Image Source:

Image Source:

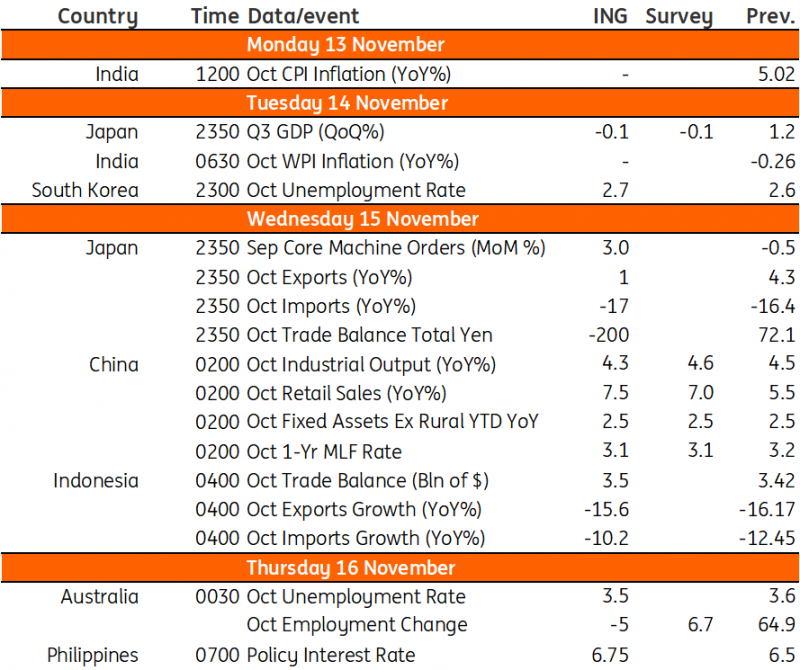

Next week features China’s data deluge with retail sales and industrial output as well as inflation data for India. Meanwhile, Japan reports GDP and Australia releases jobs numbers.

Onion prices leading India’s inflationIndia releases inflation data next week. October is the beginning of the festive and wedding season, and food inflation is expected to accelerate due to strong demand. Onion prices in particular have increased for six consecutive months, and last month surged by 60% month-on-month according to India’s Department of Consumer Affairs. As such, we expect inflation to push up to 5.3% year-on-year.

China’s industrial output growth to slow while retail sales growth picks upChina will see a raft of activity and other data in the coming week. Industrial output is likely to slow to 4.3% YoY due to base effects, and the official manufacturing PMI also hinted at a contraction in manufacturing activity, contributing to the slowdown.Retail sales, on the other hand, are likely to accelerate to 7.5% YoY due to Covid-19 lockdowns last year. The first ‘Golden Week’ Holiday following the pandemic should also do retail sales a favor. Lastly, China is unlikely to cut the MLF rates as the yuan is still facing downward pressure amid expectations of “higher for longer” US rates.

Australian unemployment could edge lowerLast month we saw full-time employment decline by 39.9k and part-time employment increase by 46.5k. We are expecting some of the full-time workers who lost their jobs to take on part-time jobs temporarily, and some part-time workers to convert to full-time positions.The net employment change could well be slightly negative, but with unemployment still rising slower than the labor force, the unemployment rate could still edge lower to 3.5% YoY.

Japan’s third-quarter GDP release and October trade dataJapan will be releasing third-quarter GDP data and we expect it to contract -0.1% quarter-on-quarter sa. This is largely due to a technical payback from the solid gain in the second quarter. Weak manufacturing activity is likely the main cause for the contraction, though this could be partially offset by the continued recovery in service activity. Private consumption rebounded despite inflation staying relatively high. Investment, on the other hand, probably shed growth. The net exports contribution should remain positive to growth. Core machinery orders are expected to rebound after having fallen for two months along with a recovery in semiconductor cycles.For trade balance, Japan is likely to record a deficit in October. The deficit will likely be due to the weak JPY and higher commodity prices, but exports still are expected to make a small gain of 1% YoY in October.

Korea’s unemployment rate edges slightlyKorea’s unemployment report will be out next week, and we are expecting the numbers to rise after two consecutive months of decline. While the unemployment rate might edge higher, it should still fall below 3%.

BSP to hike again next week? Hawkish comments suggest soThe Bangko Sentral ng Pilipinas hiked rates at an off-cycle policy meeting last month in a bid to safeguard the 2024 inflation path. BSP Governor Eli Remolona indicated that he is open to hiking rates further if needed, or if data points to inflation breaching their target again next year. The latest BSP inflation forecast indicated that prices would average 4.7% YoY – well above the upper end of the BSP’s inflation target band.We believe Remolona could hike again next week, especially if the BSP expects all the risks to the inflation outlook to materialize over the next few months.

Key events in Asia next week Image Source: Refinitiv, INGMore By This Author:Buying Into The US SlowdownUS Could Soon See 2% Inflation Rates Spark: The 4.5% Line In The Sand Is Breached

Image Source: Refinitiv, INGMore By This Author:Buying Into The US SlowdownUS Could Soon See 2% Inflation Rates Spark: The 4.5% Line In The Sand Is Breached

Asia Week Ahead: China Activity Data Plus Growth From Japan