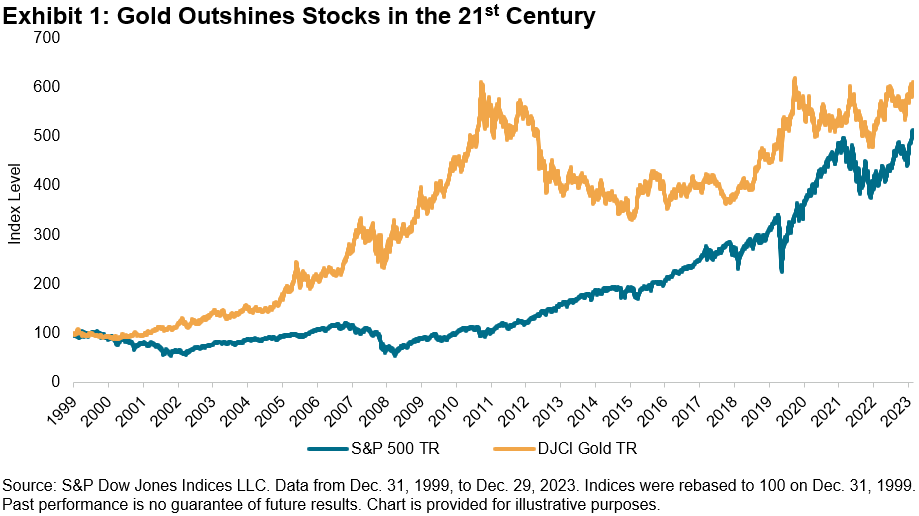

The equity markets roared to the finish line, easily passing commodities and bonds with a 26.3% return for the in 2023. Much of that rally could be attributed to declining consumer price indices and favorable Federal Reserve guidance, with increased confidence in a soft landing. Declining inflation can best be observed at the kitchen table, where the saw 15% declines on the year and the remained flat.Despite another strong year of equity performance, the maintained its top perch for this century after reaching an all-time high in December. Gold achieved a 12.8% return, outpacing both bonds and broad commodities, with the recording a -4.3% annual return. Going back to the start of the century, the DJCI Gold produced a 7.8% annual return, compared to a 7% return for the S&P 500 during that time. Adjusting for volatility, gold has demonstrated better risk-adjusted returns than stocks, with a Sharpe ratio of 0.48 versus 0.45 for equities.(Click on image to enlarge)

Central banks appear to have taken notice in the outperformance of gold. After trading flat for much of the year, the and staged a fourth quarter rally, rising 11.4% and 7.2%, respectively. Global central banks supported gold demand, adding over 800 metric tons to their portfolios with data through October. Gold has historically provided investors an alternative to fiat currency. Digging into the central bank purchase data, countries including Russia and China have led the increase in central bank holdings. Foreign central banks appear to increasingly value gold’s hedge against inflation, debt default and dollarization.

Commodity Market Recap

Energy weighed down commodity performance in 2023, with the falling 62.6%. The decline reflects a return to the longer-term price levels observed during the past decade, as well as robust production along with reduced export demand of liquefied natural gas. The broader petroleum complex was mixed, as lower oil didn’t translate to falling gas prices. The dropped 5.2% for the year, while the rose 5.0%.More By This Author:

Twenty-First Century Fox: DJCI Gold Tops Stocks And Bonds This Century