Image Source:

Image Source:

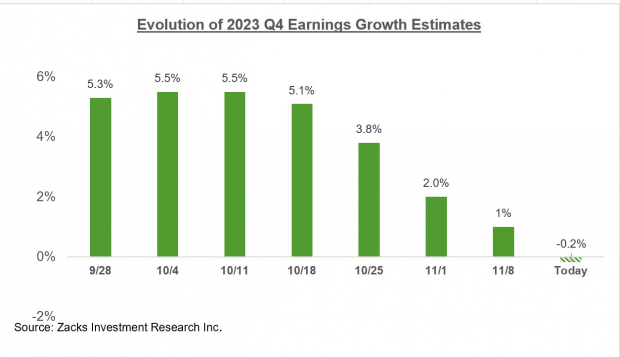

For 2023 Q4, total S&P 500 earnings are currently expected to be -0.2% below the year-earlier period on +2.3% higher revenues. This would follow the +3.5% increase in index earnings in 2023 Q3 on +2% higher revenues.Earnings estimates for Q4 have been steadily coming down since the quarter got underway, as the chart below shows. Image Source: Zacks Investment ResearchThis is a bigger decline in quarterly estimates compared to what we had seen in the comparable periods for either of the preceding two quarters, a reversal of the favorable revisions trend we have spotlighted in this space since April 2023.Not only is there a bigger magnitude of cuts to Q4 estimates, but the pressure is also widespread, with estimates for 11 of the 16 Zacks getting cut since the start of the period. The biggest cuts to estimates have been for the Transportation, Construction, Conglomerates, Consumer Discretionary, Technology, and Medical sectors.On the positive side, Q4 estimates have been raised since the quarter got underway for 5 sectors, with the most significant upward adjustments to estimates for the Utilities, Industrial Products, Autos, Finance, and Energy sectors.The Utilities sector typically doesn’t figure prominently in discussions of earnings trends, but analysts have raised estimates for a number of utility companies. Consolidated Edison ( – ), for example, is currently expected to earn $0.95 per share in Q4. This is up from $0.87 per share that analysts expected Consolidated Edison to earn a month back and $0.81 per share expected three months back. A.O. Smith ( – ) and Emerson Electric ( – ) are examples of industrial companies enjoying positive estimate revisions.Estimates for full-year 2024 have been coming down as well. You can see the pressure on full-year 2024 earnings estimates in the chart below, which shows the aggregate earnings estimates for the S&P 500 index since mid-May 2024.

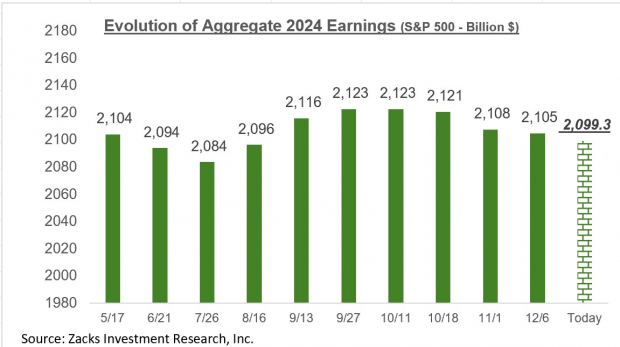

Image Source: Zacks Investment ResearchThis is a bigger decline in quarterly estimates compared to what we had seen in the comparable periods for either of the preceding two quarters, a reversal of the favorable revisions trend we have spotlighted in this space since April 2023.Not only is there a bigger magnitude of cuts to Q4 estimates, but the pressure is also widespread, with estimates for 11 of the 16 Zacks getting cut since the start of the period. The biggest cuts to estimates have been for the Transportation, Construction, Conglomerates, Consumer Discretionary, Technology, and Medical sectors.On the positive side, Q4 estimates have been raised since the quarter got underway for 5 sectors, with the most significant upward adjustments to estimates for the Utilities, Industrial Products, Autos, Finance, and Energy sectors.The Utilities sector typically doesn’t figure prominently in discussions of earnings trends, but analysts have raised estimates for a number of utility companies. Consolidated Edison ( – ), for example, is currently expected to earn $0.95 per share in Q4. This is up from $0.87 per share that analysts expected Consolidated Edison to earn a month back and $0.81 per share expected three months back. A.O. Smith ( – ) and Emerson Electric ( – ) are examples of industrial companies enjoying positive estimate revisions.Estimates for full-year 2024 have been coming down as well. You can see the pressure on full-year 2024 earnings estimates in the chart below, which shows the aggregate earnings estimates for the S&P 500 index since mid-May 2024. Image Source: Zacks Investment ResearchThe chart below shows the overall earnings picture on a quarterly basis.

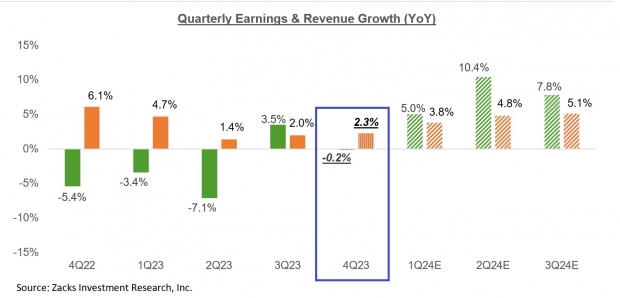

Image Source: Zacks Investment ResearchThe chart below shows the overall earnings picture on a quarterly basis. Image Source: Zacks Investment ResearchAs you can see from these quarterly earnings-growth expectations, the growth picture is expected to steadily improve over the next few quarters.Below, we show the overall earnings picture for the S&P 500 index on an annual basis.

Image Source: Zacks Investment ResearchAs you can see from these quarterly earnings-growth expectations, the growth picture is expected to steadily improve over the next few quarters.Below, we show the overall earnings picture for the S&P 500 index on an annual basis. Image Source: Zacks Investment ResearchGiven the expected moderation in the U.S. economy’s growth trajectory as a result of the cumulative effects of Fed tightening, these estimates likely need to come down. Some of that downward adjustment is already happening, as we showed earlier. In any case, there is no recession in this outlook.More By This Author:Q4 Earnings: What Can Investors Expect?Is An Earnings Recession Coming? Looking Ahead To Q4 Earnings

Image Source: Zacks Investment ResearchGiven the expected moderation in the U.S. economy’s growth trajectory as a result of the cumulative effects of Fed tightening, these estimates likely need to come down. Some of that downward adjustment is already happening, as we showed earlier. In any case, there is no recession in this outlook.More By This Author:Q4 Earnings: What Can Investors Expect?Is An Earnings Recession Coming? Looking Ahead To Q4 Earnings

Q4 Earnings Loom: What To Expect