EUR/USD looks to EZ CPI

EUR/USD is holding above 1.09 amid a subdued U.S. dollar and as investors look ahead to eurozone inflation data along with central bank speakers. Eurozone inflation is expected to confirm the preliminary reading of 2.4% YoY, a 28-month low, down from 2.9%. The data comes after the German Ifo business climate unexpectedly fell in December, which, combined with the weak PMI data earlier in the month, points to a deteriorating economic outlook. Still, the ECB sounded relatively hawkish in the December meeting, pushing back on rate cut bets, saying that there are still upside risks to inflation and insisting that cutting rates had not been discussed. Given that inflation is so close to the central bank’s 2% target and the economy is already likely in a recession, it is questionable that the ECB should be pushing back against imminent rate cuts, which contrasts significantly with the Fed meeting. The US dollar has come under pressure in recent sessions after the Federal Reserve indicated that it could hike interest rates three times next year. However, since then, Fed speakers have pushed back and played down on rate cut bets, which has seen the selloff in the US dollar steady. Looking ahead, attention will be on the US housing sector, with both housing starts and building permits due. Both are expected to decline by 1.2% and 0.8%, respectively, in November. Weaker-than-expected figures could raise concerns over the health of the housing market. Vice-chair John Williams is also due to speak. On Friday, he said it was too soon to call victory and fight against inflation and fed rate cuts.

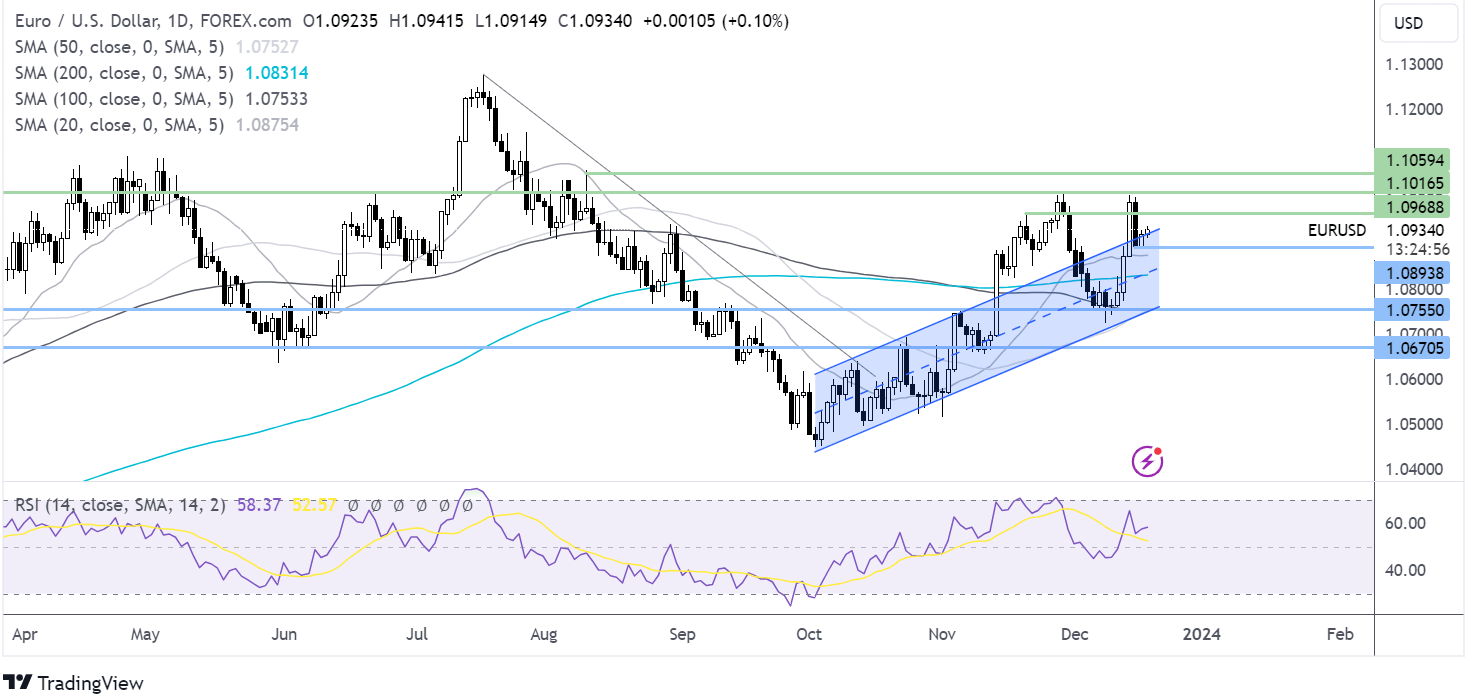

EUR/USD forecast – technical analysis EUR/USD found support at 1.0890 and is rising back above the rising trendline. A rise above here, combined with the RSI above 50 keeps buyers hopeful of further upside. Buyers will look for a rise above 1.10 psychological level to test 1.1020 the November high. Failure to rise above the rising trendline resistance could see the pair retest 1.0890 and 1.0870 the 20 SMA. A break below here brings 1.0830 the 200 SMA back into focus. (Click on image to enlarge)

USD/JPY rises after the BoJ leaves rates unchanged

USD/JPY is rising after the BoJ, as expected, left interest rates on hold in negative territory and affirmed that it would continue with its yield curve control measures in order to support the Japanese economy. BoJ left its interest rates at -0.1% and said it would continue with asset purchases and monetary stimulus, maintaining its ultra-dovish stance. The BoJ offered few clues on its plans for any policy tightening in the coming year, disappointing the market and sending the yen lower. While Governor Ueda had recently offered hints at a potential hawkish pivot in 2024, there is a lot of uncertainty surrounding the timing of such a move, and no further clarity was given at this meeting. Meanwhile, the US dollar selloff has steadied as Fed the speakers played down rate cut bets. Attention U.S. housing start figures and. John Williams is also due to speak.

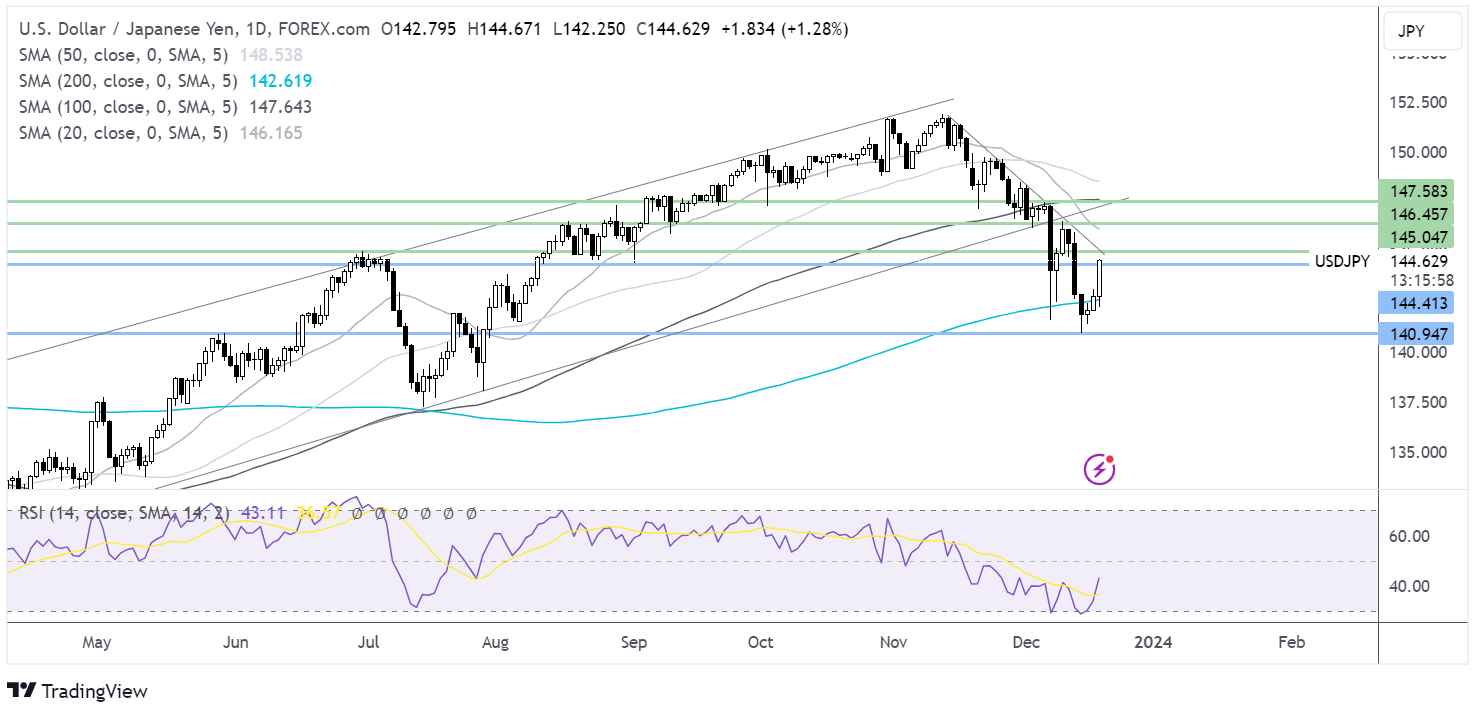

USD/JPY forecast – technical analysis USD/JPY has extended its rebound from 140.95 at the December low, rising above the 200 SMA, and is testing resistance at 144.45 at the September low. A rise above here and 145.00, the July high, could see the pair test 146.50, last week’s high. Sellers would need to break back below the 200 SMA at 142.60 to extend losses towards 140.95 and 140.00, the psychological level. (Click on image to enlarge) More By This Author:

More By This Author: