UK shares were once again in the red Tuesday as the blue-chip index lost over 1% on the session, with the pound and government bond yields rising after strong labour data raised concerns about a potential delay in interest rate cuts from the Bank of England. British wages excluding bonuses grew by 6.2% in the last three months of 2023, indicating a tight labour market. The pound and the yield on Britain’s 10-year gilt both increased, negatively impacting equities. Traders have adjusted their expectations for interest rate cuts from the Bank of England to around 69 basis points, down from 78 bps before the data release. Market participants were further concerned by U.S. inflation data which showed an uptick in inflation in the world’s largest economy and led to further repricing of Federal Reserve interest rate cuts for the year ahead. In the light of the wages data House construction companies saw a decline in their stocks following the release of the most recent UK employment data, which indicated that interest rates may remain elevated for an extended period. This led to decreases in the stock prices of Persimmon down 4%, with Barratt Developments posting the largest percentage losses on the session down 4.59%.On the positive side of the ledger Citi upgrades GSK to ‘buy’ for the first time in seven years, raising the target price to 21 pounds from 17 pounds. The stock is up as much as 2.7% at 1,670p. The upgrade is based on positive results from the DREAMM-7 study for its multiple myeloma drug, Blenrep. Citi believes that Blenrep will have a significant role for at least the next 5 years as standard of care for refractory myeloma patients. GSK’s RSV market share gain is also seen as positive. Citi anticipates all Zantac litigations to be settled over the next 6 months for liabilities of under $3 billion. GSK stock was up 0.9% in 2023.

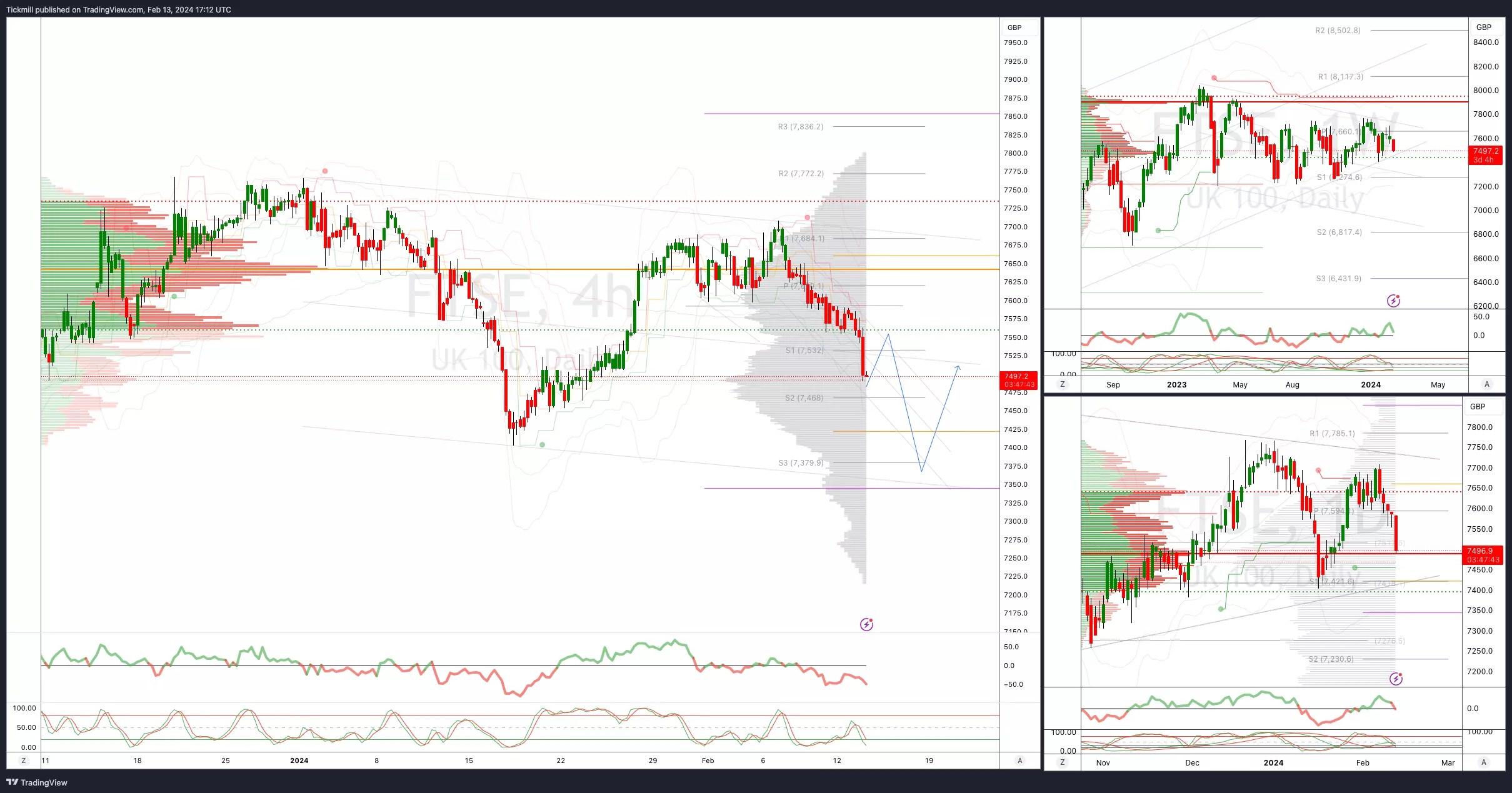

FTSE Bias: Bullish Above Bearish below 7530

(Click on image to enlarge) More By This Author:

More By This Author: