Image Source:

Image Source:

Markets are continuing their march higher today during this seasonally strong period. Santa Claus has indeed arrived, with the Nasdaq Composite and Dow Jones Industrial indices reaching new all-time highs this morning. A sharp increase in construction activity, which could have been interpreted as inflationary, failed to derail sentiment, as yields and the dollar plunge. Even an escalation in the Middle East couldn’t halt the bull stampede, with oil prices trading at their highest levels in over two weeks.

Construction Picks Up

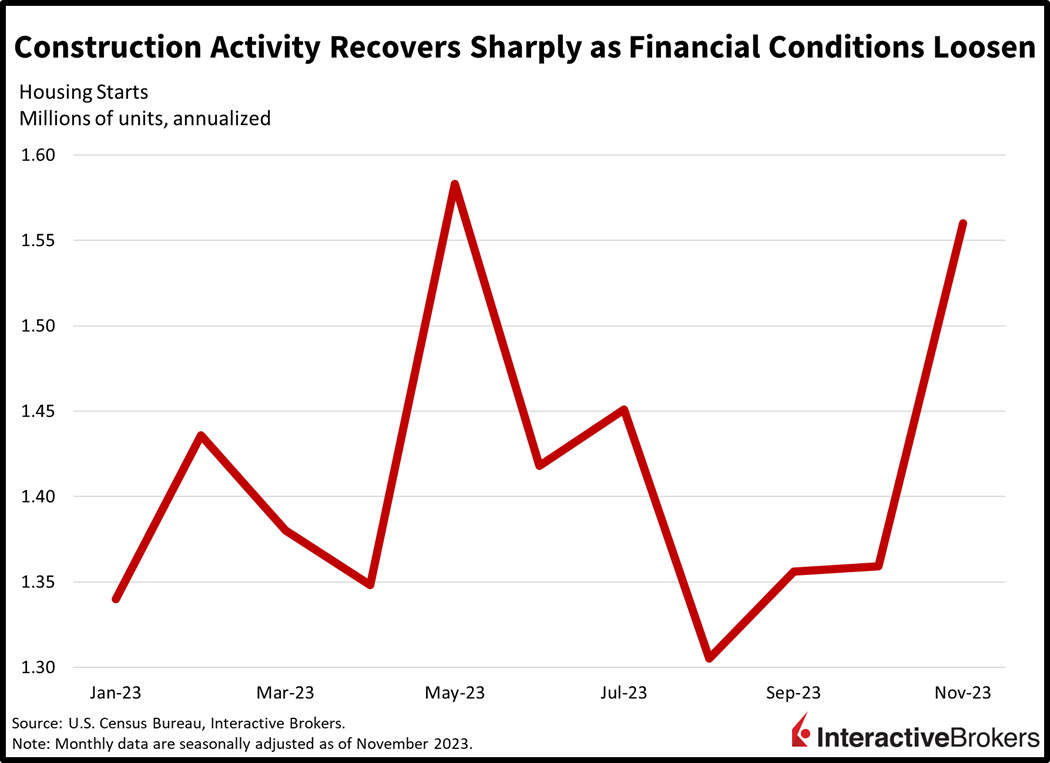

This morning’s real estate data came in much stronger than expected, with the pace of shovels in the ground rising 14.8% on a month-over-month (m/m) basis. The New Residential Construction report from the U.S. Census Bureau detailed housing starts of 1.56 million seasonally adjusted annualized units (SAAU) last month, much higher than the 1.36 million projected and the 1.359 million from October. Building permits, which point to plans for future construction arrived slightly softer, coming in at 1.46 million SAAU versus the 1.47 million anticipated and the 1.498 million from the previous period.(Click on image to enlarge)

Multi-family Lags as Landlords Lack Pricing Power

Across asset classes, single-family performed much better than multi-family, as landlords have been reporting difficulties raising rents. Meanwhile, landlords of new developments are trimming their revenue projections, with rents on recently completed projects dropping consistently. Multi-family permits fell 9.6% m/m, with builders neglecting the segment, which appears to be vastly oversupplied. On the other hand, single-family permits and starts rose 0.7% and 18% m/m. Multi-family starts rose 8.9% m/m. Across regions, the Northeast, South, West and Midwest reported m/m gains for starts of 100%, 16.3%, 2.1% and 1.4%. Permits offered mixed m/m results, with the Midwest and West regions up 12.4% and 12.1% while the Northeast and South were down 34.4% and 6.7%.

Nasdaq, Dow Jones Reach All-Time Highs

Markets are continuing their remarkable run with all major U.S. indices higher while yields and the dollar are lower. Financial conditions are continuing to loosen, which explains recent data coming in firmer than projections. Equity indices are being led by the small-cap Russell 2000, which is incredibly sensitive to rates and policy, it’s up 1.6% to its highest level in the past 52 weeks. Similarly, the Dow Jones Industrial and Nasdaq Composite indices are higher by 0.5% and 0.4%, reaching the highest levels ever recorded. The S&P 500 Index is up 0.5%, to its highest level in the past 52 weeks but remains about 1% off of a fresh all-time high. Sectoral breadth is terrific, with all segments higher as materials, consumer discretionary and real estate lead, the sectors are all higher by about 1%. Turning to fixed-income land, Treasuries are getting bid up at the margins, with the 2- and 10-year maturities trading at 4.44% and 3.91%, as their yields drift lower by 1 and 3 basis points (bps) on the session. As market players dial up odds of a 25-bp rate cut in March to 68%, the dollar is suffering, with its index down 40 bps to 102.1. The greenback is shedding value relative to the pound sterling, franc, euro, yuan and Aussie and Canadian dollars. The U.S. currency is gaining versus the yen though.

Operation Prosperity Guardian

Trouble in the middle east is pushing up the price of oil, with Tehran backed Houthi rebels from Yemen attacking commercial vessels in the Red Sea. Around 10% of global trade goes through the Red Sea towards the Suez Canal, while 40% of goods moved between Europe and Asia are transported through the route. Most companies involved in shipping goods throughout the volatile region, including Maersk, Hapag-Lloyd, MSC and others are recognizing the risk and taking an alternative, more expensive and longer voyage via the Cape of Good Hope, which goes around South Africa. The substitute is expected to prolong deliveries by 7 to 10 days and unfortunately snarls up supply chains globally. U.S. President Joe Biden and his Department of Defense Secretary Lloyd Austin have huddled to create a multinational maritime task force named Operation Prosperity Guardian, which is comprised of a united international front. The United Kingdom, Bahrain, Canada, France, Italy, Netherlands, Norway, Seychelles, and Spain are assisting Washington which intends to protect the free flow of commerce. WTI crude oil is up 1.9%, or $1.39, to $74.21 per barrel on the news, its highest level since December 4.

The Journey Across the Bridge

Construction activity is benefiting greatly from lighter mortgage rates, improved credit availability and looser financial conditions. And it’s not just the housing market, the Fed’s collective messaging on rate cuts next year is unleashing animal spirits in equity markets and propelling consumer spending. Indeed, last week’s retail sales report arrived much better than projected as well. From a less rosy angle, however, our real-time indicators of inflation are reflecting a strong pop this month, with commodities leading the way, spreading to goods and also pushing up the costs of services. External shocks from the Middle East certainly don’t help, but we noticed a sharp increase prior to the recent escalation in the region. Continued inflationary pressures would augment the journey across the monetary policy bridge while incrementally delaying the Fed’s first rate cut. We hope that this short-term rise in prices cools off soon, so that our expedition across the bridge ends sooner rather than later.More By This Author:

Forget Inflation, Santa Is Here