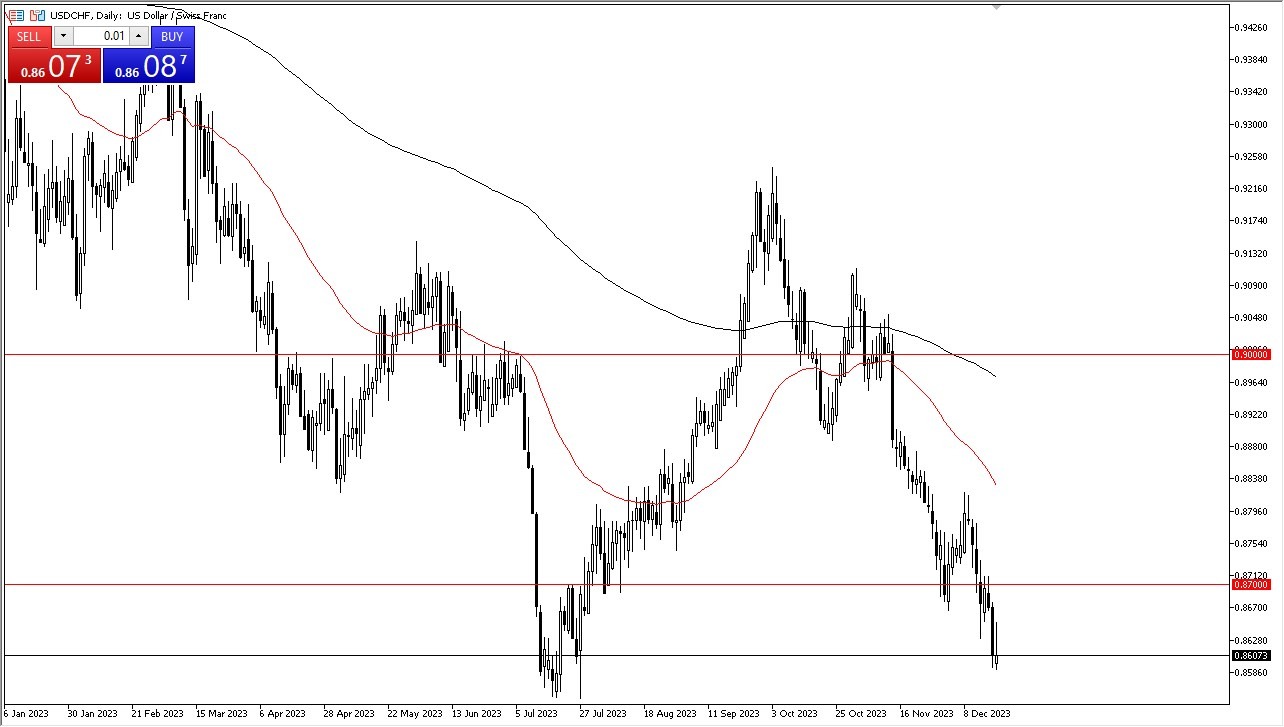

The Swiss franc is approaching a recent high against the US dollar at the 0.8550 region, and if we were to punch below that level, it would obviously be a very big move for the Swiss franc just waiting to happen. The initially trying to rally during the trading session on Wednesday, but then fell as buyers could not hang on to the move. At this point, it’s a situation where traders are paying close attention to the Federal Reserve, and the Federal Reserve of course has recently moved the dots on the dock plot to suggest that there might be interest rate cuts in 2024, and therefore traders are trying to price in the trajectory of a weakening US dollar.The Swiss franc is approaching a recent high against the US dollar at the 0.8550 region, and if we were to punch below that level, it would obviously be a very big move for the Swiss franc just waiting to happen. Ultimately, the Swiss National Bank will have to worry about that, but at the end of the day, they are too small to move the market significantly for a longer-term trend change. The 0.87 level above is a significant barrier, so any rally toward that area probably gets looked at with a significant amount of skepticism on any attempt to break above it. That being said, if we were to break above the 0.8725 level, then it’s possible that the market may try to find a longer-term bottom. Holiday Liquidity IssuesObviously, we are heading toward Christmas on Monday and that will have a lot of influence on the liquidity situation in the markets, so we may have the markets just sit still eventually, or we could even see erratic moves because somebody big may come in and try to square off a position after most traders leave. Either way, you need to be cautious this time of year because you don’t want to have a sudden change in your profit and loss statement based upon a lack of trading participation.If we can break down below the 0.85 level, the Swiss franc will likely continue to strengthen toward the 0.63 level. Rallies at this point would see the 0.87 level offer a significant amount of resistance, and I think to break it above there then you have to start to look at the possibility of a longer-term “double bottom”, but at this point, it looks like it’s a little bit difficult to achieve.(Click on image to enlarge) More By This Author:USD/JPY Forecast: Fights Against the YenUSD/CAD Forecast: Sees Overhead PressureBTC/USD Forecast: Moves Higher

More By This Author:USD/JPY Forecast: Fights Against the YenUSD/CAD Forecast: Sees Overhead PressureBTC/USD Forecast: Moves Higher

USD/CHF Forecast: Struggles Against The Swiss Franc