Yesterday, the market closed observably down. There are all sorts of reasons why; technical trading, geopolitical worries, Wall St. types heading out for X-mas, in a word, momentum. There is a good chance that the market will head back up, today.Wednesday, the S&P 500 closed at 4,698, down 70 points, the Dow closed at 37,082, down 476 points, and the Nasdaq Composite closed at 14,778, down 225 points.

There is a good chance that the market will head back up, today.Wednesday, the S&P 500 closed at 4,698, down 70 points, the Dow closed at 37,082, down 476 points, and the Nasdaq Composite closed at 14,778, down 225 points. Most actives led by Tesla (), down 3.9%, followed by Pfizer (), down 1.9% and Ford (), down 1.8%.

Most actives led by Tesla (), down 3.9%, followed by Pfizer (), down 1.9% and Ford (), down 1.8%. In early morning futures trading, S&P 500 market futures are trading up 26 points, Dow market futures are trading up 149 points and Nasdaq 100 market futures are trading up 109 points.In a TalkMarkets Editor’s Choice column, notes that we need to change our paradigm in .”As investors cheer on the Magnificent 7, some football fans are forging new allegiances in hopes of rooting for the coming Super Bowl champion. The task isn’t easy. Recent favorites like the Bills and Bengals are fighting to make the playoffs. Indeed, a few fans of those teams will jump on the recently popular Dolphins or Lions bandwagon. Others may stick with the dependable Eagles, Chiefs, and Forty Niners.Stock market investors and football fans are not that different. As 2023 ends, professional and amateur investors start thinking about what stock or investment theme bandwagon to jump on for the coming year.This year, the Magnificent 7 stocks are the odds-on favorites to win the stock market Super Bowl. While hats off to those profiting from the Magnificent 7, we must look ahead. To do so, we must appreciate the bandwagon bias harbored in our mindsets and not let it cloud our vision of the future…

In early morning futures trading, S&P 500 market futures are trading up 26 points, Dow market futures are trading up 149 points and Nasdaq 100 market futures are trading up 109 points.In a TalkMarkets Editor’s Choice column, notes that we need to change our paradigm in .”As investors cheer on the Magnificent 7, some football fans are forging new allegiances in hopes of rooting for the coming Super Bowl champion. The task isn’t easy. Recent favorites like the Bills and Bengals are fighting to make the playoffs. Indeed, a few fans of those teams will jump on the recently popular Dolphins or Lions bandwagon. Others may stick with the dependable Eagles, Chiefs, and Forty Niners.Stock market investors and football fans are not that different. As 2023 ends, professional and amateur investors start thinking about what stock or investment theme bandwagon to jump on for the coming year.This year, the Magnificent 7 stocks are the odds-on favorites to win the stock market Super Bowl. While hats off to those profiting from the Magnificent 7, we must look ahead. To do so, we must appreciate the bandwagon bias harbored in our mindsets and not let it cloud our vision of the future… This year’s most popular investment bandwagon is the Magnificent 7, comprised of Apple, Microsoft, Google, Tesla, Nvidia, Amazon, and Meta. The graphs below, courtesy of Goldman Sachs, and our table show these 7 stocks gained 71% this year to date, while the remaining 493 stocks added a mere 6%. The outperformance pushed up their contribution to the S&P 500 to nearly 30%. Lastly, the sharp increase in stock prices led to even more extreme valuations for the group…

This year’s most popular investment bandwagon is the Magnificent 7, comprised of Apple, Microsoft, Google, Tesla, Nvidia, Amazon, and Meta. The graphs below, courtesy of Goldman Sachs, and our table show these 7 stocks gained 71% this year to date, while the remaining 493 stocks added a mere 6%. The outperformance pushed up their contribution to the S&P 500 to nearly 30%. Lastly, the sharp increase in stock prices led to even more extreme valuations for the group…![]()

![]() The Magnificent 7 are fundamentally stronger companies than the aggregate of the S&P 500. Per Goldman Sachs, revenues for the Magnificent 7 are expected to grow by 8% more than the S&P 500. At the same time, net margins are forecasted to be around 21% for the next two years. Such is double the S&P 500. Is their share price outperformance justified? Yes. However, if the prices outperformed their fundamentals, as may likely be the case, it will now be much harder for a repeat performance in 2024…To help appreciate what may lie ahead, we compare Nvidia to Albemarle. Nvidia is up 230% year to date. As a result of the stock surge, Nvidia’s investors are paying a 250% premium for Nvidia’s earnings versus those of the S&P 500. Nvidia’s earnings will undoubtedly grow faster than the market for a while, but by how much and for how long? Can they avoid competition and margin pressures while keeping sales elevated long enough to justify the premium?…For example, since early November, small-cap stocks have handily beat the S&P 500 and Magnificent 7. These stocks are interest rate sensitive. Ergo, the more dovish Fed stance should help these relatively beaten-down stocks more than the less interest rate-sensitive large-cap stocks. Small-cap stocks may or may not be the winning bandwagon for 2024…The graphic below shows that the Super Bowl tends to have different teams vying for the trophy each year. Some helmets appear more often than others, but there are few consecutive champions.

The Magnificent 7 are fundamentally stronger companies than the aggregate of the S&P 500. Per Goldman Sachs, revenues for the Magnificent 7 are expected to grow by 8% more than the S&P 500. At the same time, net margins are forecasted to be around 21% for the next two years. Such is double the S&P 500. Is their share price outperformance justified? Yes. However, if the prices outperformed their fundamentals, as may likely be the case, it will now be much harder for a repeat performance in 2024…To help appreciate what may lie ahead, we compare Nvidia to Albemarle. Nvidia is up 230% year to date. As a result of the stock surge, Nvidia’s investors are paying a 250% premium for Nvidia’s earnings versus those of the S&P 500. Nvidia’s earnings will undoubtedly grow faster than the market for a while, but by how much and for how long? Can they avoid competition and margin pressures while keeping sales elevated long enough to justify the premium?…For example, since early November, small-cap stocks have handily beat the S&P 500 and Magnificent 7. These stocks are interest rate sensitive. Ergo, the more dovish Fed stance should help these relatively beaten-down stocks more than the less interest rate-sensitive large-cap stocks. Small-cap stocks may or may not be the winning bandwagon for 2024…The graphic below shows that the Super Bowl tends to have different teams vying for the trophy each year. Some helmets appear more often than others, but there are few consecutive champions. ![]() Bandwagon bias can be good as riding the hot theme or group of stocks helps investors grow their wealth. Unfortunately, jumping on a market bandwagon too late can come with steep costs.As we enter 2024, be open to the possibility that last year’s winners will not take the crown this year.”TM contributor takes a look at where .

Bandwagon bias can be good as riding the hot theme or group of stocks helps investors grow their wealth. Unfortunately, jumping on a market bandwagon too late can come with steep costs.As we enter 2024, be open to the possibility that last year’s winners will not take the crown this year.”TM contributor takes a look at where . “The expects consumers in the U.S. to spend an average of $885 on core holiday items including gifts, decorations, food, and other holiday-related purchases this year, up 5 percent from last year’s holiday budgets and just above the five-year average in expected spending.When it comes to where Americans will be splashing their holiday cash, 58 percent of people said they’d shop online while 49 percent plan to go to a department store. 48 percent are planning to shop at a discount store while 44 percent are going to make holiday purchases at a grocery store.So while it seems that many Americans like to avoid the crowds and do most of their holiday shopping online, physical stores still have role to play during the year’s busiest shopping season.In terms of getting into the Christmas spirit, shopping for gifts at a nicely-decorated store while the store radio plays some holiday classics beats hunting for bargains online every time.”Right on time for the holidays economist and contributor checks “Today, the Confidence Board’s consumer confidence index clocked in at 110.7, vs. Bloomberg consensus of 103.8. The and to a lesser extent the Conference Board survey of confidence have diverged from their historical correlation with inflation and unemployment. Interestingly, while the Michigan measure in particular has deviated from the text based measure, they have both now started reverting toward the text based measure.

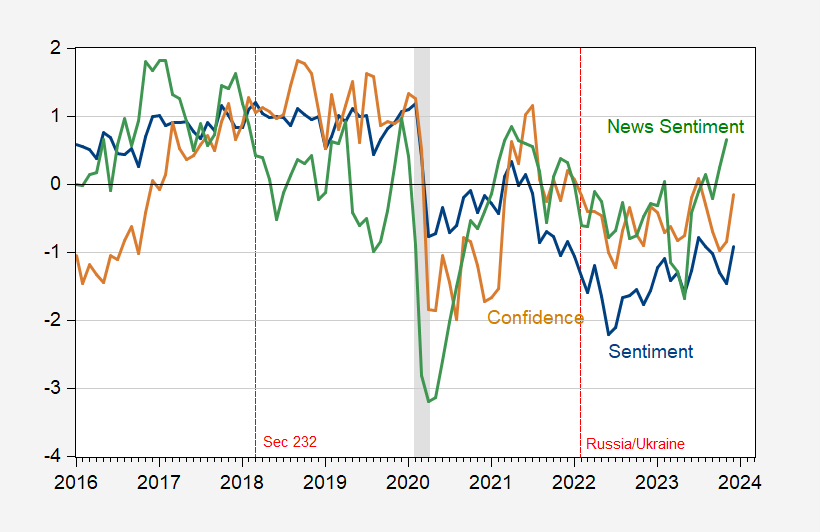

“The expects consumers in the U.S. to spend an average of $885 on core holiday items including gifts, decorations, food, and other holiday-related purchases this year, up 5 percent from last year’s holiday budgets and just above the five-year average in expected spending.When it comes to where Americans will be splashing their holiday cash, 58 percent of people said they’d shop online while 49 percent plan to go to a department store. 48 percent are planning to shop at a discount store while 44 percent are going to make holiday purchases at a grocery store.So while it seems that many Americans like to avoid the crowds and do most of their holiday shopping online, physical stores still have role to play during the year’s busiest shopping season.In terms of getting into the Christmas spirit, shopping for gifts at a nicely-decorated store while the store radio plays some holiday classics beats hunting for bargains online every time.”Right on time for the holidays economist and contributor checks “Today, the Confidence Board’s consumer confidence index clocked in at 110.7, vs. Bloomberg consensus of 103.8. The and to a lesser extent the Conference Board survey of confidence have diverged from their historical correlation with inflation and unemployment. Interestingly, while the Michigan measure in particular has deviated from the text based measure, they have both now started reverting toward the text based measure. Figure 1: University of Michigan Consumer Sentiment (blue), Conference Board Consumer Confidence (tan), and Daily News Sentiment Index (green), all demeaned and normalized by standard deviation (for the displayed sample period). Michigan December observation is preliminary. The News Index observation for December is through 12/10. NBER defined peak-to-trough recession dates shaded gray. Source: U.Mich via FRED, Conference Board via Investing.com, , NBER, and author’s calculations.To the extent that the survey based and news text based series diverge, this gives some support to the of the dour mood of the public (subject to the condition that the Daily News Index accurately summarizes the news).The jump in the Confidence Board measure was due to increases in both the present situation and expectations components.

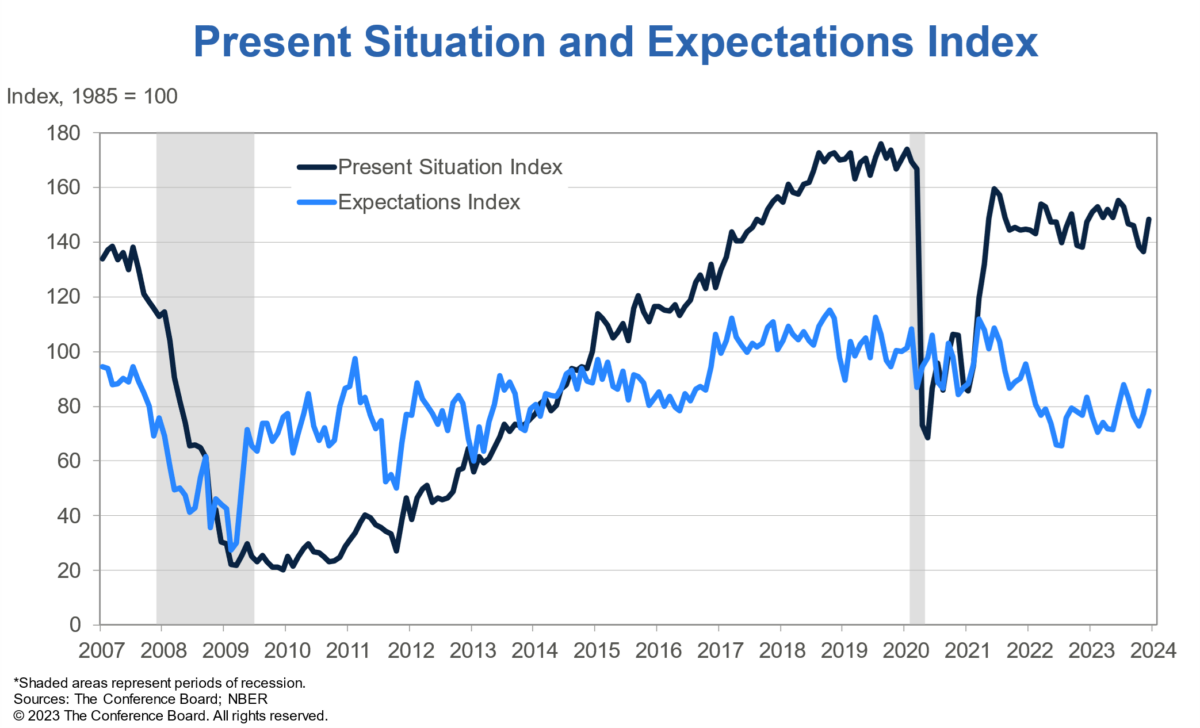

Figure 1: University of Michigan Consumer Sentiment (blue), Conference Board Consumer Confidence (tan), and Daily News Sentiment Index (green), all demeaned and normalized by standard deviation (for the displayed sample period). Michigan December observation is preliminary. The News Index observation for December is through 12/10. NBER defined peak-to-trough recession dates shaded gray. Source: U.Mich via FRED, Conference Board via Investing.com, , NBER, and author’s calculations.To the extent that the survey based and news text based series diverge, this gives some support to the of the dour mood of the public (subject to the condition that the Daily News Index accurately summarizes the news).The jump in the Confidence Board measure was due to increases in both the present situation and expectations components. Source: , accessed 12/20/2023.On the trend divergence between (inverted) misery index and sentiment and confidence indices, see Figure 2 below.

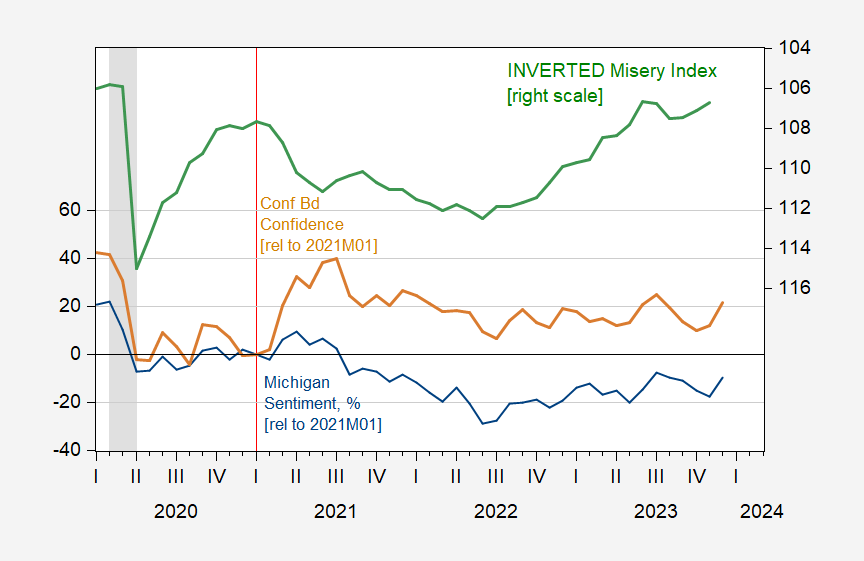

Source: , accessed 12/20/2023.On the trend divergence between (inverted) misery index and sentiment and confidence indices, see Figure 2 below. Figure 2: University of Michigan Consumer Sentiment (blue, left scale), Conference Board Consumer Confidence (tan, left scale), both demeaned and normalized by standard deviation (for the displayed sample period).and inverted Misery Index (green, right scale). Michigan December observation is preliminary. The News Index observation for December is through 12/10. NBER defined peak-to-trough recession dates shaded gray. Source: U.Mich via FRED, Conference Board via Investing.com, NBER, and author’s calculations.”Contributor discusses “Wednesday was one of those days where I waiting (and waiting) for the profit taking to kick in, but by the time sellers made their appearance I had reached my loss limit for the day and so that, was that. You can see all of my whipsaw trades here. For the record, I only work off price action, looking at support/resistance and tells like rapid stop take outs, usually a good sign for a reversal.

Figure 2: University of Michigan Consumer Sentiment (blue, left scale), Conference Board Consumer Confidence (tan, left scale), both demeaned and normalized by standard deviation (for the displayed sample period).and inverted Misery Index (green, right scale). Michigan December observation is preliminary. The News Index observation for December is through 12/10. NBER defined peak-to-trough recession dates shaded gray. Source: U.Mich via FRED, Conference Board via Investing.com, NBER, and author’s calculations.”Contributor discusses “Wednesday was one of those days where I waiting (and waiting) for the profit taking to kick in, but by the time sellers made their appearance I had reached my loss limit for the day and so that, was that. You can see all of my whipsaw trades here. For the record, I only work off price action, looking at support/resistance and tells like rapid stop take outs, usually a good sign for a reversal. Given that, we can see sellers had plenty of motivation to take profits and jumped in on yesterday’s afternoon trading. While there was a big reversal in the Russell 2000 () it still didn’t come into the breakout gap; I suspect we will see this Thursday. Volume climbed to register as distribution.

Given that, we can see sellers had plenty of motivation to take profits and jumped in on yesterday’s afternoon trading. While there was a big reversal in the Russell 2000 () it still didn’t come into the breakout gap; I suspect we will see this Thursday. Volume climbed to register as distribution. Yesterday, the Nasdaq held up a little better on bullish net technicals. There was no distribution and I could see buyers making some inroads tomorrow, but even if the selling continues there is support at the 20-day MA.

Yesterday, the Nasdaq held up a little better on bullish net technicals. There was no distribution and I could see buyers making some inroads tomorrow, but even if the selling continues there is support at the 20-day MA. The S&P had its own round of selling on higher volume distribution. The index is underperforming relative to its peers since November so I would be looking for more selling pressure here. Next key support is the 20-day MA.For Thursday, I would be looking for some buying support although it may be a bit of a scratchy day. Markets do have to consolidate October gains and today may be the start of this. If sharp selling continues, then look to 20-day MAs as a place where buyers may feel confident of stepping in.”TalkMarkets contributor closes the column out with a feel good Christmas present .

The S&P had its own round of selling on higher volume distribution. The index is underperforming relative to its peers since November so I would be looking for more selling pressure here. Next key support is the 20-day MA.For Thursday, I would be looking for some buying support although it may be a bit of a scratchy day. Markets do have to consolidate October gains and today may be the start of this. If sharp selling continues, then look to 20-day MAs as a place where buyers may feel confident of stepping in.”TalkMarkets contributor closes the column out with a feel good Christmas present .