It’s Christmas on Wall Street as the long-awaited pivot is here, with Jerome Powell announcing the Fed’s giving up on inflation and turning to that long-promised recession.The so-called Federal Reserve dot-plot, which measures Fed members’ rate projections, went dovish – meaning inflationary – for the first time since the pandemic.Bloomberg was downright giddy, trumpeting that the “Great Monetary Pivot of 2024” is nigh. Stocks, bonds, and currencies all soared, as financial markets filled up the punch bowl and lined up the coke and hookers just when Joe Biden’s election campaign needed them most.All courtesy of a Federal Reserve that, apparently, has traded in the Paul Volcker baseball cards for a very clever inflation-fighting strategy of let ‘er rip and hope for the best.Indeed, Mike Alfred ventured that Janet Yellen and the big guy himself may have “intervened” with some pointed dialogue with Jerome Powell about their ability to punish the Fed for wrongthink.Markets reacted like a San Francisco junkie on a UBI, with literally everything going up but the dollar – including gold, which rallied $60 dollars in the space of hours. As Bloomberg approvingly put it, “virtually no corner of financial markets was left out.” It was the biggest one-day rally since 2009.(Click on image to enlarge)

It’s Christmas on Wall Street as the long-awaited pivot is here, with Jerome Powell announcing the Fed’s giving up on inflation and turning to that long-promised recession.The so-called Federal Reserve dot-plot, which measures Fed members’ rate projections, went dovish – meaning inflationary – for the first time since the pandemic.Bloomberg was downright giddy, trumpeting that the “Great Monetary Pivot of 2024” is nigh. Stocks, bonds, and currencies all soared, as financial markets filled up the punch bowl and lined up the coke and hookers just when Joe Biden’s election campaign needed them most.All courtesy of a Federal Reserve that, apparently, has traded in the Paul Volcker baseball cards for a very clever inflation-fighting strategy of let ‘er rip and hope for the best.Indeed, Mike Alfred ventured that Janet Yellen and the big guy himself may have “intervened” with some pointed dialogue with Jerome Powell about their ability to punish the Fed for wrongthink.Markets reacted like a San Francisco junkie on a UBI, with literally everything going up but the dollar – including gold, which rallied $60 dollars in the space of hours. As Bloomberg approvingly put it, “virtually no corner of financial markets was left out.” It was the biggest one-day rally since 2009.(Click on image to enlarge) Why did markets go wild? Because despite ongoing inflation, Jerome Powell just signaled the green light for a speculative mania. Last year was a lean one on the street, with dark Jerome warning that “pain is coming” as he strangled financial markets to clear room for the federal government to spend everything their dark little hearts crave.Now Jerome’s apparently traded his dark warnings about exuberance with all but begging Wall Street to exuberate away.The problem is given inflation’s nowhere near licked, this is essentially the Fed giving up. In a recent article I worried about the Fed repeating its catastrophic 1970’s stagflation, when it eased in the eye of the storm and setting off another inflationary crisis.In fact, looking at core inflation, it’s merrily running at double the Fed’s target. Yet here’s Jerome desperately flicking matches on the next tissue-fire boom.So what’s next?The Fed’s praying for a soft landing, the deus ex to save its institutional independence.(Click on image to enlarge)

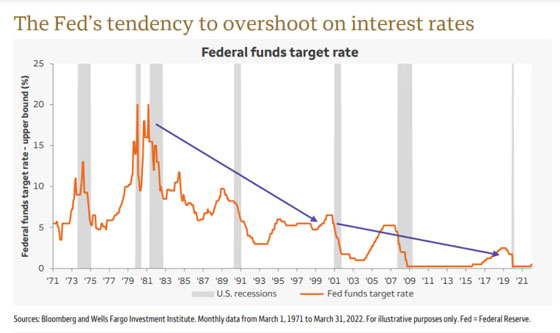

Why did markets go wild? Because despite ongoing inflation, Jerome Powell just signaled the green light for a speculative mania. Last year was a lean one on the street, with dark Jerome warning that “pain is coming” as he strangled financial markets to clear room for the federal government to spend everything their dark little hearts crave.Now Jerome’s apparently traded his dark warnings about exuberance with all but begging Wall Street to exuberate away.The problem is given inflation’s nowhere near licked, this is essentially the Fed giving up. In a recent article I worried about the Fed repeating its catastrophic 1970’s stagflation, when it eased in the eye of the storm and setting off another inflationary crisis.In fact, looking at core inflation, it’s merrily running at double the Fed’s target. Yet here’s Jerome desperately flicking matches on the next tissue-fire boom.So what’s next?The Fed’s praying for a soft landing, the deus ex to save its institutional independence.(Click on image to enlarge) The biggest problem is it’s not going to work. The Federal Reserve has never, in its 110 years of existence, pulled off a soft landing. The media hypes it every time. But it’s a myth, a mirage, a fairytale to help Wall Street traders sleep. In fact, the Federal Reserve has a single recession play: hike til it breaks, then flood money to bail them out.The Fed just advanced us to the next stage to the 70’s. What comes next is mass bankruptcies, layoffs, and daily articles about the famous misery index that we thought were a distant memory.More By This Author:

The biggest problem is it’s not going to work. The Federal Reserve has never, in its 110 years of existence, pulled off a soft landing. The media hypes it every time. But it’s a myth, a mirage, a fairytale to help Wall Street traders sleep. In fact, the Federal Reserve has a single recession play: hike til it breaks, then flood money to bail them out.The Fed just advanced us to the next stage to the 70’s. What comes next is mass bankruptcies, layoffs, and daily articles about the famous misery index that we thought were a distant memory.More By This Author:

Fed Delivers Champagne To Wall Street