Image from the New York Fed, annotations by MishTotal Household Debt Reaches $17.29 Trillion in Q3 2023The New York Fed reports

Image from the New York Fed, annotations by MishTotal Household Debt Reaches $17.29 Trillion in Q3 2023The New York Fed reports

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The Report shows total household debt increased by $228 billion (1.3%) in the third quarter of 2023, to $17.29 trillion. The report is based on data from the New York Fed’s nationally representative Consumer Credit Panel.

Mortgage balances rose by $126 billion from the previous quarter and stood at $12.14 trillion at the end of September. Credit card balances increased by $48 billion to $1.08 trillion in Q3 2023, representing a 4.7% quarterly increase. Auto loan balances rose by $13 billion, consistent with the upward trajectory seen since 2011, and now stand at $1.6 trillion. Student loan balances increased by $30 billion and now stand at $1.6 trillion. Other balances, which include retail cards and other consumer loans, increased by $2 billion.

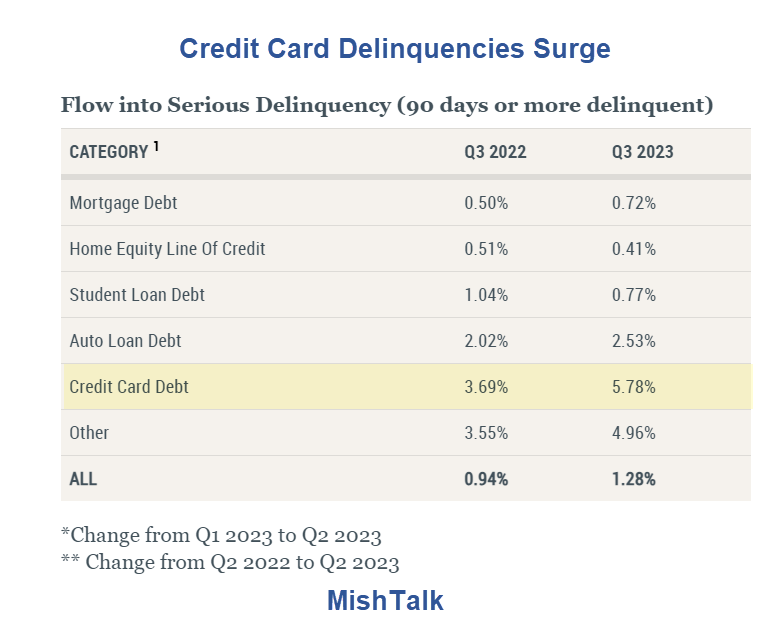

Aggregate delinquency rates increased in Q3 2023, with 3% of outstanding debt in some stage of delinquency at the end of September. Delinquency transition rates increased for most debt types except student loans and home equity lines of credit. The increases in credit card delinquency were the sharpest among borrowers between the ages of 30 and 39.

“Credit card balances experienced a large jump in the third quarter, consistent with strong consumer spending and real GDP growth,” said Donghoon Lee, Economic Research Advisor at the New York Fed. “The continued rise in credit card delinquency rates is broad based across area income and region, but particularly pronounced among millennials and those with auto loans or student loans.”

Consumer Credit in Billions of Dollars Consumer Credit Data from St. Louis Fed, chart by MishThe third and largest of the three rounds of fiscal stimulus shows clearly in the above chart. Starting around March of 2023, stimulus finally seems to have been used up.Delinquencies are on the rise over credit stress.Revolving Consumer Credit in Billions of Dollars

Consumer Credit Data from St. Louis Fed, chart by MishThe third and largest of the three rounds of fiscal stimulus shows clearly in the above chart. Starting around March of 2023, stimulus finally seems to have been used up.Delinquencies are on the rise over credit stress.Revolving Consumer Credit in Billions of Dollars Revolving Consumer Credit Data from St. Louis Fed, chart and “Real” calculation by Mish.Adjusted for inflation, revolving consumer credit declined in September. Nominal credit rose slightly. Revolving credit trends to sink in recessions.Credit Card Debt Grinds To A Halt As Average APR Hits New Record HighZerohedge comments

Revolving Consumer Credit Data from St. Louis Fed, chart and “Real” calculation by Mish.Adjusted for inflation, revolving consumer credit declined in September. Nominal credit rose slightly. Revolving credit trends to sink in recessions.Credit Card Debt Grinds To A Halt As Average APR Hits New Record HighZerohedge comments

the slowdown in debt, and especially credit card debt, is not a surprise since as the Fed also reported today, in September, the average rate on credit cards across US financial institutions just hit a record high of 22.77%.

Good luck with carrying all that debt at 22.77 percent.Five Alarm Bell – Biden Trails Trump in Five of Six Battleground StatesFinancial stress is showing up in the polls.CPI Rises More Than Expected as Rent Jumps Another 0.6 Percent CPI data from the BLS via the St. Louis Fed, chart by MishI repeat the core key theme for something like two years now. People keep telling me rents are falling, I keep doubting. The doubters have it correct again.All these “rents are falling” projections have been based on the price of new leases, but existing leases, vastly more important, keep rising.On October 12, I noted

CPI data from the BLS via the St. Louis Fed, chart by MishI repeat the core key theme for something like two years now. People keep telling me rents are falling, I keep doubting. The doubters have it correct again.All these “rents are falling” projections have been based on the price of new leases, but existing leases, vastly more important, keep rising.On October 12, I noted

Rent of primary residence, the cost that best equates to the rent people pay, jumped 0.6 percent. Rent of primary residence has gone up at least 0.4 percent for 26 consecutive months!

It is not the wealthy who make up the majority of renters. So rent alone is fueling the pain. Factor in food.A rising stock market and home prices does not help those with no assets. And the poor have no assets.Five Alarm BellsPlease note

Discontent pulsates throughout the Times/Siena poll, with a majority of voters saying Mr. Biden’s policies have personally hurt them.

Voters under 30 favor Mr. Biden by only a single percentage point, his lead among Hispanic voters is down to single digits and his advantage in urban areas is half of Mr. Trump’s edge in rural regions.

Note the credit card stress in those in their 30s. And they are also struggling with rent.Other than rent, food, EVs crammed down everyone’s throat, unlimited aid to Israel and Ukraine while there is suffering here, and a half dozen other things, everything else is OK (if you have assets and an existing mortgage refinanced at 3 percent).If you seek a one-sentence explanation of the polls, just read the above paragraph.More By This Author:Record Number Of Supertankers Heads To The Gulf To Export US Oil Hello President Biden, About Your Plan To Waste $45 Billion On Housing Conversions Silly Idea Of The Day: The Price Of Gold In China Is The Accurate Price