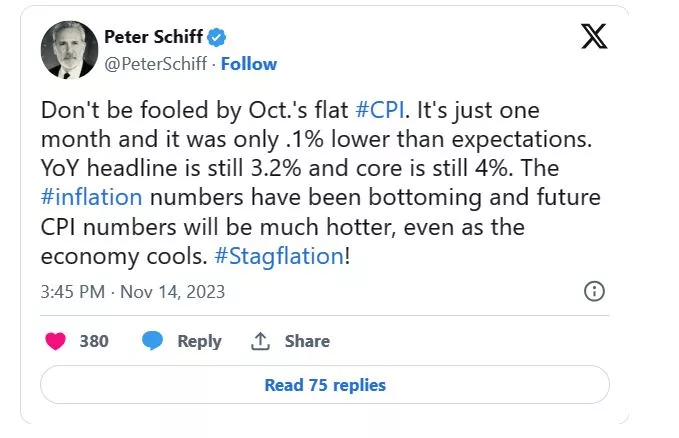

The index (DXY) retreated to the lowest level since November 9 after the latest US Consumer Price Index (CPI) data. It retreated to a low of $104.93, much lower than last week’s high of $106 and last month’s high of $107.35.  The DXY retreat also coincided with the deep dive of the VIX index, which tumbled to a low of $14.70, the lowest point since September 20th. It has crashed by almost 40% from the highest point in October. US inflation dataThe biggest USD news on Tuesday was the latest US consumer report. According to the Bureau of Labor Statistics (BLS), the headline consumer price index retreated from 0.3% in September to 0.0% in October. This decline translated to a YoY drop of 3.2%. Core inflation, which is closely watched because it excludes the volatile food and energy prices, dropped from 4.1% in September to 4.0%. It retreated from 0.3% to 0.2% on a MoM basis.

The DXY retreat also coincided with the deep dive of the VIX index, which tumbled to a low of $14.70, the lowest point since September 20th. It has crashed by almost 40% from the highest point in October. US inflation dataThe biggest USD news on Tuesday was the latest US consumer report. According to the Bureau of Labor Statistics (BLS), the headline consumer price index retreated from 0.3% in September to 0.0% in October. This decline translated to a YoY drop of 3.2%. Core inflation, which is closely watched because it excludes the volatile food and energy prices, dropped from 4.1% in September to 4.0%. It retreated from 0.3% to 0.2% on a MoM basis. These numbers were watched closely because of their impact on the Federal Reserve, which has committed to be data-dependent. In its recent decision, the bank decided to leave interest rates unchanged between 5.25% and 5.50%.Additional data published earlier this month revealed that the labor market softened in October. The economy added over 150k jobs in October while the unemployment rate jumped to 3.9%. Wage growth decelerated during the month.Therefore, with the jobless rate rising and with inflation falling, analysts believe that the Fed will leave interest rates unchanged in the December meeting. There are also expectations that the bank will deliver several rate cuts in the December meeting. Many analysts believe that the Fed has succeeded in bringing inflation down from a 40-year high in 2022. The path to the bank’s 2.0% will be lengthy, especially if the price of crude oil remains at an elevated level.The weak inflation numbers will also impact US equities and cryptocurrencies. Key indices like the Dow Jones and Nasdaq 100 have all surged recently while Bitcoin remains at its highest point in more than 18 months. US dollar index forecast

These numbers were watched closely because of their impact on the Federal Reserve, which has committed to be data-dependent. In its recent decision, the bank decided to leave interest rates unchanged between 5.25% and 5.50%.Additional data published earlier this month revealed that the labor market softened in October. The economy added over 150k jobs in October while the unemployment rate jumped to 3.9%. Wage growth decelerated during the month.Therefore, with the jobless rate rising and with inflation falling, analysts believe that the Fed will leave interest rates unchanged in the December meeting. There are also expectations that the bank will deliver several rate cuts in the December meeting. Many analysts believe that the Fed has succeeded in bringing inflation down from a 40-year high in 2022. The path to the bank’s 2.0% will be lengthy, especially if the price of crude oil remains at an elevated level.The weak inflation numbers will also impact US equities and cryptocurrencies. Key indices like the Dow Jones and Nasdaq 100 have all surged recently while Bitcoin remains at its highest point in more than 18 months. US dollar index forecast The four-hour chart shows that the DXY index made a strong bearish breakout after the latest US inflation data. It retested the important support level at $104.85, the lowest point on November 7th. The index has plunged below the crucial support level at $105.35, the lowest swing on October 24th. It has moved below all moving averages and the 23.6% Fibonacci Retracement level. Therefore, the outlook for the US dollar index is bearish, with the next support level to watch being at $104.50. The stop-loss of this trade will be at $105.35.More By This Author:

The four-hour chart shows that the DXY index made a strong bearish breakout after the latest US inflation data. It retested the important support level at $104.85, the lowest point on November 7th. The index has plunged below the crucial support level at $105.35, the lowest swing on October 24th. It has moved below all moving averages and the 23.6% Fibonacci Retracement level. Therefore, the outlook for the US dollar index is bearish, with the next support level to watch being at $104.50. The stop-loss of this trade will be at $105.35.More By This Author:

Here’s Why The US Dollar Index And The VIX Slipped After CPI Data