“The big question is how overweight are investors in money markets,” Kristina Hooper, chief global market strategist at Invesco, said in a Bloomberg Television interview earlier this week.

“Some exposure makes sense. That’s part of being diversified. But there is significant overweight on the part of some investors and I do think that starts to come out.”

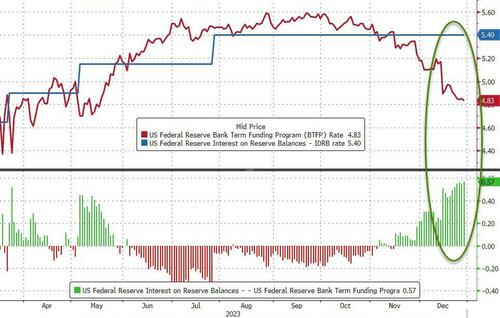

Interestingly, bank deposits are rising rapidly in the last few weeks as are money-market funds…Source: BloombergNotably, with year-end liquidity needs growing, the exodus from The Fed’s reverse-repo facility has stalled (for now)…Source: BloombergThe Fed’s balance sheet shrank by $11.3BN last week to its lowest level since March 2021…Source: BloombergUsage of The Fed’s bank bailout facility rose by another $4.5BN last week to a new record high of $136BN…Source: BloombergBut Regional bank shares don’t care…Source: BloombergThe BTFP-Fed Arb continues to offer ‘free-money’ (and usage of the BTFP has risen by $26.7BN since the arb existed):

The rate on the Fed’s Bank Term Funding Program – which allows banks and credit unions to borrow funds for up to one year, pledging US Treasuries and agency debt as collateral valued at par – is the one-year overnight index swap rate plus 10 basis points.

That figure is currently 4.83%, down from 5.59% in September.

For institutions that have an account at the Fed, they can borrow from the BTFP at 4.83% and park that at the central bank to earn 5.40% – the interest on reserve balances.

Source: Bloomberg

The 57bp spread is the widest level since the Fed introduced the facility to support a struggling banking system after the collapse of California’s Silicon Valley Bank and Signature Bank in New York.

Finally, equity market caps continue to soar after recoupling with bank reserves at The Fed (though the stalling in the drawdown of the RRP has slowed the expansion again this week in a bigger way)…Source: BloombergWTF are banks going to do when The Fed shuts down this ‘temporary’ bailout program in March?More By This Author: