It’s a heady few days for financial markets with the upcoming Fed meeting.Followed by a “Super Thursday” Bank of England meeting (that means updated forecasts and press conference), sandwiched by Big Tech earnings which come ahead of Friday’s monthly US non-farm payrolls report.

The most important event for markets over the medium-term should be tonight’s FOMC meeting, even though no changes to policy are expected.

There are no new dot plots or economic projections so the focus will be on the language and tone of the statement and Chair Powell’s press conference.

Powell push back is fully expectedConsensus predicts pushback against current market pricing of 130bps of Fed rate cuts this year.The risk is the FOMC does not want to sound too hawkish since inflation is easing, which will create room for rate cuts at some point in the coming months.But that could trigger a bond rally and ease financial conditions further before the Fed even started doing so.

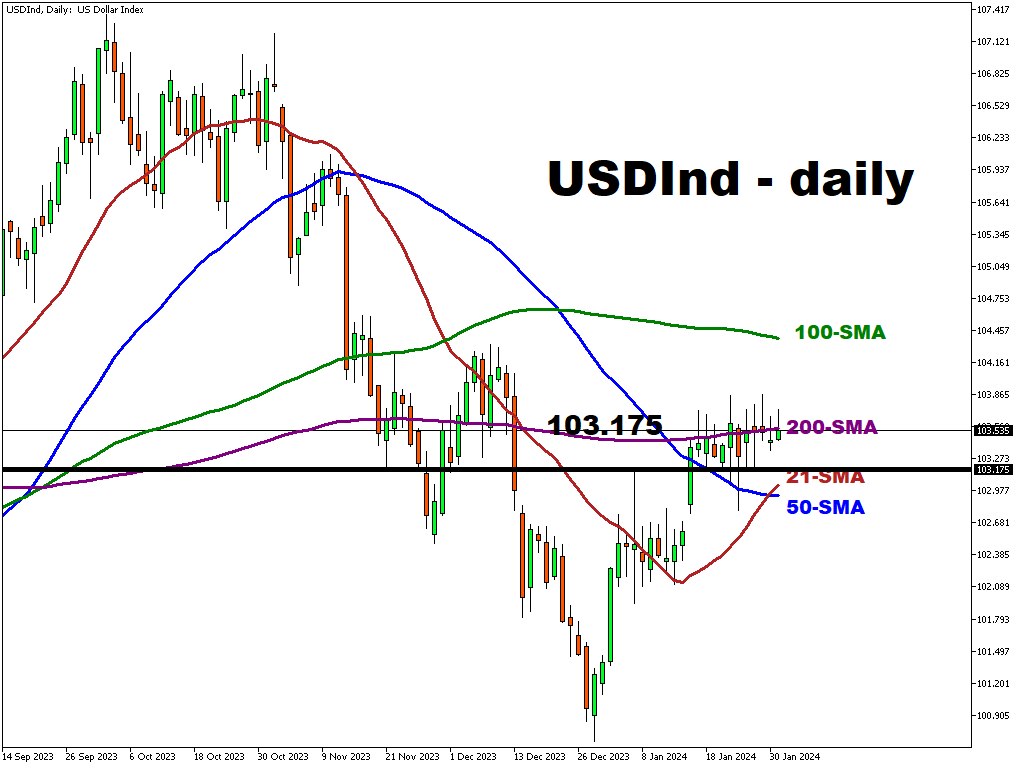

If Powell is successful and markets do pare some of the excessive bets, this should underpin some support for the USD which continues to trade around its 200-day simple moving average.

US data later this week which includes NFP and ISM manufacturing could underscore the message, which means there is potential for the greenback to appreciate in line with rising US yields, especially against an ailing euro.

US data later this week which includes NFP and ISM manufacturing could underscore the message, which means there is potential for the greenback to appreciate in line with rising US yields, especially against an ailing euro.

EUR looking weak ahead of inflation figuresWe get French and German CPI releases today, before the eurozone’s inflation data tomorrow.Economists expect lower figures due to base effects and this should keep the door open for an April ECB rate cut which has become more likely since last week’s relatively dovish ECB meeting.EUR/USD is moving down away from its 200-day simple moving average at 1.0840 and could test the 1.08 level and this week’s low at 1.0795 with soft data and a more hawkish Powell.

How close is the Bank of England to a first rate cut?

The BoE seems more reticent than other major central banks to endorse policy easing.It is expected to remain cautious at Thursday’s meeting and tread carefully even though its key metrics, wage growth, and services inflation are tracking below the bank’s November projections.Markets will focus on the updated two-year inflation forecast.This is seen as a good gauge of whether markets have got it right on the rate cuts priced in. Currently, there are less than 100bps of rate cuts for 2024.Any changes to the statement and the vote will also be crucial, with the latter now expected to be unanimous.GBP has been the best major currency against the dollar this year. The six-week range in cable of 1.26 to 1.2828 could be challenged over the next few days. More By This Author:Can S&P 500 Reach 5,000 By February? XAUUSD Edges Towards 50-SMA Despite Stronger GDP Reading EURUSD Upticks Towards 50-period SMA Ahead Of ECB Meeting

More By This Author:Can S&P 500 Reach 5,000 By February? XAUUSD Edges Towards 50-SMA Despite Stronger GDP Reading EURUSD Upticks Towards 50-period SMA Ahead Of ECB Meeting