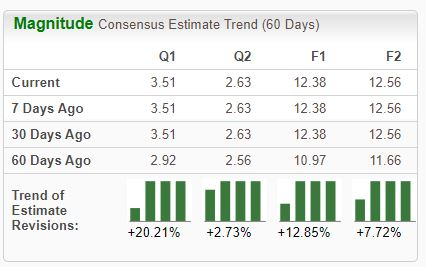

EMCOR Group, Inc. () is a leader in mechanical and electrical construction, industrial and energy infrastructure, and building services. The company serves commercial, industrial, utility, and institutional clients.Analysts have taken a bullish stance on the company’s outlook across the board, pushing it into a favorable Zacks Rank #1 (Strong Buy). As shown below, the revisions trend has been particularly positive for the company’s current quarter, up more than 20% over the last several months.(Click on image to enlarge) Image Source: Zacks Investment ResearchIn addition, the company is part of the Zacks Building Products – Heavy Construction industry, currently ranked in the top 34% of all Zacks industries. Aside from the improved earnings outlook and favorable industry standing, let’s take a closer look at a few other aspects of the company. EMCOR GroupEMCOR shares have delivered a notably strong performance in 2023, up nearly 50% and outperforming the general market handily on the back of better-than-expected quarterly results. Concerning its latest release, the company posted a 33% beat relative to the Zacks Consensus EPS Estimate and reported sales 2% ahead of expectations, with revenue of $3.2 billion reflecting a quarterly record.The company’s top line remains in good shape, recovering nicely from pandemic lows in 2020.(Click on image to enlarge)

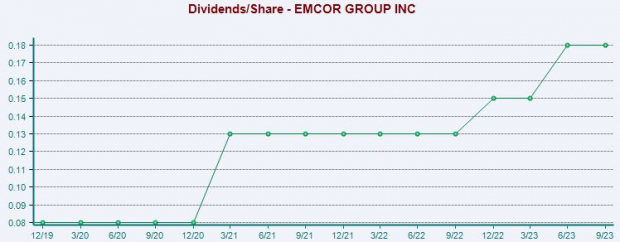

Image Source: Zacks Investment ResearchIn addition, the company is part of the Zacks Building Products – Heavy Construction industry, currently ranked in the top 34% of all Zacks industries. Aside from the improved earnings outlook and favorable industry standing, let’s take a closer look at a few other aspects of the company. EMCOR GroupEMCOR shares have delivered a notably strong performance in 2023, up nearly 50% and outperforming the general market handily on the back of better-than-expected quarterly results. Concerning its latest release, the company posted a 33% beat relative to the Zacks Consensus EPS Estimate and reported sales 2% ahead of expectations, with revenue of $3.2 billion reflecting a quarterly record.The company’s top line remains in good shape, recovering nicely from pandemic lows in 2020.(Click on image to enlarge) Image Source: Zacks Investment ResearchThe better-than-expected quarterly results were driven by continued strength within its U.S. Construction segments, with sales increasing 16% year-over-year on a combined basis. The company continued to see resilient demand for its services, particularly in semiconductors, data centers, manufacturing re-shoring, healthcare, and across the EV value chain.EMCOR lifted its current year revenue and EPS guidance following the strong quarter, now expecting full-year revenues of $12.5 billion and EPS in a band of $12.25 – $12.65 per share ($10.75 – $11.25 per share previously).Investors also stand to reap a passive income from EME shares, presently yielding a modest 0.3% annually paired with a sustainable payout ratio sitting at 6% of its earnings. While the yield may be on the lower end, the company’s 21% five-year annualized dividend growth rate helps pick up the slack.(Click on image to enlarge)

Image Source: Zacks Investment ResearchThe better-than-expected quarterly results were driven by continued strength within its U.S. Construction segments, with sales increasing 16% year-over-year on a combined basis. The company continued to see resilient demand for its services, particularly in semiconductors, data centers, manufacturing re-shoring, healthcare, and across the EV value chain.EMCOR lifted its current year revenue and EPS guidance following the strong quarter, now expecting full-year revenues of $12.5 billion and EPS in a band of $12.25 – $12.65 per share ($10.75 – $11.25 per share previously).Investors also stand to reap a passive income from EME shares, presently yielding a modest 0.3% annually paired with a sustainable payout ratio sitting at 6% of its earnings. While the yield may be on the lower end, the company’s 21% five-year annualized dividend growth rate helps pick up the slack.(Click on image to enlarge) Image Source: Zacks Investment ResearchShares currently trade at a 17.4X forward 12-month earnings multiple, above the five-year median by a fair margin but well off the 20.1X high earlier in 2023. The stock carries a Style Score of “C” for Value. Bottom LineInvestors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.EMCOR Group, Inc would be an excellent stock for investors to consider, as displayed by its Zack Rank #1 (Strong Buy).More By This Author:Bear Of The Day: The Walt Disney Co. Time to Buy These Highly Ranked Growth Stocks2023 Rewind: 5 Valuable Lessons

Image Source: Zacks Investment ResearchShares currently trade at a 17.4X forward 12-month earnings multiple, above the five-year median by a fair margin but well off the 20.1X high earlier in 2023. The stock carries a Style Score of “C” for Value. Bottom LineInvestors can implement a stellar strategy to find expected winners by taking advantage of the Zacks Rank – one of the most powerful market tools that provides a massive edge.The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks should outperform the market more than any other rank.EMCOR Group, Inc would be an excellent stock for investors to consider, as displayed by its Zack Rank #1 (Strong Buy).More By This Author:Bear Of The Day: The Walt Disney Co. Time to Buy These Highly Ranked Growth Stocks2023 Rewind: 5 Valuable Lessons

Bull Of The Day: Emcor Group, Inc.