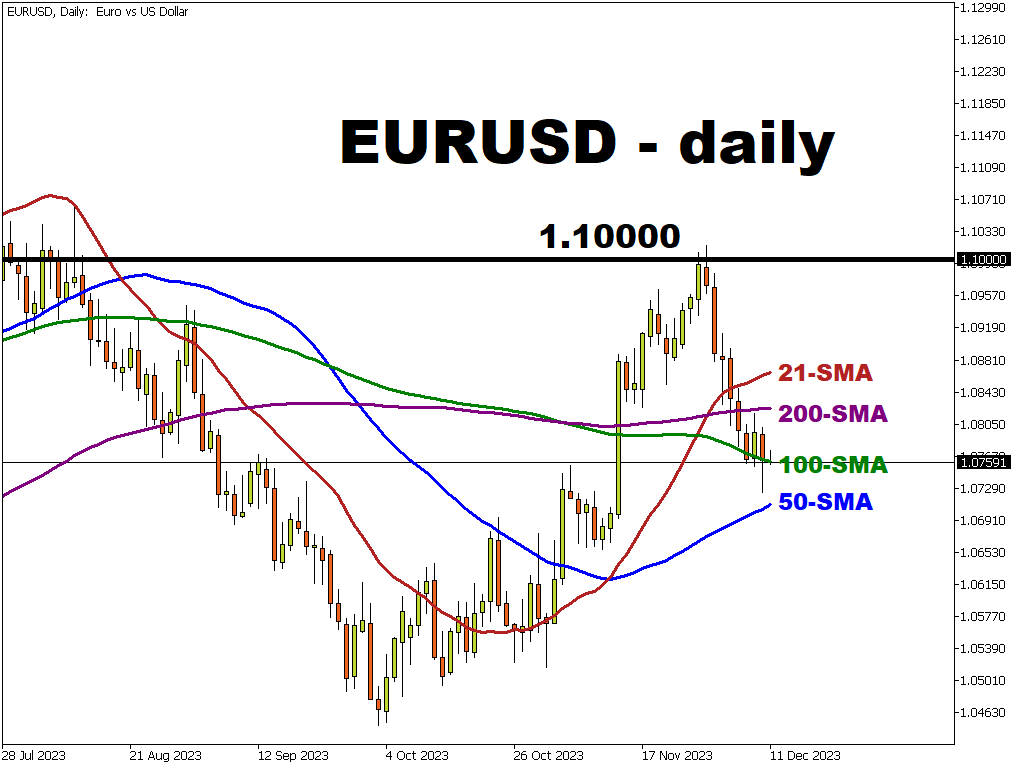

The world’s most popular currency pair has been in the doldrums this month after peaking above 1.10 at the end of November.

The huge dovish repricing of ECB rate cut bets has seen markets give a 75% chance of a 25bp cut in March and 135bps next year. Will the ECB (and Fed) push back on this?

Technically, the major found some support around the 100-day simple moving average at 1.0765 and the 38.2% retracement (1.0764) of the summer decline. Lose this and the 50-day simple moving average sits below around 1.07.

Events Watchlist

Wednesday, December 13: FOMC Meeting

The Fed will keep rates unchanged at 5.25% – 5.50% and publish their new dot plots and summary of economic projections. New CPI data the day before is likely to show ongoing disinflation. This process has seen markets price in multiple rate cuts next year and a big easing in financial conditions, not something the Fed wishes for.

Thursday, December 14: Bank of England Meeting

It’s a similar picture for the other central bank meetings this week. Expectations are for the BoE to push back against rate cuts next year, even though there is less policy easing priced in than the Fed and ECB. Fresh wage growth data out on Tuesday should still be too high for some members of the MPC so GBP could benefit.

Thursday, December 15: ECB Meeting

The ECB will also almost certainly keep rates on hold. The key question is how much it will endorse the market’s aggressive pricing for policy easing next year. The Governing Council may be more cautious about signing off on the death of inflation with a still relatively solid labor market and wage growth. This could help support the euro.

Here’s a comprehensive list of other key economic data and events due this week:Monday, December 11

Tuesday, December 12

Wednesday, December 13

Thursday, December 14

Friday, December 15

More By This Author: