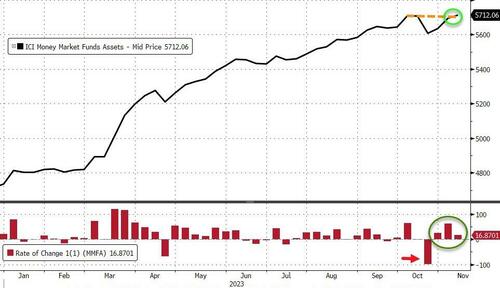

Money-market funds saw inflows for the 3rd straight week (since the biggest outflow since Lehman), adding $16.9BN to reach a new record high of $5.71TN… Source: BloombergIn a breakdown for the week to Nov. 8, government funds – which invest primarily in securities like Treasury bills, repurchase agreements and agency debt – saw assets rise to $4.66 trillion, a $9.63 billion increase.Prime funds, which tend to invest in higher-risk assets such as commercial paper, meanwhile saw assets climb to $926 billion, a $6.35 billion increase.Retail fund inflows continued unabated (and institutions saw their 3rd straight week of inflows)…

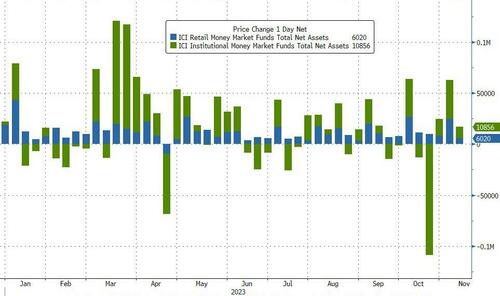

Source: BloombergIn a breakdown for the week to Nov. 8, government funds – which invest primarily in securities like Treasury bills, repurchase agreements and agency debt – saw assets rise to $4.66 trillion, a $9.63 billion increase.Prime funds, which tend to invest in higher-risk assets such as commercial paper, meanwhile saw assets climb to $926 billion, a $6.35 billion increase.Retail fund inflows continued unabated (and institutions saw their 3rd straight week of inflows)… Source: BloombergThe resurgence in money-market fund inflows is diverging from bank deposits (which are gently rising on a seasonally-adjusted basis)…

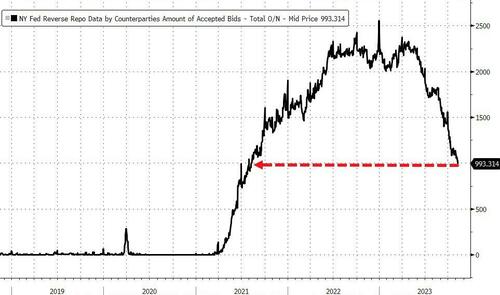

Source: BloombergThe resurgence in money-market fund inflows is diverging from bank deposits (which are gently rising on a seasonally-adjusted basis)… Source: BloombergMeanwhile, as we detailed earlier, the amount of money that investors are parking at The Fed’s reverse repo facility dropped below $1 trillion for the first time in more than two years.

Source: BloombergMeanwhile, as we detailed earlier, the amount of money that investors are parking at The Fed’s reverse repo facility dropped below $1 trillion for the first time in more than two years. Source: BloombergIt marks a steep decline from a record $2.554 trillion stashed on Dec. 30 and is the smallest sum since August 2021.

Source: BloombergIt marks a steep decline from a record $2.554 trillion stashed on Dec. 30 and is the smallest sum since August 2021.

“It’s a big number,” said Deutsche Bank strategist Steven Zeng, referring to the decline past $1 trillion.

“I can see it falling further with dealers owning so much of the new bond.”

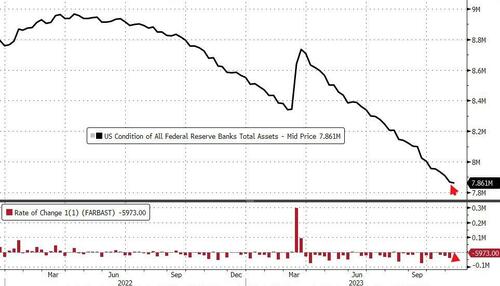

Demand for the facility, however, has been fading this year as the Treasury ramped up fresh bill issuance, offering an alternative for short-term investors.But as Bloomberg notes, as usage of the Fed’s facility fades, Wall Street strategists are weighing whether there will be further impact on the central bank’s policy decisions. If demand falls toward zero, strategists say, the Fed will have to halt its quantitative tightening program because excess liquidity will have been completely drained and bank reserves will have reached a point of scarcity.The Fed’s balance sheet contracted by a very modest $6BN last week (the balance sheet is now down over $1.1TN from its highs… Source: BloombergThe Fed’s QT program stalled last week, with its securities-held RISING by $313BN…

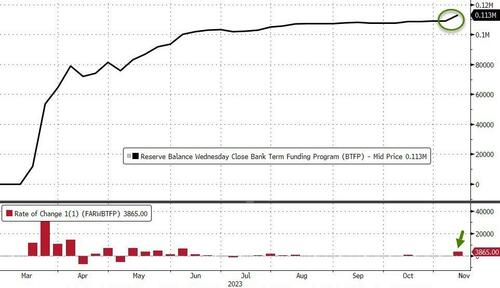

Source: BloombergThe Fed’s QT program stalled last week, with its securities-held RISING by $313BN… Source: BloombergMost notably, usage of The Fed’s emergency funding facility for the banks soared higher by $3.9BN to a new record high above $113BN… (the biggest jump since June)

Source: BloombergMost notably, usage of The Fed’s emergency funding facility for the banks soared higher by $3.9BN to a new record high above $113BN… (the biggest jump since June) Source: BloombergOf course, having seen equity market capitalization crash back to earth and recouple with bank reserves at The Fed, this week saw equities bounce higher as reserves also increased…

Source: BloombergOf course, having seen equity market capitalization crash back to earth and recouple with bank reserves at The Fed, this week saw equities bounce higher as reserves also increased… Source: BloombergFinally, we note that after Bill Gross apparently ‘called the bottom’ in regional banks last week, their share prices all jumped initially, but FHLB issuance limits and general risk-off has them giving some back. And we just remind those buyers that bond yields have exploded higher since SVB…

Source: BloombergFinally, we note that after Bill Gross apparently ‘called the bottom’ in regional banks last week, their share prices all jumped initially, but FHLB issuance limits and general risk-off has them giving some back. And we just remind those buyers that bond yields have exploded higher since SVB… Source: Bloomberg…and they are borrowing ever more ($113BN) from The Fed at an expensive rate to fill the holes in their balance sheets. Does that sound like the bottom is in?More By This Author:WeWork Shares Have Plunged 99% But Founder Adam Neumann Remains A BillionaireContinuing Jobless Claims Jump To Highest Since AprilEndgame: Interest On U.S. Debt Skyrockets Above $1 Trillion For The First Time Ever

Source: Bloomberg…and they are borrowing ever more ($113BN) from The Fed at an expensive rate to fill the holes in their balance sheets. Does that sound like the bottom is in?More By This Author:WeWork Shares Have Plunged 99% But Founder Adam Neumann Remains A BillionaireContinuing Jobless Claims Jump To Highest Since AprilEndgame: Interest On U.S. Debt Skyrockets Above $1 Trillion For The First Time Ever