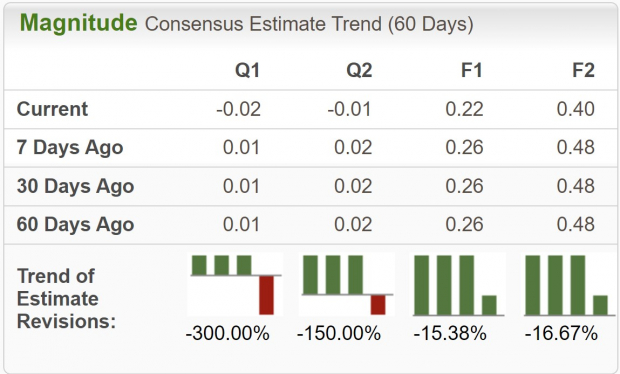

eXp World Holdings () , a forward-looking, cloud-based real estate brokerage, is dealing with numerous headwinds in the current economic environment, contributing to faltering sales growth and declining earnings estimates.In addition to a Zacks Rank #5 (Strong Sell) rating, it also has a premium valuation, increasing downside risks, which is further compounded by the fact that it is becoming a popular short trade.Furthermore, with interest rates pushing 16-year highs in recent weeks, sales in the residential housing market have slowed considerably. As a real estate brokerage, this has put huge downward pressure on EXPI’s volume and thus sales growth.Because of this setup, I think eXp World Holdings stock should be avoided by investors. Tumbling Earnings EstimatesAs a somewhat experimental startup company, eXp World Holdings already struggles with a potentially questionable business model. The stock enjoyed a powerful run during the frothy days of 2021, but has since fallen nearly -90%.Net margins have fluctuated from negative to barely positive, and even gross margins are quite low, below 10%. While I am not certain that it is a broken business model, it certainly isn’t appealing where it stands today.Sales forecasts are not strong either. FY23 sales are projected to fall -3.3% YoY, and FY24 are expected to grow just 4.9% YoY.Because of this situation, analysts have not surprisingly lowered earnings expectations. Current quarter earnings estimates have been revised from $0.01 to -$0.02 and FY23 earnings estimates have declined by -15.4% in just the last week.(Click on image to enlarge) Image Source: Zacks Investment Research Bloated ValuationWhile some of the current data may be forgivable given the interest rate situation, eXp World Holdings stock is still priced for big growth, and industry disruption, neither of which appears to be a reality currently.EXPI is trading at a one year forward earnings multiple of 54.5x, which is much higher than the industry average and is in line with its recent median. And because sales and earnings estimates are projected to be so weak, it is hard to rationalize this as anything but overvalued.(Click on image to enlarge)

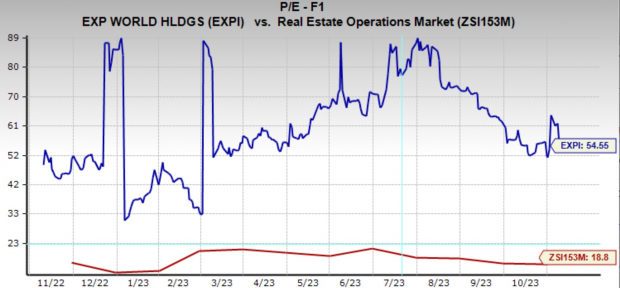

Image Source: Zacks Investment Research Bloated ValuationWhile some of the current data may be forgivable given the interest rate situation, eXp World Holdings stock is still priced for big growth, and industry disruption, neither of which appears to be a reality currently.EXPI is trading at a one year forward earnings multiple of 54.5x, which is much higher than the industry average and is in line with its recent median. And because sales and earnings estimates are projected to be so weak, it is hard to rationalize this as anything but overvalued.(Click on image to enlarge) Image Source: Zacks Investment Research Short Sellers Love ItThis rather obvious bearish scenario has not been overlooked by investors, as EXPI has become a popular shorting opportunity. In the chart below, you see that every big rally in the stock has been met by huge selling pressure.Short interest in eXp World Holdings has risen to 25% of the outstanding float. At 25%, EXPI has clearly become a short target for hedge funds, and although growing short interest can increase the possibility of a short squeeze, it doesn’t seem likely at this point.(Click on image to enlarge)

Image Source: Zacks Investment Research Short Sellers Love ItThis rather obvious bearish scenario has not been overlooked by investors, as EXPI has become a popular shorting opportunity. In the chart below, you see that every big rally in the stock has been met by huge selling pressure.Short interest in eXp World Holdings has risen to 25% of the outstanding float. At 25%, EXPI has clearly become a short target for hedge funds, and although growing short interest can increase the possibility of a short squeeze, it doesn’t seem likely at this point.(Click on image to enlarge) Image Source: TradingView Bottom LineeXp World Holdings is in a very challenging position. It showed huge promise after going public, with a unique value proposition, and strong sales growth. But that success appears to now be in the rearview mirror, with a challenging macro environment, and still evolving business economics.And while a lot of bad news has been priced into the stock, it looks like there may be potential for further downside, as a premium valuation offers little downside support.I don’t know what the path forward for EXPI looks like, but I do think investors should avoid the stock until its future becomes clearer. More By This Author:

Image Source: TradingView Bottom LineeXp World Holdings is in a very challenging position. It showed huge promise after going public, with a unique value proposition, and strong sales growth. But that success appears to now be in the rearview mirror, with a challenging macro environment, and still evolving business economics.And while a lot of bad news has been priced into the stock, it looks like there may be potential for further downside, as a premium valuation offers little downside support.I don’t know what the path forward for EXPI looks like, but I do think investors should avoid the stock until its future becomes clearer. More By This Author:

Bear Of The Day: Exp World Holdings