Image Source:

Image Source:

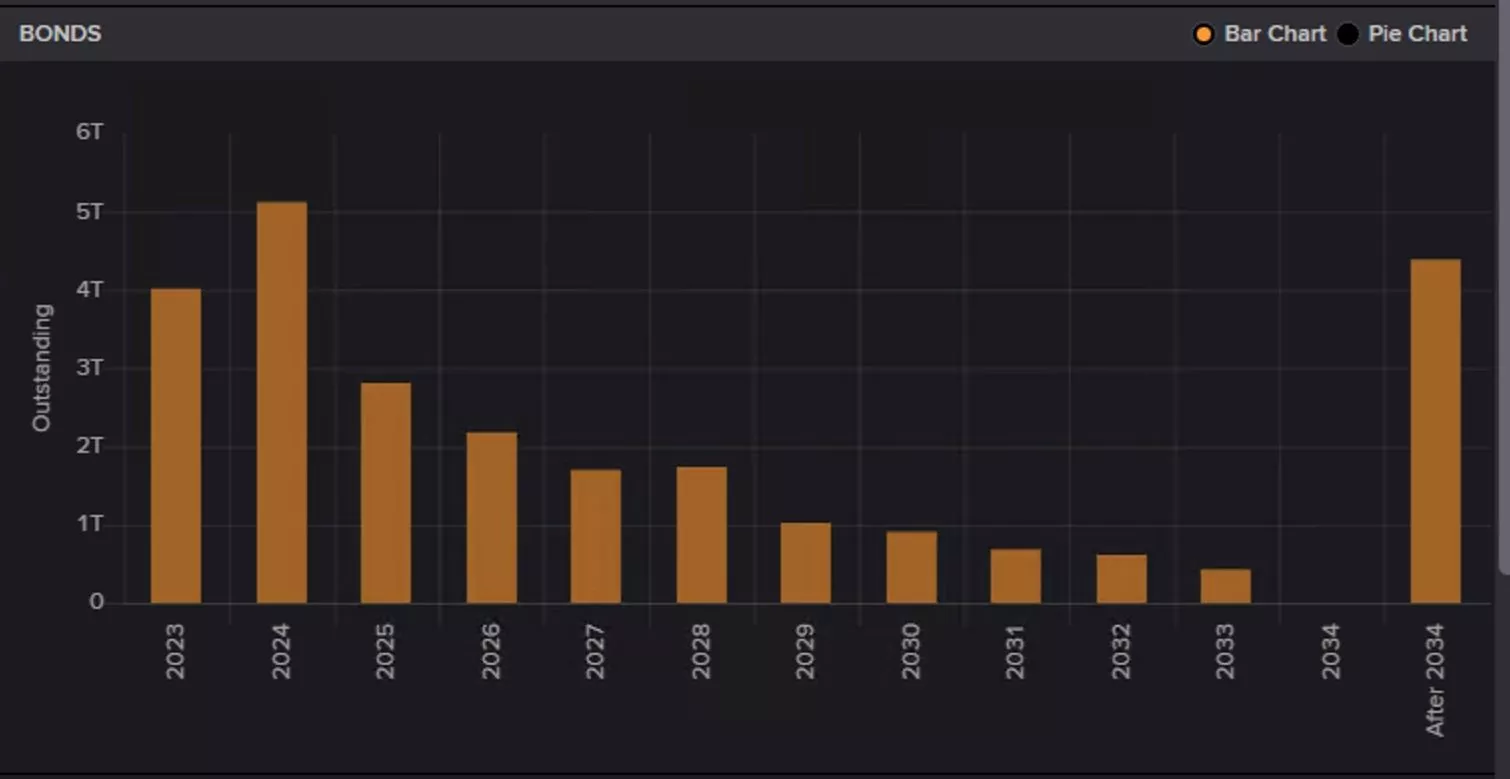

Many believe we are currently at the peak of Treasury yields, or close to it. Inflation is slowing down, the tightening of monetary policy by the Federal Reserve is starting to have an impact, and so on.In my view, these expectations significantly underestimate the impact of the refinancing volume of the national debt. According to Refinitiv data from the chart below, it shows that next year, about $5 trillion of Treasuries will mature, which is roughly 25% more than this year. Additionally, there’s the budget deficit, likely to be around $1.8-2 trillion, and it will be covered by issuing new government debt. This adds up to around $7 trillion.(Click on image to enlarge)

Also, there hasn’t been a significant influx of foreign capital into Treasuries yet. , non-resident investments in the national debt have increased by only $214 billion in the last 12 months, from $7.493 trillion to $7.707 trillion. This seems more like a reinvestment of earned income than an inflow of new capital.On a side note, it’s worth mentioning that the borrower is not the private sector but the government, which pays little attention to the rates at which it borrows, especially when funds are needed for military support to allies.Therefore, as a target for the yield of 10-year Treasuries, a level around 6.75% annually can be indicated. This level has alternately been an important resistance and support level for 30 years, from 1970 to 2000.More By This Author:

Will Yields Drop In 2024?