It’s important to note that the intention to short silver in the foreseeable future is not advisable, given the prevailing market dynamics.

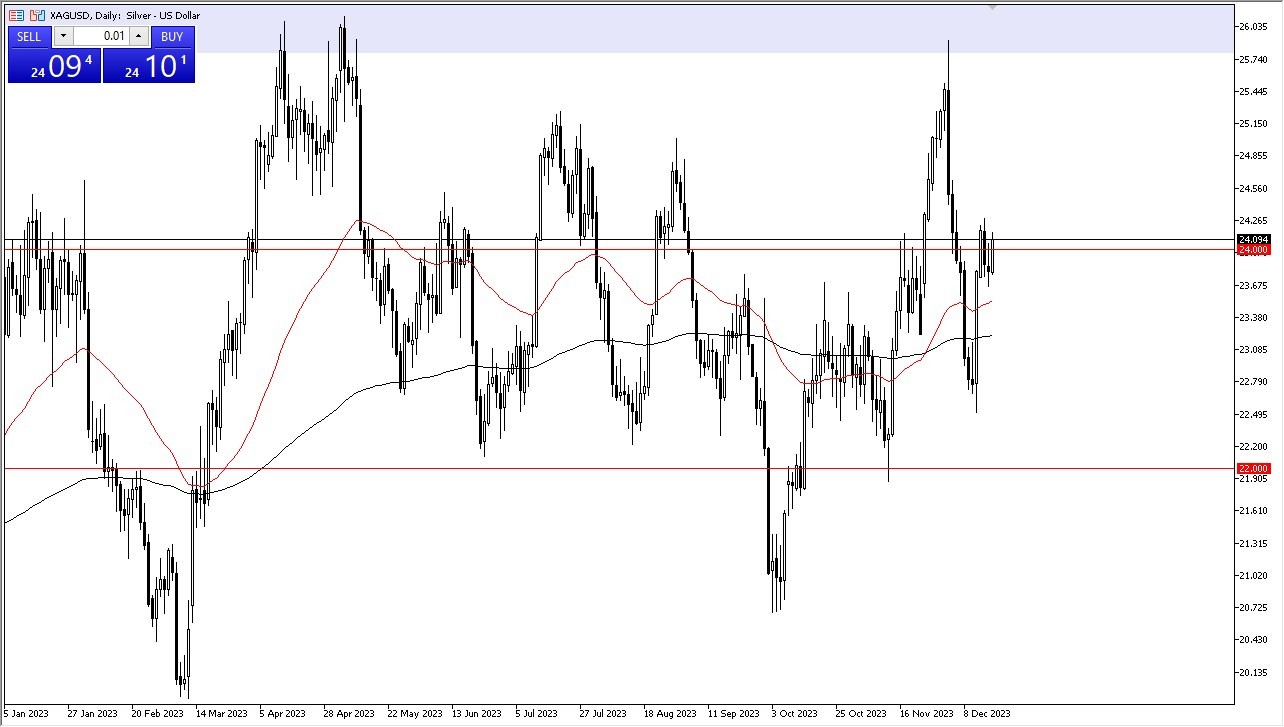

Buying on the DipsNotably, the market appears to offer buying opportunities with each dip, with investors eager to acquire what they perceive as “affordable silver.” It’s imperative to acknowledge silver’s sensitivity to the interest rate dynamics in the bond markets, particularly in the United States. The 10-year yield is closely monitored by many, and if these yields continue to decline, silver is likely to sustain its upward momentum. This trend emerges from traders seeking to preserve wealth in response to lower interest rates, which diminish the appeal of bonds and bolster the attractiveness of precious metals.In addition to these financial considerations, silver’s industrial demand remains a focal point, driven in part by the emergence of “green technology” demands. The market’s appeal also stems from its broader industrial applications. Overall, this market appears conducive to a strategy of seeking buying opportunities during dips, with the 200-Day serving as a reliable support level, preceded by the 50-Day EMA. All things considered; this is a market that will have several areas under that could get into the picture as well.It’s important to note that the intention to short silver in the foreseeable future is not advisable, given the prevailing market dynamics. However, it is prudent to exercise caution as we enter the holiday season, as the expected decrease in liquidity can contribute to heightened . Navigating these market conditions requires a judicious approach to risk management to mitigate potential surprises. The market will continue to be very difficult, but in the end, the yields in America will have a major impact on the silver markets. The negative correlation will be a major mover in this market, and therefore you will have to keep an eye on both charts, the 10-year yield and the silver markets.(Click on image to enlarge) More By This Author:Ethereum Forecast: Sees Upward MomentumBTC/USD Forecast: Looks For Buyers On Dips Gold Forecast: Markets Continue To See Upward Pressure Overall

More By This Author:Ethereum Forecast: Sees Upward MomentumBTC/USD Forecast: Looks For Buyers On Dips Gold Forecast: Markets Continue To See Upward Pressure Overall