The AUD/USD price analysis took a bearish turn as the Australian dollar fell, reacting to the Reserve Bank of Australia’s (RBA) choice to maintain unchanged interest rates. At the same time, a stronger dollar added to the downward pressure.–Are you interested to learn more about ? Check our detailed guide-The RBA maintained rates at 4.35%, in line with expectations, and noted that economic data received since November aligned with forecasts. Additionally, Bullock kept to the tempered tightening bias from the previous month. She stated that the need for further rate hikes would hinge on evolving data and risk assessments.Notably, this marked the RBA’s final opportunity to raise rates before the February meeting. Consequently, there is relief for mortgage holders during the holiday season. Matt Simpson, senior market analyst at City Index, noted that the Australian dollar experienced significant gains in recent weeks. Therefore, it might be undergoing profit-taking and the unwinding of bets on a more hawkish RBA statement.Meanwhile, analysts attributed the US dollar’s upward movement to a correction following its decline in recent weeks. The dollar index fell around 3% in November, its sharpest monthly drop in a year. At the same time, investors are awaiting this week’s US economic indicators, including November’s non-manufacturing ISM figures and the highly anticipated nonfarm payrolls report. These will offer more insight into the future trajectory of interest rates. AUD/USD key events today

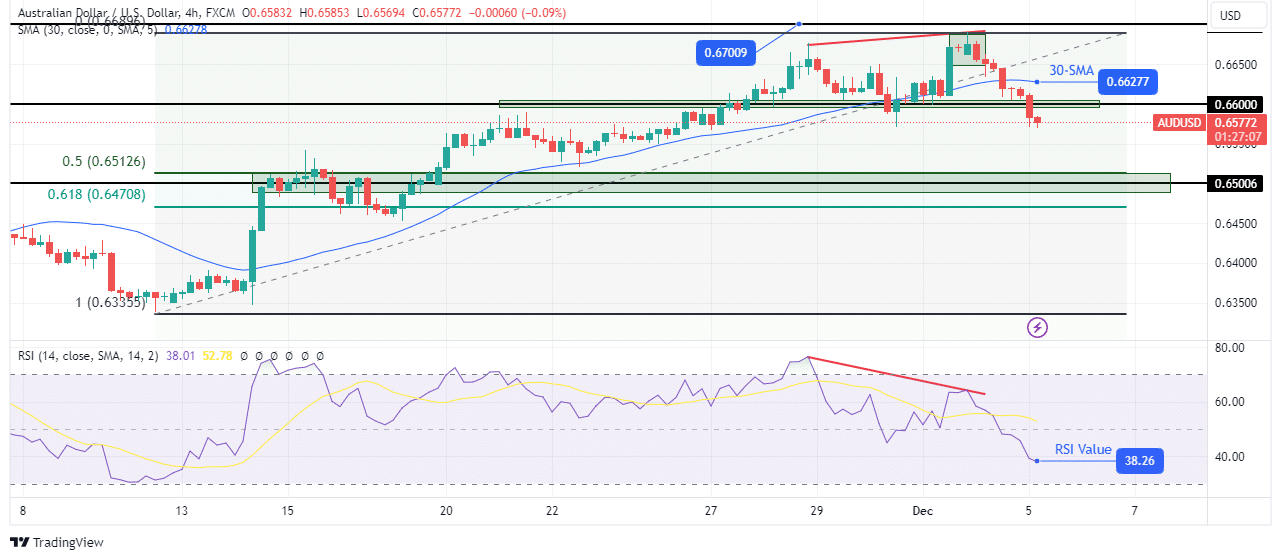

AUD/USD technical price analysis: RSI divergence sparks trend reversal(Click on image to enlarge) AUD/USD 4-hour chartThe bearish RSI divergence on the 4-hour chart has led to a trend reversal for AUD/USD. Bears have taken the lead, pushing the price below the 30-SMA and the RSI below 50. Notably, the decline came after the price made a bearish engulfing candle. Moreover, the price has broken below the 0.6600 support level.Meanwhile, bears are now on the verge of making a lower low, which would further confirm a new trend. If this happens, the price will likely make lower highs and lows as it descends to the next support level. The next strong support for bears is a zone comprising the 0.5 fib retracement and the 0.6500 support.More By This Author:Gold Price Struggling To Recover After 6% Dip from All-Time HighUSD/JPY Outlook: Yen Firm Despite Downbeat Tokyo CPIUSD/CAD Outlook: Dollar Mounts A Comeback Post Powell

AUD/USD 4-hour chartThe bearish RSI divergence on the 4-hour chart has led to a trend reversal for AUD/USD. Bears have taken the lead, pushing the price below the 30-SMA and the RSI below 50. Notably, the decline came after the price made a bearish engulfing candle. Moreover, the price has broken below the 0.6600 support level.Meanwhile, bears are now on the verge of making a lower low, which would further confirm a new trend. If this happens, the price will likely make lower highs and lows as it descends to the next support level. The next strong support for bears is a zone comprising the 0.5 fib retracement and the 0.6500 support.More By This Author:Gold Price Struggling To Recover After 6% Dip from All-Time HighUSD/JPY Outlook: Yen Firm Despite Downbeat Tokyo CPIUSD/CAD Outlook: Dollar Mounts A Comeback Post Powell