Image Source:

Image Source:

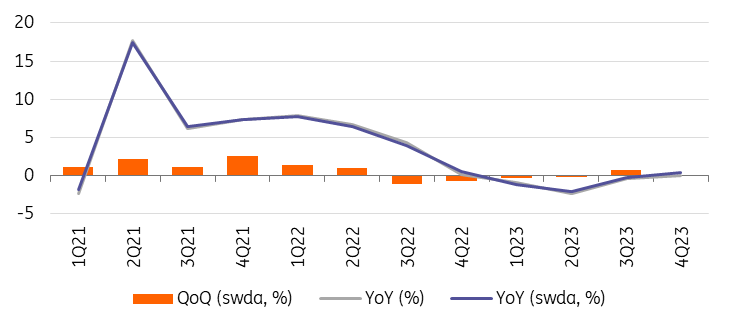

High-frequency data already suggested that economic activity in the fourth quarter wouldn’t be too good, although we had hoped for a reprieve. However, the reality has become harsher, and that doesn’t bode well for the 2024 outlook.Hungarian GDP growth in the fourth quarter of last year came in at 0.0% year-on-year (YoY) as a result of a stagnant quarterly growth rate. This is well below market consensus and much worse than ING’s. However, the seasonally and calendar-adjusted data is somewhat higher, as GDP growth in Q4 was 0.4% higher than in the same quarter of the previous year. This difference between the raw and adjusted data can be explained mainly by calendar effects, as seen in the case of the latest industrial production data for December.

The 2023 time series is yet again prone to revisionsNevertheless, the short-term momentum, as indicated by the 0% quarter-on-quarter (QoQ) growth figure, looks disappointing. What’s more, the Hungarian Central Statistical Office noted that there is a lot of uncertainty regarding the effectiveness of estimation methods and seasonality, which may have a greater impact on the size of revisions than usual. In this regard, the entire 2023 GDP time series was revised, confirming that Hungary was indeed in a four-quarter technical recession previously.We bring this up because, after the release of the Q3 GDP data, the Q2 growth rate was revised to 0%, meaning that the technical recession officially lasted only three quarters, followed by a flat quarterly growth rate. Now, with the latest Q4 GDP data, it appears that Q2 has been revised again (to -0.1%), confirming our view that the economy was indeed in a technical recession for four quarters. In this regard, the technical recession ended in the third quarter with a one-off – mainly agricultural – boost, only to be followed by an abysmal performance in the fourth quarter.

Hungarian GDP growth Source: HCSO, ING This is only the first estimate from the Statistical Office, which means that it has provided few details on the growth structure. But what we’ve got is in line with our expectations. Some parts of the services sector and agriculture contributed to growth, while industry, construction, and retail services were significant drags on the economy.The reason why agriculture made a positive contribution in 4Q23 is that last year’s base was very low due to a very bad agricultural year in 2022. This, combined with better-than-expected weather conditions, resulted in an overall good agricultural year, which means that agriculture was a tailwind for growth this time. However, it’s hardly surprising that construction was a drag on growth in a double-digit interest rate environment, combined with a lack of EU funding in 2023.

Source: HCSO, ING This is only the first estimate from the Statistical Office, which means that it has provided few details on the growth structure. But what we’ve got is in line with our expectations. Some parts of the services sector and agriculture contributed to growth, while industry, construction, and retail services were significant drags on the economy.The reason why agriculture made a positive contribution in 4Q23 is that last year’s base was very low due to a very bad agricultural year in 2022. This, combined with better-than-expected weather conditions, resulted in an overall good agricultural year, which means that agriculture was a tailwind for growth this time. However, it’s hardly surprising that construction was a drag on growth in a double-digit interest rate environment, combined with a lack of EU funding in 2023.

Industry has been a drag on growth, and the outlook is no brighterAs far as industry is concerned, we said in that industry may have been a drag on growth in the fourth quarter, as output deteriorated sharply in November and December. It seems that once inventories have been replenished, the industry as a whole simply lacks further demand impulses. This is a problem because, although domestic demand is gradually recovering, the lack of external demand is a real problem. Our biggest trading partner, Germany, hasn’t been in good shape recently, clouding the outlook for industrial production.Such a weak ending in 2023 might explain why the government is pushing so hard for pro-growth measures and an upward revision of this year’s deficit target from 2.9% to 4.5% of GDP. In this regard, the idea of changing the reference rate for new corporate loans (case closed with a compromise) served the sole purpose of stimulating lending activity and, thus, economic growth.In addition, a total of around HUF910bn in EU funding is expected to be announced in the coming months under the Operational Programme for Economic Development and Innovation Plus. In the area of business development, the budget is HUF 450bn, most of which is loan-based funding at 0% interest. The other HUF 460bn envelope largely covers non-repayable grants with the aim of increasing labor market activity.

The carry-over effect is weaker than expectedSo, 2023 was a recessionary year, as GDP fell by 0.8% for the year as a whole, according to seasonally and calendar-adjusted data. However, this is weaker than both what we and the market consensus expected. With this weak fourth-quarter performance, the so-called carry-over effect in 2024 will also be much weaker than expected, which, based on our calculation, is around 0.4%. In other words, with a full year of stagnation, annual economic growth in 2024 would be around 0.4%. However, with a good end of the year, it could have been double or even triple that.All this means that the government’s 4% economic growth forecast would require very strong quarterly growth rates during 2024, as the base would help very little. However, even ING’s more pessimistic GDP growth forecast of 3% is under threat, given the economic performance at the end of last year, so we see clear downside risks to the growth outlook.As a final note, we will write our final assessment after the Statistical Office publishes the details of the structure of growth on March 5th.More By This Author:The Netherlands Exits Its Shallow Recession Year-End Optimism For The Polish Economy Is Set To Continue In 2024 Caution Advised On Latest Eurozone Production Figures

Economic Recovery Comes To An Abrupt Halt In Hungary