Small-caps rallied huge last week in reaction to the so-called Fed pivot. That said, no sooner did Powell deliver that message last Wednesday, leading to futures traders now demanding six cuts next year, than three different FOMC members came out and said ‘not so fast’. They are warning the markets not to get carried away with their demands for aggressive easing next year. “The longer the base, the higher in space,” as they say.The Russell 2000 last week broke out of a nearly two-year range. The small cap index has gone back and forth between 1900 and 1700 since January last year. The 200-point range spanning one month short of a couple of years qualifies for a big base. In a perfect world, bulls have a shot at 2100. Until proven otherwise, the breakout deserves respect.The rangebound action preceded a peak in the Russell 2000 in November 2021 at 2459, followed by three troughs below 1700 at 1640s – in June and October last year and October this year (Chart 1).Since the June 2022 trough, the Russell 2000 reclaimed 1900 three times, but only for momentum to soon peter out. In August 2022, it retreated after ticking 2030. This year, the reversal came after tagging 2007 in February and 2004 in July.Last Friday, the index touched 2009 intraday – past 2023 highs but still below the August 2022 high – and reversed lower to finish the session/week at 1985. The August high is worth a watch. Just north of 2000, there are a lot of trapped bulls, who could very well cash in on the latest upsurge and bail out.Secondly, last week’s breakout was the result of an unexpected dovish turn by the Federal Reserve.

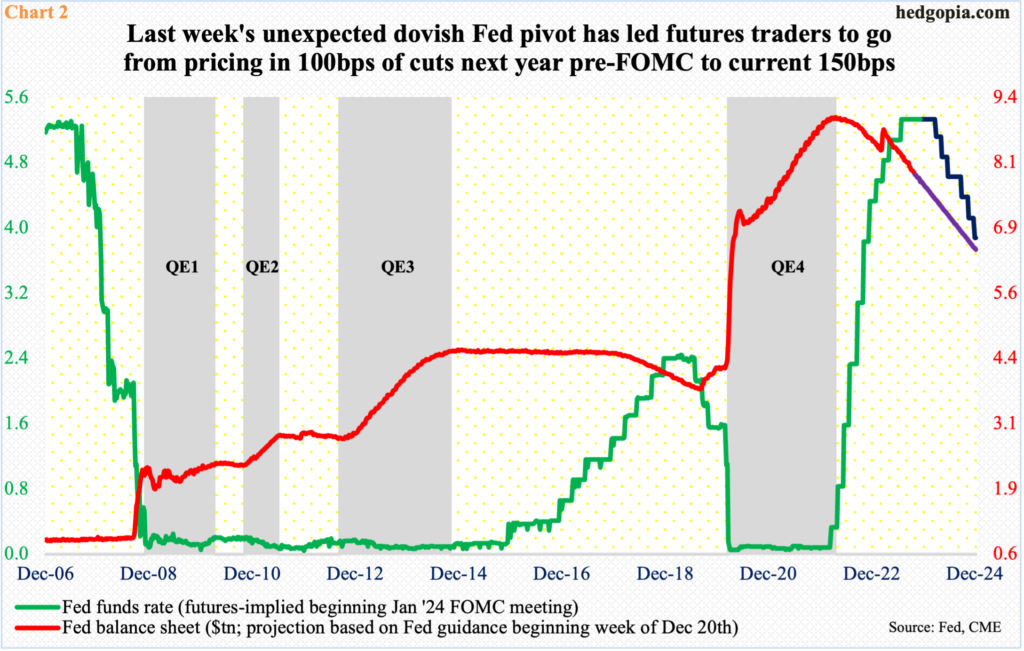

“The longer the base, the higher in space,” as they say.The Russell 2000 last week broke out of a nearly two-year range. The small cap index has gone back and forth between 1900 and 1700 since January last year. The 200-point range spanning one month short of a couple of years qualifies for a big base. In a perfect world, bulls have a shot at 2100. Until proven otherwise, the breakout deserves respect.The rangebound action preceded a peak in the Russell 2000 in November 2021 at 2459, followed by three troughs below 1700 at 1640s – in June and October last year and October this year (Chart 1).Since the June 2022 trough, the Russell 2000 reclaimed 1900 three times, but only for momentum to soon peter out. In August 2022, it retreated after ticking 2030. This year, the reversal came after tagging 2007 in February and 2004 in July.Last Friday, the index touched 2009 intraday – past 2023 highs but still below the August 2022 high – and reversed lower to finish the session/week at 1985. The August high is worth a watch. Just north of 2000, there are a lot of trapped bulls, who could very well cash in on the latest upsurge and bail out.Secondly, last week’s breakout was the result of an unexpected dovish turn by the Federal Reserve. Going into last week’s FOMC meeting, the central bank had already raised the fed funds rate to a range of 525 basis points to 550 basis points, up from zero to 25 basis points in March last year. In the prior meeting on October 31-November 1, Chair Jerome Powell had dropped enough hints they were just about done raising rates, although they would continue to reduce the balance sheet, which at the current pace is on course to reaching $6.4 trillion by the end of next year, down from nearly $9 trillion in April last year (Chart 2).So last Wednesday when it was announced the benchmark rates were left unchanged, this hardly came as a surprise. What did surprise the markets was an out-and-out dovish tone adopted by Powell, plus the fact that the dot plot now expected three 25-basis-point cuts next year, up from two during the September meeting. Futures traders immediately adjusted by pricing in six reductions next year, up from four going into the meeting. Equities were bid up, and within it, investors gravitated toward small-caps in expectation that a soft-landing was at hand and that a low interest rate environment would particularly help the domestically focused small-caps.Amidst this, after last week’s FOMC meeting, three Fed officials have now tried to walk back some of the dovish message doled out on Wednesday – or how it was interpreted by the markets. Austan Goolsbee, Chicago Fed president, said in a CBS interview on Sunday that it is too early to declare victory over inflation. On Friday, New York Fed President John Williams said on CNBC “We aren’t really talking about rate cuts right now.” Also on Friday, Raphael Bostic, Atlanta Fed president, echoed that message in an interview with Reuters. Bostic will be voting next year, while Goolsbee does not vote until 2025. New York Fed has a permanent voting seat.

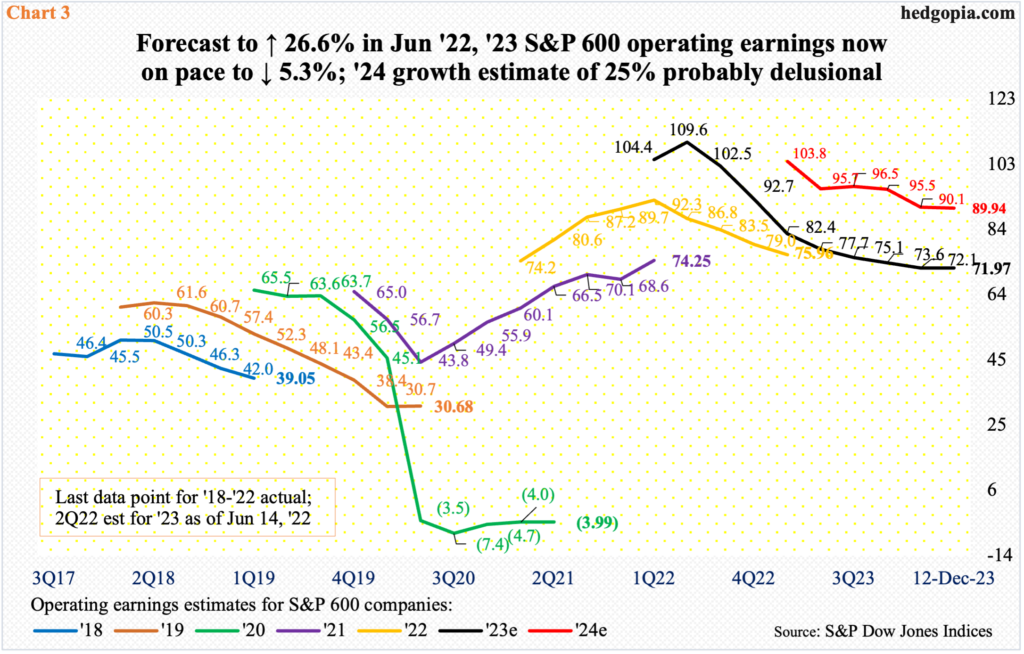

Going into last week’s FOMC meeting, the central bank had already raised the fed funds rate to a range of 525 basis points to 550 basis points, up from zero to 25 basis points in March last year. In the prior meeting on October 31-November 1, Chair Jerome Powell had dropped enough hints they were just about done raising rates, although they would continue to reduce the balance sheet, which at the current pace is on course to reaching $6.4 trillion by the end of next year, down from nearly $9 trillion in April last year (Chart 2).So last Wednesday when it was announced the benchmark rates were left unchanged, this hardly came as a surprise. What did surprise the markets was an out-and-out dovish tone adopted by Powell, plus the fact that the dot plot now expected three 25-basis-point cuts next year, up from two during the September meeting. Futures traders immediately adjusted by pricing in six reductions next year, up from four going into the meeting. Equities were bid up, and within it, investors gravitated toward small-caps in expectation that a soft-landing was at hand and that a low interest rate environment would particularly help the domestically focused small-caps.Amidst this, after last week’s FOMC meeting, three Fed officials have now tried to walk back some of the dovish message doled out on Wednesday – or how it was interpreted by the markets. Austan Goolsbee, Chicago Fed president, said in a CBS interview on Sunday that it is too early to declare victory over inflation. On Friday, New York Fed President John Williams said on CNBC “We aren’t really talking about rate cuts right now.” Also on Friday, Raphael Bostic, Atlanta Fed president, echoed that message in an interview with Reuters. Bostic will be voting next year, while Goolsbee does not vote until 2025. New York Fed has a permanent voting seat. Markets are demanding the Fed cut aggressively next year. Risk-on assets such as the small-caps are already rallying on this optimism. But this is hardly set in stone.In the end, this could very well be a case of Catch-22. The Fed is not going to deliver six cuts next year unless the economy craters, in which case the small-caps have the potential to suffer the most anyway.Arguably, small-cap bulls are not on the same page as the sell-side. These analysts have penciled in a bumper year in operating earnings – expected to grow 25 percent next year to $89.94 from this year’s expected $71.97 (Chart 3). They obviously are seeing things with rose-tinted glasses. Small-cap equity bulls, on the other hand, expect the economy to decelerate enough so the Fed steps in with a series of rate cuts. As a reminder, the economy this year is set to grow north of two percent; yet, S&P 600 companies are on course to contracting earnings 5.3 percent from last year.

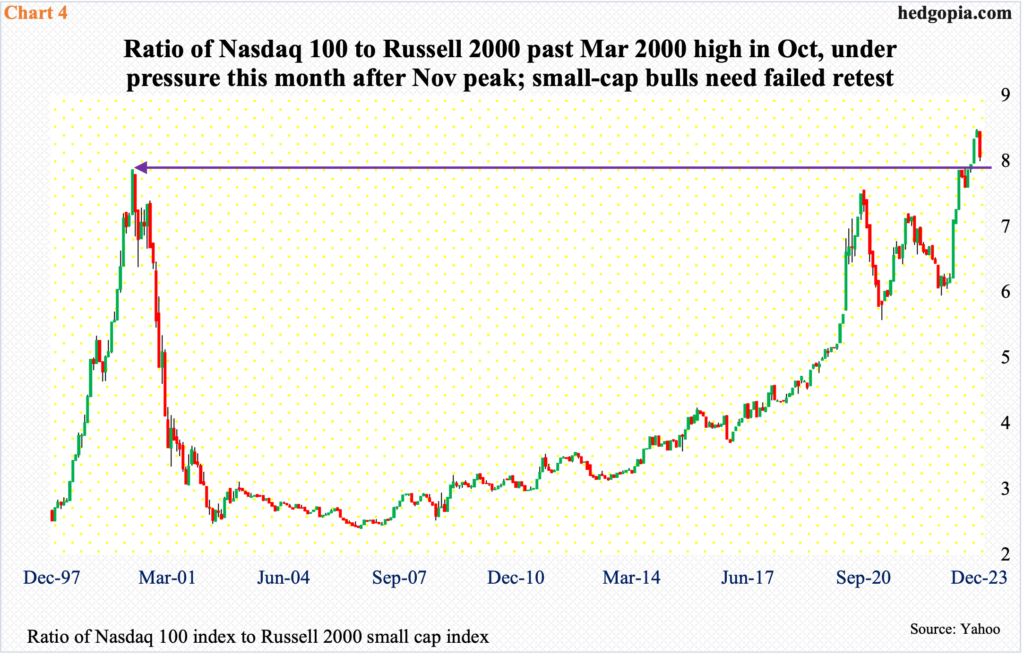

Markets are demanding the Fed cut aggressively next year. Risk-on assets such as the small-caps are already rallying on this optimism. But this is hardly set in stone.In the end, this could very well be a case of Catch-22. The Fed is not going to deliver six cuts next year unless the economy craters, in which case the small-caps have the potential to suffer the most anyway.Arguably, small-cap bulls are not on the same page as the sell-side. These analysts have penciled in a bumper year in operating earnings – expected to grow 25 percent next year to $89.94 from this year’s expected $71.97 (Chart 3). They obviously are seeing things with rose-tinted glasses. Small-cap equity bulls, on the other hand, expect the economy to decelerate enough so the Fed steps in with a series of rate cuts. As a reminder, the economy this year is set to grow north of two percent; yet, S&P 600 companies are on course to contracting earnings 5.3 percent from last year. Here is the thing. Next year’s earnings estimates have remained elevated for a while now. In fact, the sell-side was expecting 2024 to ring up as high as $105.68 in March this year. Yet, the Russell 2000 struggled to break out. Investors were simply not buying into this optimism. Now, they seem to do so, and this needs confirmation.Throughout this year, investors preferred tech, ignoring small-caps. If the time has come for a rotation to occur – out of tech and into small-caps – this will begin to get evident in Chart 4, and that will be the time small-cap bulls can begin to pat themselves on the back.A ratio of the Nasdaq 100 to the Russell 2000 broke out in October – past its March 2000 high. November brought further gains. But December, although it is only midway through, is reversing hard. A breakout retest is imminent. And that will decide the staying power of last week’s move by the small-caps. Should the retest fail and small-caps begin to outperform tech, last week’s breakout by the Russell 2000 will have been vindicated.More By This Author:CoT This Week: Peeking Into The Future Thru Futures, Hedge Fund PositionsDoves Fly, Bulls Run, Animal Spirits On LooseOptions-Related Sentiment Readings Can Begin To Flash Red Should S&P 500 Break Out Of July High Post-FOMC

Here is the thing. Next year’s earnings estimates have remained elevated for a while now. In fact, the sell-side was expecting 2024 to ring up as high as $105.68 in March this year. Yet, the Russell 2000 struggled to break out. Investors were simply not buying into this optimism. Now, they seem to do so, and this needs confirmation.Throughout this year, investors preferred tech, ignoring small-caps. If the time has come for a rotation to occur – out of tech and into small-caps – this will begin to get evident in Chart 4, and that will be the time small-cap bulls can begin to pat themselves on the back.A ratio of the Nasdaq 100 to the Russell 2000 broke out in October – past its March 2000 high. November brought further gains. But December, although it is only midway through, is reversing hard. A breakout retest is imminent. And that will decide the staying power of last week’s move by the small-caps. Should the retest fail and small-caps begin to outperform tech, last week’s breakout by the Russell 2000 will have been vindicated.More By This Author:CoT This Week: Peeking Into The Future Thru Futures, Hedge Fund PositionsDoves Fly, Bulls Run, Animal Spirits On LooseOptions-Related Sentiment Readings Can Begin To Flash Red Should S&P 500 Break Out Of July High Post-FOMC

Small-Caps Rallied Big On Fed Pivot