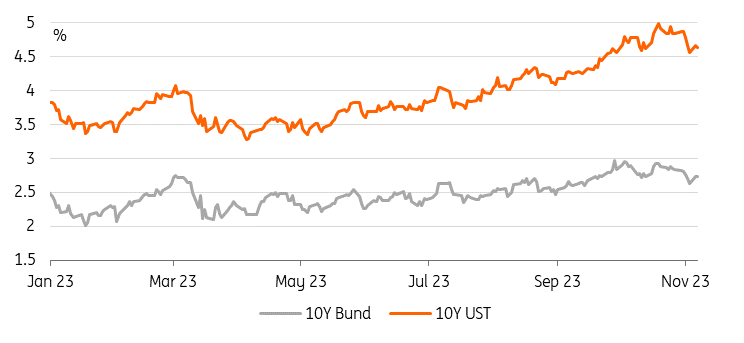

After a huge fall in yields last week, there has been an attempt to engineer some semblance of a reversal so far this week. We expect to see more of that in the days ahead, with data unlikely to get in the way and supply pressure pushing in the direction of a concessional build in the coming days. The main focus will be on UST auctions this week, beginning with the sale of $48 billion in new 3Y notes tonight. Market rates edging higher from Friday’s lows, led by the USMarket rates have staged a bit of a fightback having hit post-payroll lows on Friday. The US 10yr Treasury yield managed to bounce off the 4.5% area, which we now regard as a key support. Stay above that level and we are good to gradually re-test higher in yield over the course of this week. It’s a week of supply right along the curve in the guise of 3yr, 10yr and 30yr auctions. It’s also a week that is unlikely to get too rocked by data releases, with Thursday’s jobless claims set to be the highlight of the week.In addition, we note that there remains an underlying supply risk for bonds generally. Even though the US Treasury has taken some pressure off long-dated issuance into year-end, it does not take away the underlying pressure coming from the elevated fiscal deficit. Fiscal pressure results not just in ongoing supply pressure, but also likely ongoing upward pressure on real yields. That in turn implies steepening pressure from the back end.Importantly, we don’t have a green light yet for a complete cycle capitulation towards a structural rate-cutting agenda. That will come, but we need more first. Yields are slowly starting to revert higher

The main focus will be on UST auctions this week, beginning with the sale of $48 billion in new 3Y notes tonight. Market rates edging higher from Friday’s lows, led by the USMarket rates have staged a bit of a fightback having hit post-payroll lows on Friday. The US 10yr Treasury yield managed to bounce off the 4.5% area, which we now regard as a key support. Stay above that level and we are good to gradually re-test higher in yield over the course of this week. It’s a week of supply right along the curve in the guise of 3yr, 10yr and 30yr auctions. It’s also a week that is unlikely to get too rocked by data releases, with Thursday’s jobless claims set to be the highlight of the week.In addition, we note that there remains an underlying supply risk for bonds generally. Even though the US Treasury has taken some pressure off long-dated issuance into year-end, it does not take away the underlying pressure coming from the elevated fiscal deficit. Fiscal pressure results not just in ongoing supply pressure, but also likely ongoing upward pressure on real yields. That in turn implies steepening pressure from the back end.Importantly, we don’t have a green light yet for a complete cycle capitulation towards a structural rate-cutting agenda. That will come, but we need more first. Yields are slowly starting to revert higher Refinitiv, ING QT lumped into the ECB’s review of the operation frameworkEuropean rates markets also pared some of the past week’s rally with 10Y Bund yields ending the first session 9bp higher above Friday’s close and thus well above 2.7% again. But it looked more like a general countermove, inspired also by a busy corporate supply slate, rather than being motivated by any single event.There were hawkish comments from the European Central Bank’s Robert Holzmann, who said the central bank should be ready to hike again if needed. But coming from him, such remarks should not surprise and are not new. Rather, his other remarks on quantitative tightening and that there won’t be anything forthcoming on that front this year were rather dovish, if anything.The debate about the ECB’s bond portfolios could not be separated from the review of the operational framework, Holzmann said. The forthcoming framework will also determine the level of excess reserves that the ECB will operate with to maintain control over front-end rates – and perhaps even foresee a structural bond portfolio to also provide it with some flexibility to intervene in bond markets.Recall that the ECB’s hawks had also postponed their push for higher minimum reserves until spring next year for a similar reason, according to earlier Reuters reports. The review will give an opportunity to address the wider issue of excess reserves in the system – and also the cost efficiency of implementing monetary policy which could also include, for instance, the remuneration of government deposits. Given the complexity and multitude of possible tweaks, we would expect the review to conclude not with a one-off adjustment but rather a gradual path towards a new framework. Today’s events and market viewThere are few data points of note over today’s session. For the eurozone, PPI is expected to slow to 0.5% month-on-month resulting in a -12.5% year-on-year figure and the US will be reporting its trade balance. The main highlight will be the busy schedule for Federal Reserve speakers, including Neel Kashkari, who last night was not convinced that rate hikes were over. Other Fed speakers are Austan Goolsbee, Christopher Waller and John Williams.Supply also returns to the spotlight. In Europe, Austria will auction 5Y and 10Y lines, but the main focus will be on the UST auctions this week, beginning with the sale of US $48 billion in new 3Y notes tonight.More By This Author:FX Daily: Waiting For The Fed Pushback Asia Morning Bites For Tuesday, November 7The Commodities Feed: Natural Gas Under Pressure

Refinitiv, ING QT lumped into the ECB’s review of the operation frameworkEuropean rates markets also pared some of the past week’s rally with 10Y Bund yields ending the first session 9bp higher above Friday’s close and thus well above 2.7% again. But it looked more like a general countermove, inspired also by a busy corporate supply slate, rather than being motivated by any single event.There were hawkish comments from the European Central Bank’s Robert Holzmann, who said the central bank should be ready to hike again if needed. But coming from him, such remarks should not surprise and are not new. Rather, his other remarks on quantitative tightening and that there won’t be anything forthcoming on that front this year were rather dovish, if anything.The debate about the ECB’s bond portfolios could not be separated from the review of the operational framework, Holzmann said. The forthcoming framework will also determine the level of excess reserves that the ECB will operate with to maintain control over front-end rates – and perhaps even foresee a structural bond portfolio to also provide it with some flexibility to intervene in bond markets.Recall that the ECB’s hawks had also postponed their push for higher minimum reserves until spring next year for a similar reason, according to earlier Reuters reports. The review will give an opportunity to address the wider issue of excess reserves in the system – and also the cost efficiency of implementing monetary policy which could also include, for instance, the remuneration of government deposits. Given the complexity and multitude of possible tweaks, we would expect the review to conclude not with a one-off adjustment but rather a gradual path towards a new framework. Today’s events and market viewThere are few data points of note over today’s session. For the eurozone, PPI is expected to slow to 0.5% month-on-month resulting in a -12.5% year-on-year figure and the US will be reporting its trade balance. The main highlight will be the busy schedule for Federal Reserve speakers, including Neel Kashkari, who last night was not convinced that rate hikes were over. Other Fed speakers are Austan Goolsbee, Christopher Waller and John Williams.Supply also returns to the spotlight. In Europe, Austria will auction 5Y and 10Y lines, but the main focus will be on the UST auctions this week, beginning with the sale of US $48 billion in new 3Y notes tonight.More By This Author:FX Daily: Waiting For The Fed Pushback Asia Morning Bites For Tuesday, November 7The Commodities Feed: Natural Gas Under Pressure

Rates Spark: Not Called Resilient For Nothing