was likely that the ECB would step up bond buying in 2025.I digress. In our story, Jack has climbed his beanstalk and is now in negotiations with the giant up in the castle. And he’s managed to get his cow tariffs watered down by promising to buy some extra LNG and military equipment. Quite some farm you live on, Jack. But as he comes back down the beanstalk with his treasure, there’s someone here to meet him. Unbeknownst to him, Jack has ended up in the UK. And Rachel Reeves, the Finance Minister, is here to tell him that most unfortunately, tax rises worth 1.5% of GDP came into effect while he was away. is getting restricted, don’t you know. But don’t worry, Reeves tells a thoroughly perplexed Jack: taxes won’t be going up again next year.”Yes, they are,” says the audience. 69% of those polled on Monday said 2025 would see further modest tax rises in Britain. We agree. The Treasury met its fiscal goals by the slimmest of margins in November. And there are plenty of ways – not least further disappointing growth figures, like those we saw this week – that the Chancellor could be forced into raising more revenue.And with that, the curtain falls. Before the children start crying and the parents begin demanding their money back, let me reassure you that they all lived happily ever after. Probably.

Source: ING. Based on a live poll at our recent webinar, categorizing 222 responses.“Oh no it isn’t,” chimes in James Knightley, entering from stage left. He’s our US economist. Yes, prices are going to rise, he says, particularly if Trump’s tariff plans are as bold as promised on the campaign trail. And growth could rise in the short-term. But timing is everything. If tariffs kick in early, and aren’t compensated for by big tax cuts, there’s going to be a .Adding to this, why Treasury yields could go above 5% next year as markets become more attuned to the fiscal black hole. Higher borrowing costs would be further drag on economic activity.That gives the Federal Reserve – which meets next week – plenty to think about. But James Knightley reckons there’s enough in the recent data for the central bank to cut rates again with a clear conscience.Back to our tale, and if you hadn’t already gathered, Jack lives in the Eurozone. And it looks like he’s going to need a miracle. Enter our fairy godmother, Christine Lagarde, over at the European Central Bank.She added a light sprinkling of fairy dust at the meeting this week, in the form of . More is undeniably coming. The message from Lagarde was clear, Carsten Brzeski reckons: rates are going back to neutral and maybe even below.But what about those other magic tricks, like quantitative easing and yield curve control? In his bold call for 2025, Carsten isn’t ruling anything out if bond yields were to surge. Our webinar audience this week was less convinced. Only 22% said it was likely that the ECB would step up bond buying in 2025.I digress. In our story, Jack has climbed his beanstalk and is now in negotiations with the giant up in the castle. And he’s managed to get his cow tariffs watered down by promising to buy some extra LNG and military equipment. Quite some farm you live on, Jack. But as he comes back down the beanstalk with his treasure, there’s someone here to meet him. Unbeknownst to him, Jack has ended up in the UK. And Rachel Reeves, the Finance Minister, is here to tell him that most unfortunately, tax rises worth 1.5% of GDP came into effect while he was away. is getting restricted, don’t you know. But don’t worry, Reeves tells a thoroughly perplexed Jack: taxes won’t be going up again next year.”Yes, they are,” says the audience. 69% of those polled on Monday said 2025 would see further modest tax rises in Britain. We agree. The Treasury met its fiscal goals by the slimmest of margins in November. And there are plenty of ways – not least further disappointing growth figures, like those we saw this week – that the Chancellor could be forced into raising more revenue.And with that, the curtain falls. Before the children start crying and the parents begin demanding their money back, let me reassure you that they all lived happily ever after. Probably.

Ahead in Developed Markets – United States (James Knightley)

The Federal Reserve has cut rates by 75 bp over the past two FOMC meetings and is expected to cut by a further 25 bp on Dec. 18. Inflation data has not been making any real progress towards the target over the past few months, but the Fed’s dual mandate means that it also has to pay close attention to what is happening in the jobs markets.Clear signs of cooling with payrolls growth slowing and unemployment shifting higher justifies the Fed moving policy closer towards neutral, but it is clear that the pace of rate cuts will slow in 2025. That is unless inflation starts to make more rapid progress towards the 2% target or the jobs market deteriorates markedly.At the moment, we aren’t expecting either of these scenarios to materialize, and we look for the Fed to signal the prospect of three 25 bp rate cuts in 2025 in its forecast update, down from the four 25 bp cuts it suggested in its September projections.In terms of the numbers, retail sales and industrial production reports are the focus. Retail sales is a nominal dollar figure and will be lifted by strong auto sales figures already published. However, chain store sales numbers suggest that non-auto related spending will be softer.Meanwhile, the improvement in the ISM manufacturing report offers hope of a modest increase in industrial output, but the overall trend of flat activity remains in place. The Fed’s favored measure of inflation, the core PCE deflator, should come in at around 0.2% based on the inputs we have already seen from the CPI and PPI reports.

United Kingdom (James Smith)

Sweden (James Smith)

Riksbank (Thursday, Dec. 19): Sweden’s interest rate-sensitive economy has necessitated more aggressive rate cuts so far from the Riksbank relative to elsewhere. Another 25 bp cut to follow November’s 50 bp move is likely next week.Those rate cuts are bearing fruit in the form of improving sentiment and housing activity. However, growth looks weak and the jobs market, though stabilizing, remains vulnerable. We expect further cuts in the new year to take the policy rate to 2%, or perhaps even below.

Norway (James Smith)

Norges Bank (Thursday, Dec. 19): Policymakers are hinting at the first rate cut in the new year, and we doubt that assessment will shift much next week. Oil prices and the trade-weighted krone are little changed since the last set of projections in September. Global market rates are higher, while core inflation was stickier in November too. That’ll keep the central bank content with keeping rates on hold for now.

Ahead in Central and Eastern Europe – Poland (Adam Antoniak)

Hungary (Peter Virovacz)

Monetary policy (Tuesday, Dec. 17): We expect the National Bank of Hungary to leave the interest rate complex unchanged once again. On the one hand, macroeconomic data would support a rate cut. Inflation data – especially underlying price pressures – look more subdued than expected in the September staff projections.Economic activity is also weaker, so the lack of demand-driven price pressures is likely to be at play. On the other hand, the Hungarian forint is 4-5% weaker against the euro since the end of September, and commodity prices (especially in agriculture) have also risen. Last but not least, the vulnerability of the forint remains a key factor, practically closing the door to any dovish action.

Czech Republic (David Havrlant)

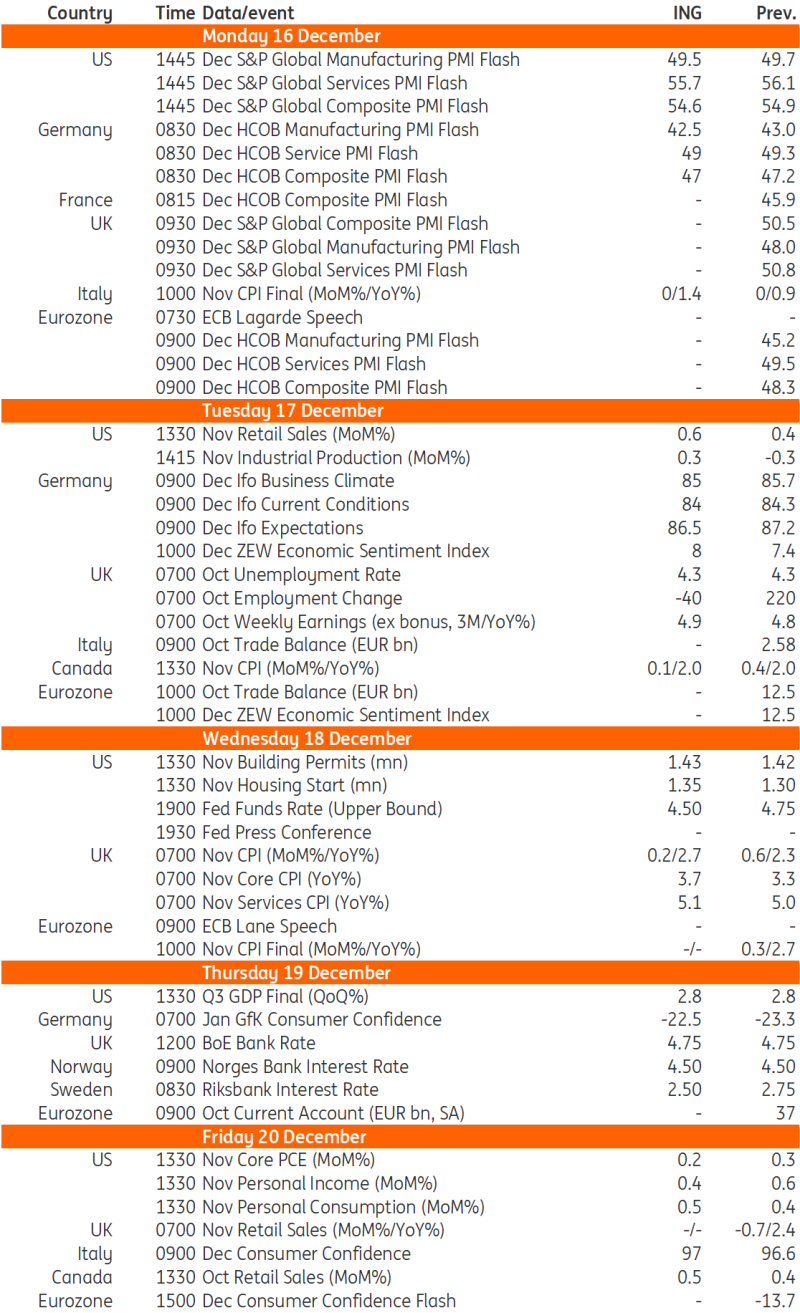

Key Events in Developed Markets Next Week

(Click on image to enlarge)Source: Refinitiv, ING

(Click on image to enlarge)Source: Refinitiv, ING

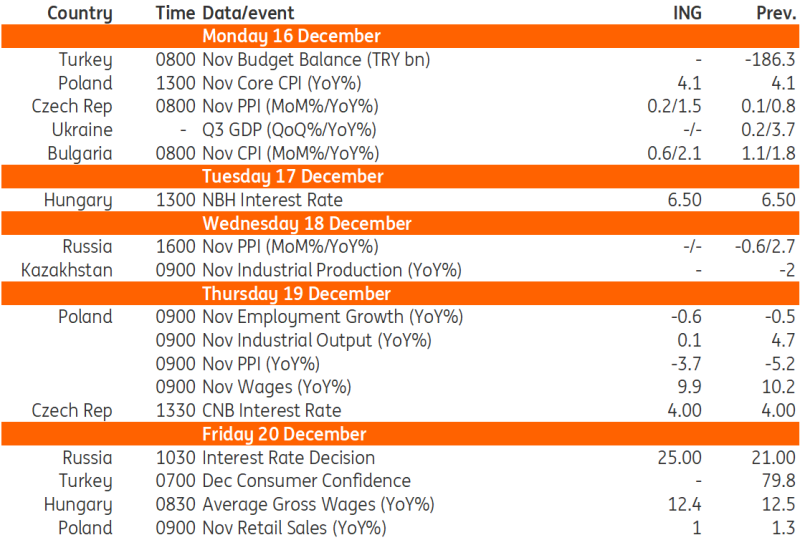

Key Events in EMEA Next Week

(Click on image to enlarge)Source: Refinitiv, INGMore By This Author:

(Click on image to enlarge)Source: Refinitiv, INGMore By This Author: