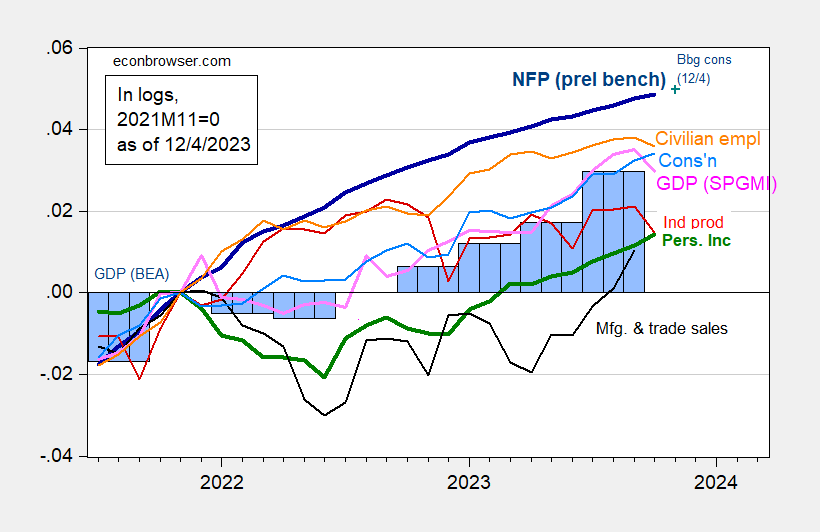

Monthly GDP, as estimated by SPGMI (formerly IHS Markit/Macroeconomic Advisers) drops 0.5% m/m (-6.3% annualized!). Figure 1: Nonfarm Payroll employment incorporating preliminary benchmark (bold dark blue), implied level using Bloomberg consensus as of 12/4 (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP, 2nd release (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, , Federal Reserve, BEA 2023Q3 2nd release incorporating comprehensive revisions, (nee Macroeconomic Advisers, IHS Markit) (12/1/2023 release), and author’s calculations.

Figure 1: Nonfarm Payroll employment incorporating preliminary benchmark (bold dark blue), implied level using Bloomberg consensus as of 12/4 (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP, 2nd release (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, , Federal Reserve, BEA 2023Q3 2nd release incorporating comprehensive revisions, (nee Macroeconomic Advisers, IHS Markit) (12/1/2023 release), and author’s calculations.

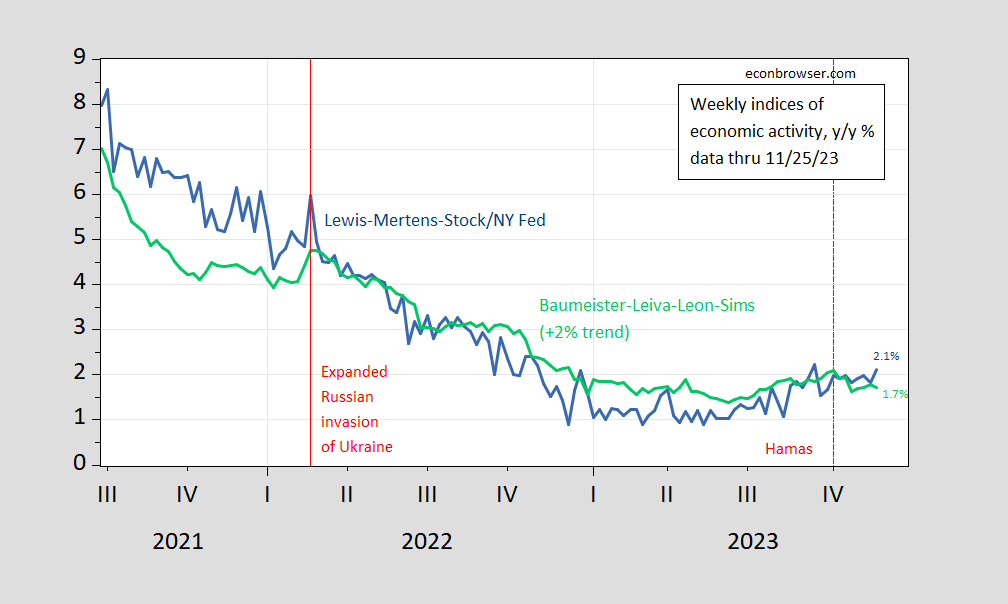

Civilian employment, industrial production, and monthly GDP declined in October, while nonfarm payroll employment and personal income ex-current transfers (both central NBER BCDC variables) continued to rise — as did consumption.While monthly GDP declined -0.5% m/m, final sales increased 0.1% m/m. To the extent that this series more closely reflects aggregate demand, the situation looks more positive. SPGMI does, however, forecast a fairly lackluster 0.9% q/q SAAR growth for Q4.These are backward-looking variables that are used by the NBER’s BCDC to determine business cycle turning points. Higher frequency (weekly) data through releases available by 11/25 indicate growth roughly at trend. Figure 2: Lewis-Mertens-Stock Weekly Economic Index (blue), and Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green), all y/y growth rate in %. Source: NY Fed via , , accessed 12/4, and author’s calculations.More By This Author:The Foreign Born Labor ForceA Decomposition Of Per Unit Price Inflation In Nonfinancial Corporate Sector, Through 2023Q3Business Cycle Indicators As Of End-November

Figure 2: Lewis-Mertens-Stock Weekly Economic Index (blue), and Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green), all y/y growth rate in %. Source: NY Fed via , , accessed 12/4, and author’s calculations.More By This Author:The Foreign Born Labor ForceA Decomposition Of Per Unit Price Inflation In Nonfinancial Corporate Sector, Through 2023Q3Business Cycle Indicators As Of End-November

Business Cycle Indicators Including Monthly GDP