(Click on image to enlarge)

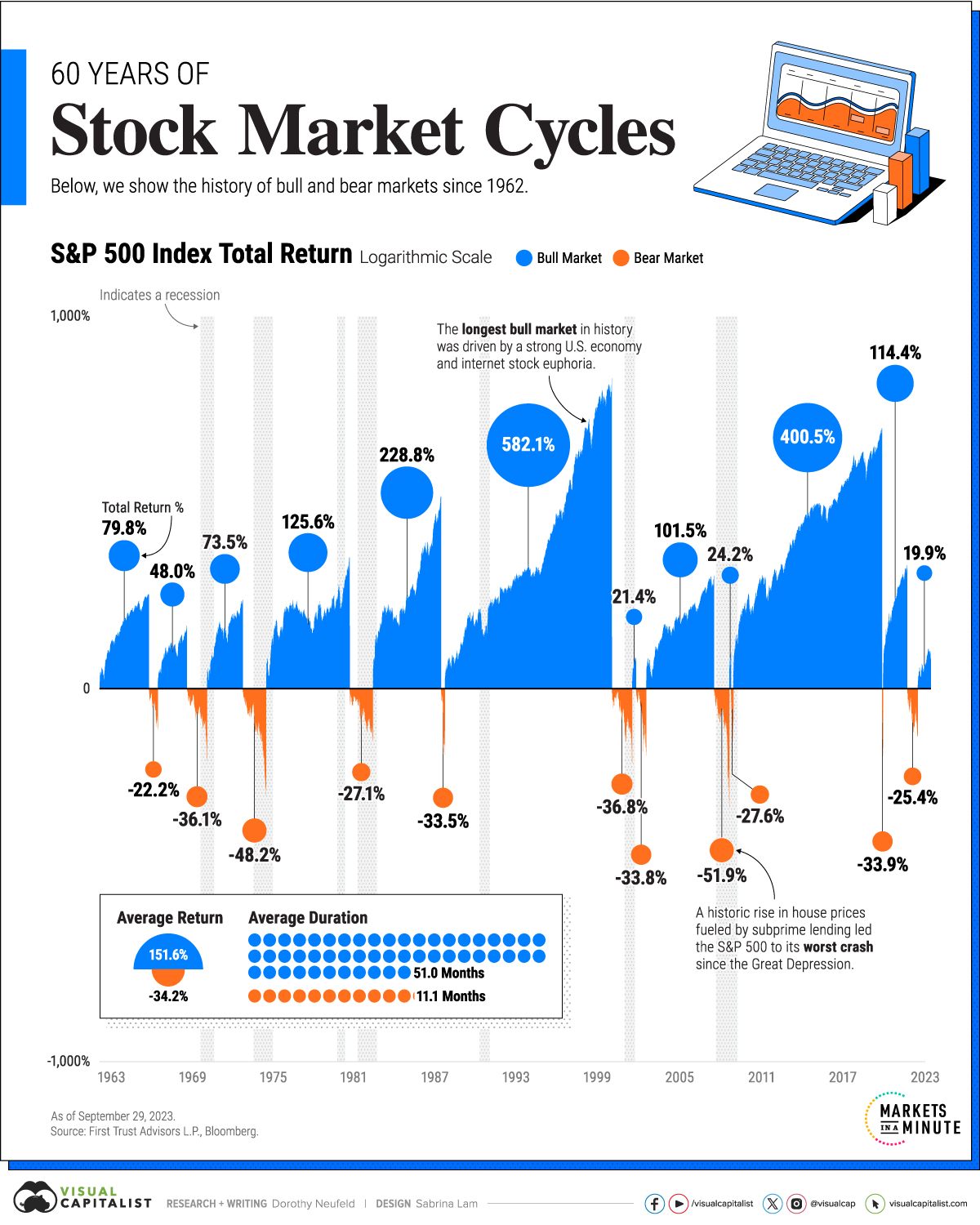

Visualizing 60 Years of Stock Market Cycles

Today’s stock market is nothing short of unusual.The S&P 500 has climbed over 24% to date against a backdrop of strong economic growth and rising interest rates. Despite these factors, the unemployment rate has remained low at 3.7% as of November, and inflation has moderated.To give some context on the current stock market cycle, this graphic shows 60 years of bull and bear markets, with data from .

Bulls and Bears Over HistoryA bear market takes place when a stock market index declines 20% from its peak.Once stocks fully recover and exceed this peak, it enters a bull market. This can happen over the course of months or years. But as the table below shows, bear markets have been much shorter than bull markets since 1962:

*As of September 29, 2022.The longest bear markets over this period were in the early 1970s and 1980s, both lasting roughly 20 months. In both cases, high inflation led the Fed to tighten monetary policy, triggering each recession. In 1974, the S&P plummeted 48.2% from its peak, in one of the sharpest declines since WWII.On the other hand, the longest bull market took place through the 1990s amid a roaring U.S. economy. Lasting over 12 years, it reached an apex during the Dotcom boom. Over the course of the bull market, the S&P 500 advanced 582.1%.After the 2008 Global Financial Crisis, the stock market witnessed another expansive bull run, this time lasting 11 years. Ultra-low interest rates and the in particular defined the cycle.In many cases, stock market peaks happen before a recession begins. Consider how in 2007, the S&P 500 hit a high in October before the recession officially began in December. Similarly, the S&P 500 peaked in September 2000, six months before the 2001 recession officially started.

How Can Investors Prepare for a Bear Market?No one knows when a bear market will begin, but there are strategies that investors can use to build a more resilient portfolio.Diversifying across sectors is one approach. Consider how cyclical sectors, such as tech and real estate tend to rise when the market is on the upswing. By contrast, when the market takes a turn, traditionally more defensive sectors like consumer staples .Asset class diversification is another tactic. Including bonds in a portfolio typically reduces risk given their stable cash flows and historically low correlation to stocks. International stocks also have a lower correlation to U.S. equities which means that when U.S. stocks are down, these types of assets can help buffer the loss.The good news is that the S&P 500 has seen +11.5% average historical returns since 1928. Overall, the majority of stock market cycles take place in bull territory both in terms of net return appreciation and length of time by a wide margin.More By This Author: