The EUR/USD weekly outlook is bullish as the US labor market has shown signs of easing. Therefore, the dollar might continue its decline next week.-If you are interested in brokers with Nasdaq, check our detailed guide-Ups and downs of EUR/USDThe EUR/USD had a bullish week, with the euro strengthening against the dollar. On Wednesday, the US released the FOMC meeting minutes. In their June meeting, the Fed unanimously decided to keep interest rates unchanged. This decision allows the Fed to evaluate the need for future rate hikes. While most members anticipated the need for policy tightening, they opted to maintain the current rates.However, the EUR/USD posted its largest gains on Friday when the US released a mixed employment report. Although the US added fewer jobs than expected, the unemployment rate fell. Still, the dollar weakened in response to the report.Next week’s key events for EUR/USD

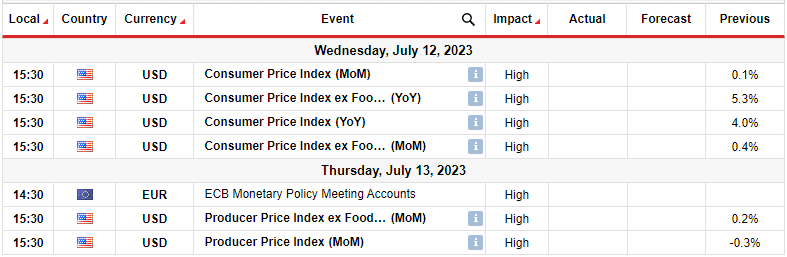

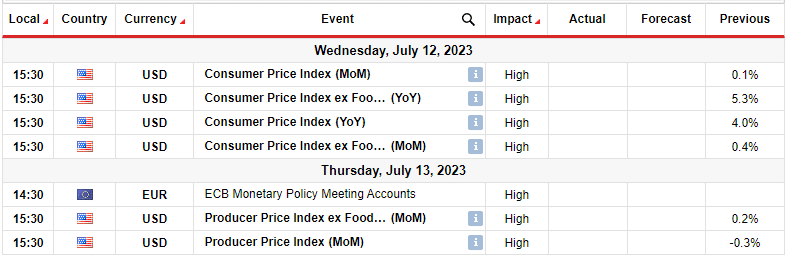

Investors are awaiting the US inflation report coming out next week. This report carries a lot of weight as it will influence the Fed’s next policy move. Notably, the Fed maintained its policy rate between 5%-5.25% last month. Furthermore, despite a robust labor market, it indicated future rate hikes due to persistently high inflation levels and a sluggish pace toward the Fed’s 2% target.Investors will also focus on the ECB policy meeting minutes that will show what went into the last ECB rate hike. Additionally, it might give clues on the next step for the European Central Bank.EUR/USD weekly technical outlook: Bulls to retest the 1.1001 and 1.1100 resistance levels.

Investors are awaiting the US inflation report coming out next week. This report carries a lot of weight as it will influence the Fed’s next policy move. Notably, the Fed maintained its policy rate between 5%-5.25% last month. Furthermore, despite a robust labor market, it indicated future rate hikes due to persistently high inflation levels and a sluggish pace toward the Fed’s 2% target.Investors will also focus on the ECB policy meeting minutes that will show what went into the last ECB rate hike. Additionally, it might give clues on the next step for the European Central Bank.EUR/USD weekly technical outlook: Bulls to retest the 1.1001 and 1.1100 resistance levels.

EUR/USD Weekly Outlook: US NFP Reports Lesser than Expected Jobs