Image Source:

Image Source:

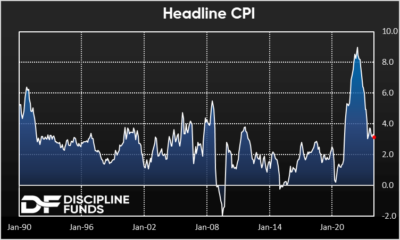

The January CPI came in much hotter than expected. Does this mean the 2024 rate cuts are off the table? Does it mean inflation is about to flare up again? Let’s take a closer look at what’s happening here and where inflation (and interest rates) might be headed this year.Headline inflation came in at 3.1% while core CPI came in at 3.9%. Both are still quite far from the Fed’s 2% target even though we’ve seen significant progress from the 2022 highs of 9%. One of our big themes for 2024 is that the move from 3% to 2% is going to be much more difficult than the move from 6% to 3%. This is part of why we’ve been calling for a June rate cut. Inflation is likely to continue disinflating, but it will disinflate slowly over the course of this year. The markets were alarmed by the January CPI as the S&P 500 sold off 1.4% and 10-year bond yields jumped from 4.17% to 4.32% on expectations of a more cautious Fed. This isn’t quite as alarming as the headlines might make it sound though.

The markets were alarmed by the January CPI as the S&P 500 sold off 1.4% and 10-year bond yields jumped from 4.17% to 4.32% on expectations of a more cautious Fed. This isn’t quite as alarming as the headlines might make it sound though.

My view is that I would expect a more modest rate of disinflation to continue this year with a year-end target of core PCE at 2.35%. The January reading was moderately worrisome, but very unlikely to persist. Markets were always too aggressive about a March rate cut and very likely the May cut as well. Markets appear to be moving closer to our expected cut date of June. The problem with May is that we’re only going to get 4 PCE readings before then. The February expectation is 2.6% which means both the March and April readings would have to show meaningful downward trends to 2%. We just don’t think it’s enough time to get there based on how much the rate of change is slowing. Beyond June the story is going to get interesting because of the election and the Fed won’t want to mess around with interest rates during election season. So you can count out September and November. And that leaves just June, July, and December. So, even if June is the first cut we’re unlikely to get more than three cuts this year. This means the market might need to adjust for the potential of just 2 or 3 cuts this year.In sum, the market was wrong-footed to begin the year and a much-needed adjustment is taking place. We’re unlikely to get many cuts this year, inflation will move lower, but will be stickier than some expect. But at the same time, the probability of a big flare-up is unlikely. So, we’re moving in the right direction albeit slower than we’d like.More By This Author: