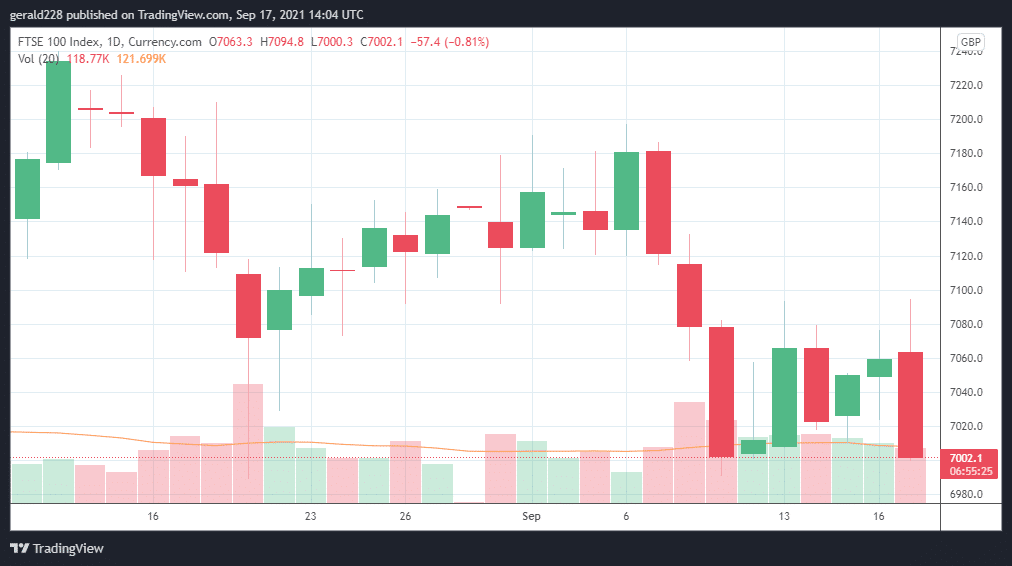

The FTSE Price looks to be ending the week on a downer with several negative factors affecting the markets as a whole. First of all, the considerable drop in retail sales for August has hit expectations hard whilst the shortage of workers continues to plague the hospitality and service industries.Additionally, it seems that Boris Johnson’s cabinet reshuffle did not go down too well with investors although a free marketeer such as Liz Truss at the Foreign Office should prove to be a success. The somewhat muddled Covid-19 ‘Plan B’ in the wake of consistently high numbers of cases is also another spanner in the works for investors as a whole.And adding all this to the expectation that inflation is expected to rise considerably until the end of the year creates a perfect storm with the FTSE price expected to see considerable retreats in the days ahead.If you wish to start trading forex, then you should take a look at our Trading Forex For Beginner’s Guide.Short Term Prediction For FTSE price: More downswing as consumption patterns threatened It would seem likely that the FTSE price will continue its descent to lower levels as the cocktail of job shortages, higher inflation and an uncertain situation regarding Covid19 continues to bite. The UK100 has descended from a high of 7171 on September to around 7030 today which means a drop of around 3% in less than 2 weeks which may seem rather alarming.If bulls would take control of the market as they smell some bargains, the FTSE would likely recover to the 7100 level. However, this rise seems highly unlikely at the present with all the uncertainty in the markets.It is much more likely that a bearish scenario will play out in the short term. This would pull the FTSE price down below the 7000 level after which critical support could break with a sell off in food stocks. With the food chain being hit hard by a lack of CO2 supplies, the outcome could be pretty brutal for the FTSE price.If you are interested in trading forex, then you should take a look at these Top Forex Brokers.Long Term Prediction For UK100: More Bears In The MarketWith all that is going on around the UK economy, it is quite fair to expect that the FTSE price is entering a bearish period. Drops are to be expected and the rapidly evolving Covid19 situation is surely a factor to be considered.The Eurozone economy is also suffering from the highest inflation rises since 2011 and the outlook continues to look bleak. If supply chains in the food sector continue to be affected by shortages and energy consumption is hit by rising fuel prices, the perfect storm for a market crash could be created.

It would seem likely that the FTSE price will continue its descent to lower levels as the cocktail of job shortages, higher inflation and an uncertain situation regarding Covid19 continues to bite. The UK100 has descended from a high of 7171 on September to around 7030 today which means a drop of around 3% in less than 2 weeks which may seem rather alarming.If bulls would take control of the market as they smell some bargains, the FTSE would likely recover to the 7100 level. However, this rise seems highly unlikely at the present with all the uncertainty in the markets.It is much more likely that a bearish scenario will play out in the short term. This would pull the FTSE price down below the 7000 level after which critical support could break with a sell off in food stocks. With the food chain being hit hard by a lack of CO2 supplies, the outcome could be pretty brutal for the FTSE price.If you are interested in trading forex, then you should take a look at these Top Forex Brokers.Long Term Prediction For UK100: More Bears In The MarketWith all that is going on around the UK economy, it is quite fair to expect that the FTSE price is entering a bearish period. Drops are to be expected and the rapidly evolving Covid19 situation is surely a factor to be considered.The Eurozone economy is also suffering from the highest inflation rises since 2011 and the outlook continues to look bleak. If supply chains in the food sector continue to be affected by shortages and energy consumption is hit by rising fuel prices, the perfect storm for a market crash could be created.

FTSE Price Prediction: A Descent Likely As Perfect Storm Approaches